Top gold ETF holdings jump most in 16 months as rally gains momentum.

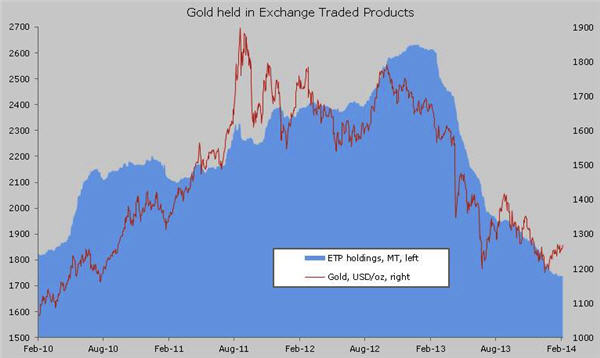

The price of gold slid 28% in 2013 – the worst annual performance since 1980 – on the back of mass liquidation of gold-backed ETFs.

Last year the world's physical gold trusts experienced net redemptions of more than 800 tonnes collectively and suffered depreciation of close to $80 billion.

Along with the stronger gold price, the first signs of a reversal of what had become a one-way bet is now visible.

Holdings of SPDR Gold Shares (NYSEARCA: GLD) – the world’s largest gold ETF by a wide margin – on Thursday shot up the most since October 2012.

Investors bought a net 7.5 tonnes on Thursday bringing holdings back above 800 tonnes for the first time this year.

That compares to just over 9 tonnes of inflows on October 4, 2012 when gold was trading just under $1,800 an ounce.

GLD recorded only 17 days of inflows all of last year and almost 540 tonnes left the fund in 2013 from a peak of more than 1,350 tonnes.

Gold bullion holdings in global ETFs hit a record 2,632 tonnes or 93 million ounces in December 2012.

Read More: www.mining.com/top-gold-etf-holdings-jumps-most-in-16-months-as-gold-breaks-1300-95221/