Why is the Gold Price Rising to New All-Time Highs?

On the week of March 4th, 2024, gold prices hit new record highs in nearly every major currency. Prices rose to as high as US$2,195, surpassing the previous record of US$2,143 set in December 2023. After more than three years of sideways price action, is gold on the cusp of another breakout rally? What are the market sentiments toward gold, and how high can the gold price reach? Let's find out.

Gold Reaches All-Time Highs in Major Currencies

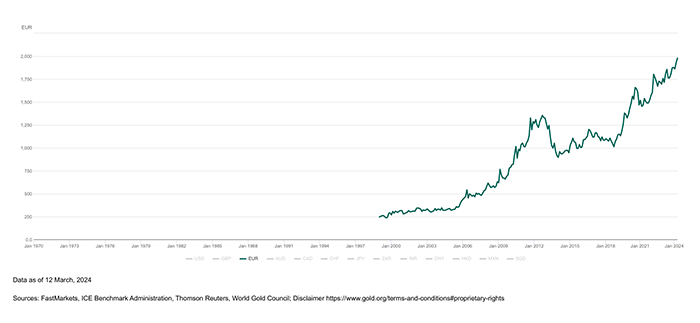

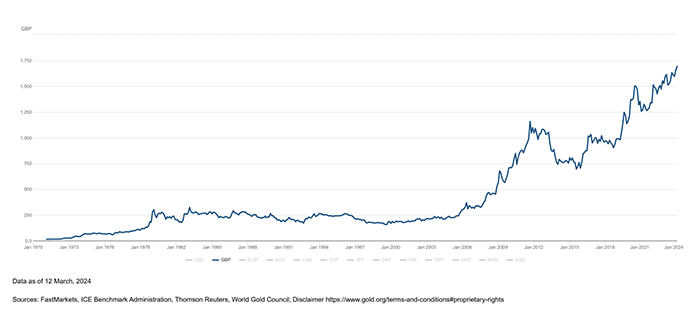

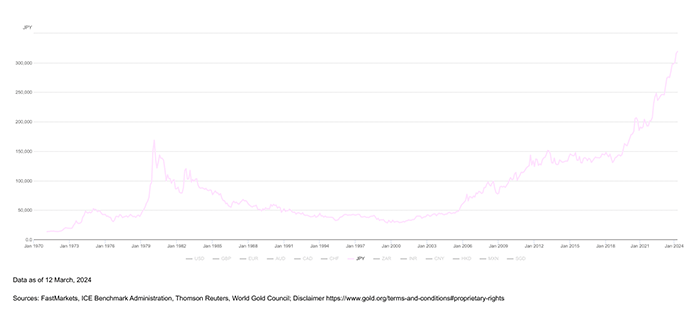

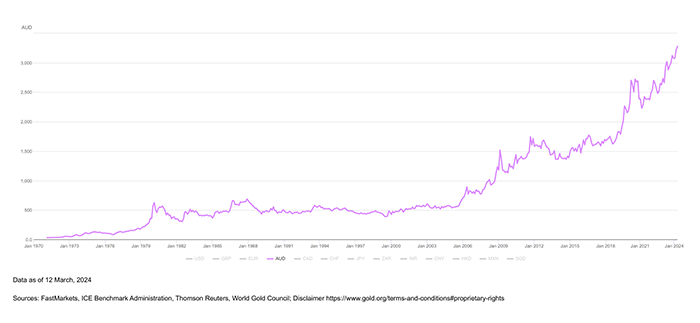

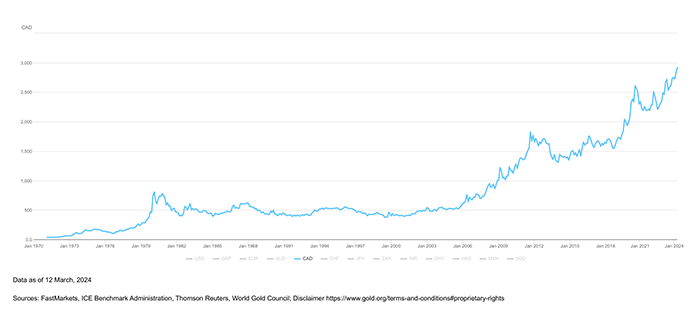

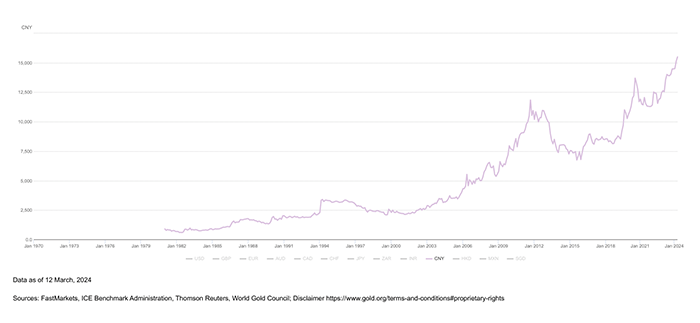

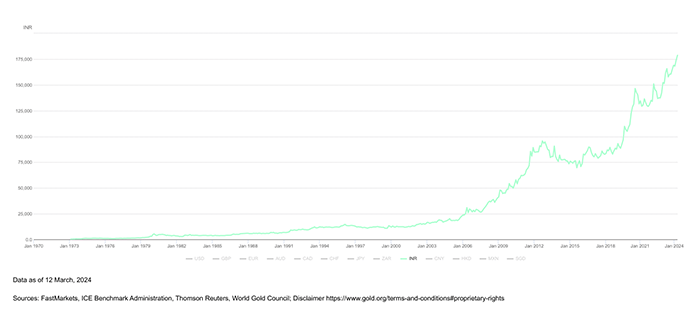

Besides the U.S. dollar, gold has also reached new all-time highs in the following major currencies on the week of March 4th 2024.

Highest Euro Gold Price- €2,006

Highest British Pound Gold Price - £1,708

Highest Japanese Yen Gold Price - ¥322,958

Highest Australian Dollar Gold Price- $3,311

Highest Canadian Dollar Gold Price - $2,957

Highest Chinese Yuan Gold Price - CN¥15,710

Highest Indian Rupee Gold Price - ₹181,609

Why is the Gold Price Rising, According to Analysts

Fed Rate Cut Expectations

When the Fed signals a potential reduction in interest rates, it generally leads to reduced yields on fixed-income investments such as bonds, making gold more attractive in comparison. Furthermore, rate cuts are often implemented in response to concerns about economic growth, leading investors to seek safe-haven assets like gold to protect their wealth.

After 2 years of relentless hiking of the Fed funds rate to the current 5.25% to 5.5%, markets are expecting the Fed to enact interest rate cuts in June 2024. Federal Reserve Chair Jerome Powell said recently that rate cuts could begin once the U.S. inflation rate settles around the central bank’s 2% target. The current inflation rate is about 3%, substantially lower than the 9% in July 2022.

