P2P Loans Regulations and More Info

Silver Bullion's Secured P2P Loans system is not required to be licensed or regulated by the Monetary Authority of Singapore (“MAS”), Ministry of Law, nor any other regulators within and outside of Singapore.

In addition, Silver Bullion is not a financial institution under Singapore law and our liquidity lending system classifies us as such. Silver Bullion is also not the lending entity. Our role is merely to match lenders with borrowers and to provide a framework for this to happen securely while charging a small fee for the service.

Efficient Pricing & Minimal Fees:

Set Your Own Interest Rate

Lenders and borrowers set their own interest rates in an open market using Loan Offers (Ask) and Borrowing Requests (Bids). When lenders and borrowers agree on terms, a contract is created.

Interest rates are determined by the market through supply-and-demand price discovery. Each loan contract has its own interest rate and liquidity depending on lender and borrower preferences.

Four loan durations are available (1, 6, 12, 24 months) and loan contracts can be made in 3 currencies (SGD, USD, EUR). Loan contracts always begin on one of four start dates each month: the 1st, 8th, 15th and 22nd.

Borrowers can submit a borrowing request at their desired interest rate and wait for a lender to accept, or they may accept an existing lending offer, thereby agreeing to the lender’s terms and creating a binding contract.

Lenders have similar options: they can accept an existing borrowing request or, if no suitable requests are available, submit their own lending offer with their preferred interest rate.

For example, a lender might submit a lending offer for USD 100,000 at 6% interest for 12 months. A borrower who sees this offer could choose to accept the 6% rate or submit a counter-request for 5% interest.

Unfilled borrowing requests or lending offers can be canceled without penalty. For instance, the lender could counter by canceling the 6% lending offer and re-submitting a 5.5% lending offer. If the borrower finds the 5.5% rate acceptable, they can then cancel their 5% borrowing request and accept the lender’s 5.5% lending offer, finalising an agreement.

Enjoy the Lowest P2P Fees in the Industry

A high degree of automation and integration means that our administrative charge is as low as 0.5% of the principal for both the lender and borrower.

We can offer low fees because the average P2P loan amount is higher, our processes are highly automated, and our integration with the storage system eliminates many of the administrative costs that a stand-alone system would incur.

Safe & Reliable:

Secured By 200% * Reserved Gold and Silver Collateral

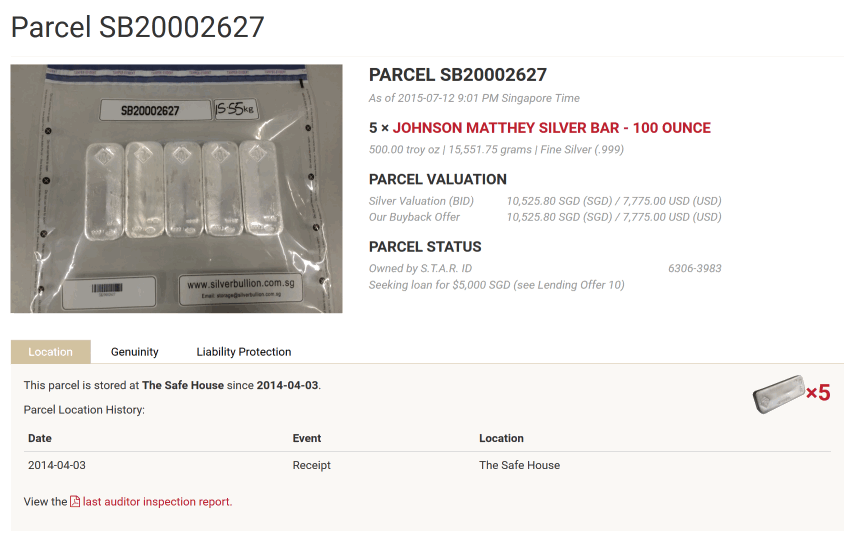

Borrower-owned S.T.A.R. Storage parcels, including gold, silver, platinum, other eligible metals, and luxury watches are held in the vault as collateral, fully restricted from sale or withdrawal until the loan is repaid.

Our P2P platform is designed to protect the lender by minimizing the risk of borrower default through high collateral coverage requirements. For most metals, loans require 200%* collateral coverage, while for gold-backed loans and 1-month loans, coverage is set at 160%. Borrowers also benefit from this high collateral coverage, as it typically results in a comparatively low interest rate and allows unrestricted use of loan proceeds.

