China’s Gold Demand

The CGA’s figures were significantly less than recorded imports into China from Hong Kong. Instead, on my analysis, the CGA figures do not represent total demand, but presumably only that portion reported to it by its members at the retail level. The purpose of this article is to set the record straight.

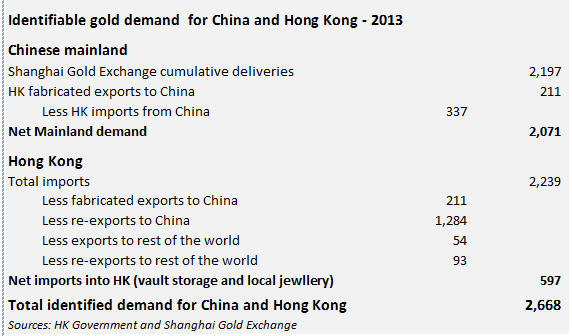

There are very few figures coming out of China that you can rely upon, and this is particularly true of gold imports. Instead, you have to take what is available and apply a judicious mix of logic and deduction. Mainland China does not publish imports and exports. The only figures for gold supplied to the Chinese public are of gold delivered through the Shanghai Gold Exchange and out of their registered vaults, which for 2013 totalled 2,197 tonnes. Most of this I have reason to believe is imported, only some of which is through Hong Kong. And to think that gold is only imported through Hong Kong is a mistake.

Hong Kong releases import, export and re-export statistics monthly. Exports are goods and raw materials processed locally, and re-exports are imported materials and goods subsequently exported unaltered, such as gold bars to SGE specifications.

The table below shows my calculations for total Chinese and Hong Kong demand.

All gold that changes hands in China is meant to go through the SGE. However, mine output is thought to be bought up by the government, most probably directly from the mines bypassing the SGE. All circumstantial evidence including government policy towards physical gold tells us this is true. And it is naïve to think a communist government – any government for that matter – would route gold from mines it controls through the market, whatever the market “rules” are.

Read More: www.mining.com/web/chinas-gold-demand/