Fed rate cuts also signal their intent to print money, which is inflationary - the central bank will be creating and injecting dollars into the economy by buying U.S. government bonds from the market to influence the lowering of the Fed funds rate. The market’s interpretation of this liquidity injection into the economy could cause market participants to front-run the Fed’s impending rate cut by positioning themselves through the buying up of undervalued assets, causing rising prices in the stock market and nominal gold prices to rise.

Heightened Geopolitical Uncertainty

Gold is traditionally seen as a safe-haven asset, which means that in times of economic and geopolitical uncertainty, investors often flock to it to preserve their capital.

Events such as military conflicts, trade wars, and political instability can create an environment of fear and uncertainty in the global economy. In such situations, the intrinsic value of gold as a physical, non-depreciable asset becomes highly appealing.

Ongoing wars in Ukraine and Gaza are no doubt contributing to geopolitical uncertainty. In addition, Houthi rebels attacking commercial vessels in the Red Sean and Gulf of Aden are disrupting global trade, given that the Red Sea’s connection to the Suez Canal is one of the most important arteries in the global shipping system.

Due to these attacks, major shippers have diverted some $200 billion in trade away from the Middle East trade route. A reroute via South Africa’s Cape of Good Hope will increase freight rates, surcharges, shipping times, and product delivery delays, leading to inflation in goods and services. This will have a knock-on effect on the financial performance of companies relying on ocean freight, and listed companies could receive analyst downgrades, causing share price loss as investors exit to seek safety by parking funds in other assets.

This flight to safety could drive up demand for gold, given its safe-haven status. This would increase its price as investors exit riskier assets and buy gold to ride out market uncertainties.

