Silver Mine Supply To Peak 2-3 Years & Drawdown Of LBMA Inventory – GFMS

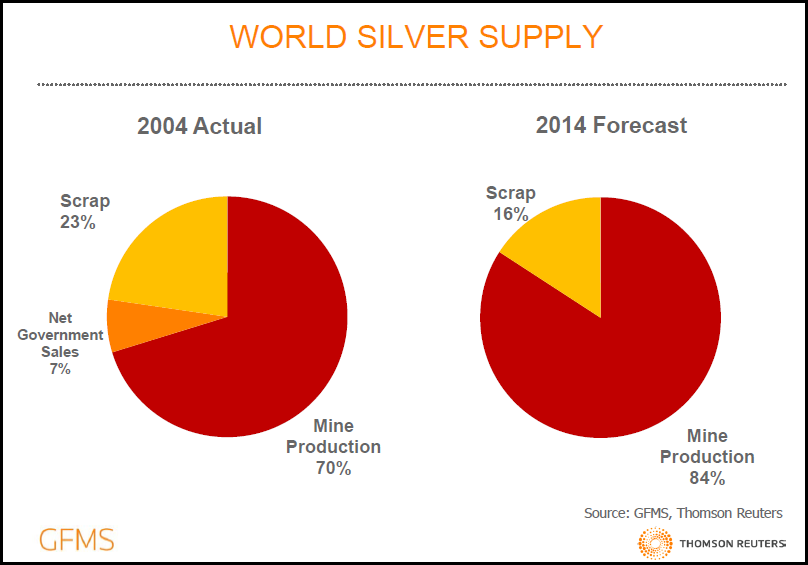

GFMS states the reason for the peak in silver mine supply is due to “current price levels maintaining production but constraining investment in new capacity.” Basically, they are saying the current low silver price will maintain production for the meanwhile, but this has created a decline in mining investment, precipitating a peak in global silver production. In addition, they see silver scrap supply falling from 25% of total supply in 2012 to only 16% in 2014.

One striking statistic from the Silver Interim Report is the total drop-off of government silver sales. From 2004 to 2013, net government silver sales totaled 366 million ounces. Government silver sales hit a high in 2006 at 78.5 million oz and a low of 7.4 million oz in 2012.

However, GFMS shows in this graph (from the Silver Interim Report), that net government sales fell from 7% of total supply in 2004 to ZIP in 2014. During the past decade, most government silver sales came from China, Russia and India. Even though government sales were only 7.9 million oz in 2013, it looks as if this official supply has now totally dried up.

And who could blame them. Why should China, Russia or India sell their government silver bullion into the market for peanuts while the Fed funnels its monetary stimulus through its member banks into the stock and bond markets while capping the value of commodities and the precious metals?