Articles

Displaying 1 to 10 of 214

-

22 Apr 2024

Benefits of Having Gold in Your Wealth Portfolio

Gold has always been the fulcrum of economic activity and the financial system for most of mankind’s history, having been used as money as a medium of exchange in commerce and a store of value for savings. There are many reasons to own gold. Its safe-haven status and other attributes have benefited investor portfolios with a long-term allocation.

(Read more) -

15 Apr 2024

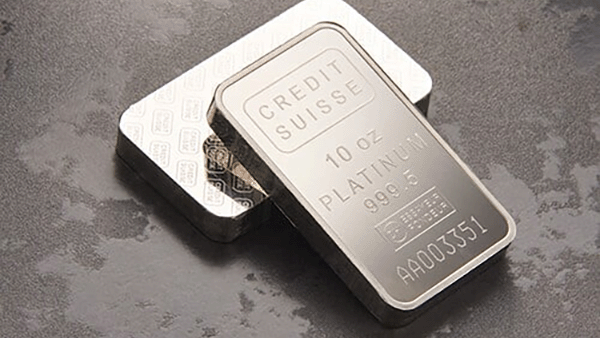

WPIC: Platinum Demand to Benefit From Artificial Intelligence’s Rise

A March 2024 ‘60 Seconds in Platinum’ article from the World Platinum Investment Council (WPIC) reported that platinum demand is expected to increase in the coming years due to the growth of artificial intelligence (AI) applications.

(Read more) -

10 Apr 2024

What is the Gold Spot Price and How is it Set?

The gold spot price has risen to new all-time highs, attracting new investors who are asking questions about how it is set. This article provides the answers.

(Read more) -

12 Mar 2024

Why is the Gold Price Rising to New All-Time Highs?

After more than 3 years of sideways price action, is gold on the cusp of another breakout rally? What are the market sentiments toward gold and how high can the gold price reach? Let’s find out!

(Read more) -

08 Mar 2024

Record Deficits in Platinum Supply Despite Rising Investment Interest

Platinum, part of the same precious metals group as gold and silver, is facing growing market deficits, according to the latest quarterly report from the World Platinum Investment Council (WPIC).

(Read more) -

14 Feb 2024

How Much Gold Did Singapore Buy in 2023?

The World Gold Council (WCG) hailed 2023 as “another year of blistering central bank buying” of gold. Sovereign gold purchases through their central banks were at 1,037 metric tons, a mere 45 metric tons short of the 2022 record. So, how much gold did Singapore buy in 2023?

(Read more) -

03 Feb 2024

Top 5 Countries That Were Net Buyers of Gold in 2023

In 2022, global central banks set a historic record with their largest annual gold acquisition, an impressive 1,083 metric tons of the precious metal.

(Read more) -

01 Feb 2024

Foreigners Deposited $1.8 Trillion in Deposits with Singapore Banks

As of 3Q 2023, Singapore has an external debt of USD $1.82 trillion, confirmed by the Department of Statistics Singapore. For a country with a total land area of 734.3 square kilometers, about 0.9 times New York City’s size, such a high amount of external debt must surely be disconcerting.

(Read more) -

20 Jan 2024

Willem Middelkoop: Resurgence of Gold in the World’s Monetary System

Gold is gaining prominence in the global monetary system, says Willem Middlekoop, founder of Dutch-based Commodity Discover Fund, in a January 2024 Bullion World article. Calling gold’s rise “an unobtrusive yet profound shift”, Middlelkoop believes the change in gold’s status in the monetary system is due to several recent developments.

(Read more) -

05 Jan 2024

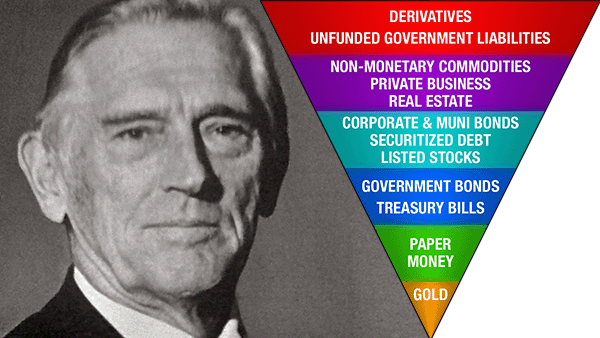

Understanding Exter's Pyramid and Gold's Pivotal Role in Global Finance

In global finance, few concepts have captured money flow quite like Exter's Pyramid. Created by John Exter, this pyramid illustrates the hierarchy and vulnerability of different asset classes in times of financial distress, and emphasizing gold's timeless significance in a world brimming with digital and ephemeral assets.

(Read more)