Increased Central Bank Gold Buying

Central banks have been major gold buyers in recent years. In 2022, World Gold Council data revealed that they amassed a record amount of 1,083 metric tons of gold. Central bank gold haul for 2023 was equally impressive, with 1,037 metric tons purchased.

Central banks’ appetite for gold stemmed not only from their desire to diversify their reserves but also to reduce exposure to fiat currencies, including the world’s reserve currency – the U.S. dollar.

Western governments' freezing of Russian foreign reserves showed the world that the U.S. dollar might not be as safe as once perceived, especially if one falls out of favor with the United States and its allies. Furthermore, European and U.S. lawmakers are mulling over the legality of measures to use frozen Russian central bank assets toward Ukraine’s reconstruction.

While such a move was aimed at helping Ukraine and disincentivizing further Russian military aggression, it has shown the world the risks of holding too many U.S. dollars despite their usefulness in world trade. Jim Rickards, author of Currency Wars, believes that touching Russian foreign reserves in this manner would be crossing the “reddest of red lines” as it would “destroy the U.S. Treasury market.”

So where else could a nation put its reserves toward that is safer than the world’s reserve currency? A quick glimpse of the Exter’s Pyramid would suggest buying gold as the only really good alternative, given its excellent track record as a counterparty risk-free asset throughout history. Rickards also aptly described gold’s advantage, “One of the attractions of gold is that it is physical, not digital. You put it in a vault and keep an eye on it. You can’t freeze it in the banking system.”

Resumption of Gold Bull Market

Given that past gold bull markets, in the 1970s and early 2000s, lasted about 10 years from trough to peak, the rise in prices to new record highs is likely to be a resumption of the gold bull market that began with the price trough in 2015.

If the 10-year pattern holds, the current gold bull market may have at least a year more for gold prices to reach a new peak. Bull markets never rise in a continuous straight line but are often marked by rallies and consolidation periods. Of course, this bull market could last beyond 10 years, and we are just using the 10-year mark as a gauge of the current gold market’s longevity.

The last gold price rally occurred between March and August 2020 during the COVID-19 pandemic panic. It was followed by a long consolidation period until February 2024 The current gold breakout to $2,195 has signalled that a new rally has begun, and we could see more record-high gold prices going into 2025 and beyond.

However, if we observe a longer-term gold price chart, a larger picture forms — the current gold price breakout is a continuation of a larger gold bull market that began in the early 2000s. From this perspective, there is no telling where the peak of this giant bull market is.

Analyst Gold Price Forecasts for 2024

When the gold bull market resumes its upward charge, how high can prices go? Here are some bank analyst forecasts from mainstream news.

J.P. Morgan – US$2,300 in 2025

ANZ Research – US$2,200 by end-2024

Goldman Sachs – US$2,133 average in 2024

Citigroup – US$2,040 average in 2024

Commerzbank – US$2,100 by 2nd half of 2024

ING – US$2,100 average by 4th quarter of 2024

UOB – US$2,200 by end-2024

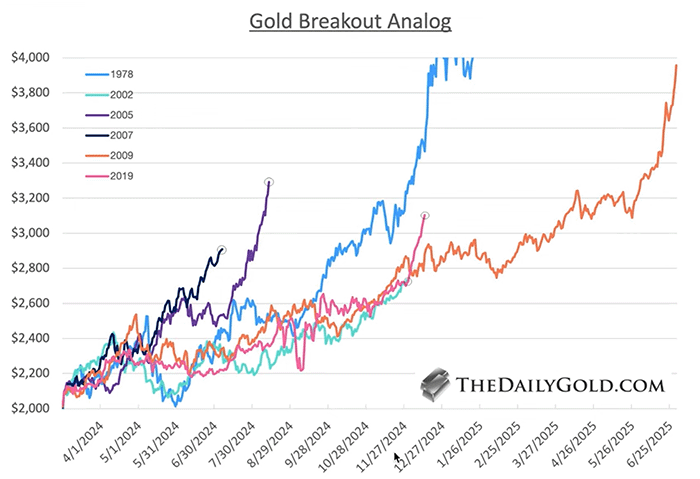

Jordan Roy-Bryne from The Daily Gold analyzed gold’s different historical breakout trajectories since 1978 as the basis to forecast where the gold price might be within the first year after a price breakout.