Only customers who own physical S.T.A.R. Storage parcels at The Safe House (TSH) can participate as borrowers, as collateral must be bullion securely stored and parcelized in Singapore. Pre-ordered bullion not yet in storage or bullion stored outside of S.T.A.R. Storage (e.g., safe deposit boxes) cannot be used as collateral.

The borrower retains full ownership of the metal, which remains at TSH, enjoying all the protective features of S.T.A.R. Storage. When a loan contract is entered into, the borrower consents to a lien on the selected collateral in favor of the lender, which will be removed upon full repayment.

Borrowers can receive up to 50% of the collateral’s valuation (200% collateral coverage)*) for silver, platinum, and other eligible metals, or up to 62.5% of the valuation (160% collateral coverage) for gold-backed loans and 1-month loans. Loan terms are available for 1, 6, 12, or 24 months.

*Only the 1-month loans can be funded with a lower ratio of 160% (or about a 62.5% loan to value ratio).

If the collateral coverage ratio falls to 125% due to a significant drop in spot prices, the borrower will receive a collateral call to either pledge additional bullion or provide a partial security deposit. If the collateral coverage further drops to 110% Silver Bullion will automatically liquidate the borrower’s metal position to ensure sufficient funds are available to repay the lender.

Convenient, Private and Extendable:

Borrow or Lend in Minutes

Once you have a Silver Bullion Storage account lending or borrowing is done in mere minutes.

This efficiency is made possible by:

- Integrating our storage and authentication system, which requires minimal additional administrative work.

- Eliminating separate borrower credit evaluations, as loans are fully backed by collateral.

- Avoiding additional third-party lien paperwork, since Silver Bullion serves as the collateral custodian.

Privacy and Systemic Risk Protection

Silver Bullion, as the custodian of your bullion, enforces contract terms and acts as an agent for both parties, who are identified solely by their unique eight-digit S.T.A.R. ID.

S.T.A.R. Storage is built with rigorous checks and balances to ensure that stored gold and silver are physically present, genuine, free from third-party encumbrances, and protected across jurisdictions, legally and physically. By constructing and managing our own vault, we have effectively eliminated most intermediary and banking dependencies.

The Secured Peer-to-Peer Loans Platform builds upon this system, using the anonymous S.T.A.R. ID to maintain the privacy of both lenders and borrowers. Contracts reference parties only by their S.T.A.R. ID, ensuring direct counterparty privacy.

In addition to privacy assurances, our system provides lenders with full collateral transparency, featuring bullion photographs, parcel ownership lists, DUX tests, third-party audits, and insurance coverage underwritten by Lloyd’s of London—including protection against the often-excluded ’Mysterious Disappearance’ event.

Through our peer-to-peer loan platform, both lenders (via pledged bullion collateral) and borrowers (via their bullion holdings) enjoy robust protection against potential systemic crises, including currency devaluation, large-scale financial bankruptcies, sovereign defaults, or possible gold nationalization events.

Contract Rollovers

Loan rollovers allow borrowers to enter into a new loan contract at prevailing market rates to repay the original loan.

Rollovers are similar to a loan renewal, but the lender or borrower can choose to deal with a different party and with a different duration. Rollovers are based on the interest rates presently offered. In essence a new loan is used to settle the old loan so that a borrower does not need to repay, or repay only a fraction, of the funds due at maturity.

A borrower, for example, having an existing Loan “A” can, valuations permitting, commit a new loan, loan “B” to pay back the principal and interest of Loan “A” instead of sending funds from elsewhere to settle Loan “A”. During such a rollover, the borrower’s collateral will be switched from Lender A to Lender B and the Loan B payout will be used to settle Loan A.

Rollovers allow for potentially indefinite borrowing by a lender, as long as collateral valuations permit (200%* coverage or greater). For lenders, rollovers allow for funds to be re-lent efficiently and without downtime.

*Only the 1-month loans can be funded with a lower ratio of 160% (or about a 62.5% loan to value ratio).

We standardized loans to start on the 1st, 8th, 15th and 22nd of the month and created the Reserve Fund, to support such rollovers. Rollovers greatly enhance flexibility and efficiency for both lenders and borrowers.