Based on past gold price breakouts, Jordan’s forecast is that a gold breakout could send the gold price close to $3,000 within 12 months of the breakout. However, he warns that the move towards $3,000 will not be a “smooth ride” as it will be marked by short-term price corrections.

Is It a Good Time to Buy Gold?

With the gold price hitting record highs, it is natural for investors to wonder if it is still a good time to buy the yellow metal.

The short answer is yes.

The reasons for buying gold in the short to medium term are tied to the abovementioned reasons for rising gold prices.

What Happens to the Gold Price When the Fed Cuts Rates?

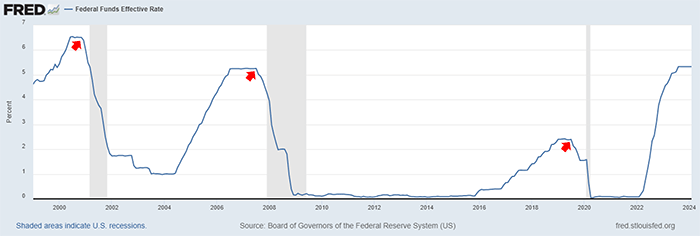

Since 2000, whenever the Fed began an extended period of rate cuts, a U.S. recession followed shortly after.

In 2000, the Fed Funds Rate began declining in December 2000. In March 2001, the U.S. economy went into a recession.

In 2007, the Fed began cutting rates from August 2007, and a recession followed in December 2007.

In 2019, Fed rate cuts started in August 2019, and the economy went into a recession in February 2020.

Red arrows indicate beginning of Fed rate cuts.

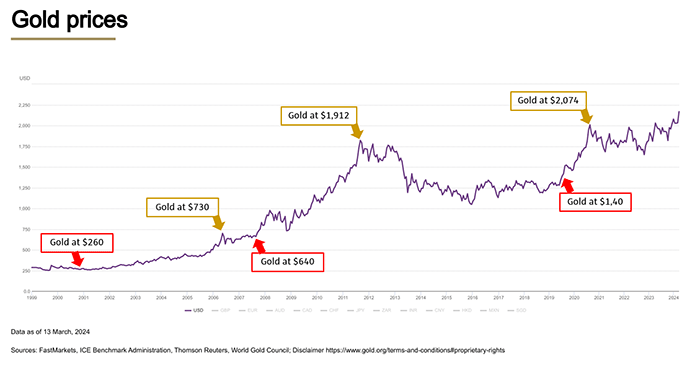

Now, with each of the 3 rate-cut instances, the price of gold rose higher. First, let’s look at the December 2000 rate cut. Gold rose from $260 to an all-time high of $730 by May 2006.

Similarly, from the August 2007 Fed rate cut, the gold price rose from $640 to an all-time high of $1,912 in August 2011.

With the August 2019 rate cut, the gold price appreciated from $1,400 to an all-time high of $2,074 in August 2020.

Red arrows indicate beginning of Fed rate cuts.

Will this pattern repeat when the Federal Reserve cuts interest rates again? Based on this 24-year data, it is highly probable that it will.

Gold and Geopolitical Tensions

Gold is widely considered a safe-haven asset against geopolitical tensions, often positively correlated with rising tensions. However, not all geopolitical tensions exact a dramatic response in gold. Those that do are usually assessed to profoundly impact global peace and stability.

Some examples of this causation are the 2011 United States debt-ceiling crisis, the 2020 COVID-19 pandemic crisis, the outbreak of the 2022 Russia-Ukraine war, and the 2023 Israel-Hamas war.

Currently, the Geopolitical Risk Indicator by Blackrock, the world’s largest asset manager, is flashing ‘high’ risk in 6 areas, warning the increasing likelihood of major cyber and terror attacks, escalation in the Russia-NATO conflict, escalating tensions between from U.S.-China competition, rising Gulf of Aden tensions, and technology decoupling between the U.S. and China.

Given these heightened geopolitical tensions across multiple critical regions, gold is poised to benefit as investors increasingly seek safe-haven assets to hedge against the uncertainty and volatility in the global markets.

Impact Of Central Banks Increasing Gold Reserves

Gold’s greater role in the global monetary system since 2010, while still unofficial, cannot be overlooked. Central banks have been net buyers of gold since 2010, an important factor supporting record gold demand in recent years. It was no doubt a result of the loss of confidence in the stability of the global financial system following the 2008 U.S. Great Financial Crisis and the Eurozone Debt Crisis, which lasted until the mid to late 2010s.

As mentioned, freezing Russian central bank assets in 2022 gave central banks more reasons to buy gold. In addition, the sharp rise in interest rates since late-2021 caused significant losses for bondholders, mainly asset managers, commercial banks, and central banks worldwide.

In particular, government bonds acquired by central banks, especially those in Europe, for quantitative easing facilitation in the prior years registered losses on their balance sheets amidst rising interest rates. These central banks suddenly faced the possibility of the need for government bail-outs for recapitalization. However, accepting government bail-outs could undermine central bank independence, a scenario central bankers are keen to avoid.

European central banks are assessing the feasibility of using their gold revaluation accounts to mitigate balance sheet losses. The loss of confidence in government bonds, previously thought risk-free, as a key asset in central banks’ reserves has led central banks to seriously consider gold as a complementary reserve asset to bonds. This could pave the way for gold to have a larger role in the financial system in the future.

We Have Not Seen the End of This Gold Bull Market

Asset price movements in bull markets often exhibit a rhythmic pattern, where phases of consolidation frequently succeed periods of rapid price increases. This ebb and flow is a natural part of market dynamics, allowing assets to stabilize before embarking on the next leg of their journey.

The gold market's recent breakout is a textbook example of this pattern. Following one of the longest consolidation phases since September 2020, gold prices have surged, breaking into record highs, reinforcing this rhythmic pattern of price rallies and consolidations.

Gold’s consolidation phase between September 2020 and February 2024, characterized by sideways price action, was the market accumulating energy, building a base like a coiled spring waiting to be released, that set the stage for the current rally.

An investment adage, “the bigger the base, the higher the project is going to be,” now hints at the trajectory of the gold price in the coming months. We are likely to witness the full measure of the released spring’s energy in the next few years. It brings to mind a frequent reminder of veteran precious metal analyst David Morgan that 90% of the gains in a bull market happen in the final 10% run-up to the peak.

Is It Time to Sell Gold?

As gold prices rise, it is inevitable for gold investors who have made a profit buying gold to consider selling gold to lock in the price gains, regardless of whether physical gold, gold ETFs, gold futures, or gold mining stocks were purchased.

Distinguishing between different gold products and their investment intent could be a better way to decide whether to continue holding gold or sell it.

Unlike gold bullion, financial instruments like gold exchange-traded products (ETFs), mining stocks, and futures do not equate to physical metal ownership. Instead, they are often proxies for gold, allowing exposure to the price of gold for trading purposes. These gold paper financial assets also have inherent counterparty risks since you do not own the underlying asset directly.

For example, the performance of gold mining stocks depends on the management team, financial performance, and jurisdictional risks of mining companies. If there is mismanagement or negative impact from new governmental mining regulations, the value of your stocks could decline despite the price of gold rising.

If you have determined a price level to sell paper gold assets, it may be wise to execute your trading plan accordingly when your price target is reached.

However, physical gold should be considered differently since it also functions as insurance against economic uncertainty, geopolitical unrest, and currency debasement. Without counterparty risks, long-term wealth protection, not speculation, would be your goal to hold gold.

If geopolitical risk is not abating, it may not be the best time to consider selling gold.

It Is Hard to be Wrong With Gold!

Unlike other financial assets available in the market today, buying physical gold is one of the safest ways to preserve and build long-term wealth. It is hard to be wrong with gold!

If modern central banks are increasingly stockpiling gold in their reserves, it is an indicator of gold’s evergreen utility and international acceptance. Even after 5000 years, gold continues to be the world’s ultimate store of value and the most trusted asset if confidence in the monetary system crumbles. This is why gold is the bedrock of the financial system, as illustrated by the Exter’s Pyramid.

Witnessing record-high gold prices also reminds us of the declining purchasing power of fiat currencies, that each currency unit is buying less gold over time. Viewing a long-term historical gold price chart reveals that gold has continuously marched higher over the decades as government money printing decimates fiat currency purchasing power.

Final Takeaway

Gold’s recent breakout resulted from geopolitical risks rising to thresholds that warranted money flight from riskier assets to the yellow metal. It was an event waiting to happen, a result of the culmination of risks tipping the scales. If you expect a less peaceful and more polarized world in the future, buying physical precious metals like gold coins and gold bars is one of the best ways to protect your wealth.