Record Deficits in Platinum Supply Despite Rising Investment Interest

Platinum, part of the same precious metals group as gold and silver, is facing growing market deficits, according to the latest quarterly report from the World Platinum Investment Council (WPIC).

Record Platinum Supply Deficit in 2023

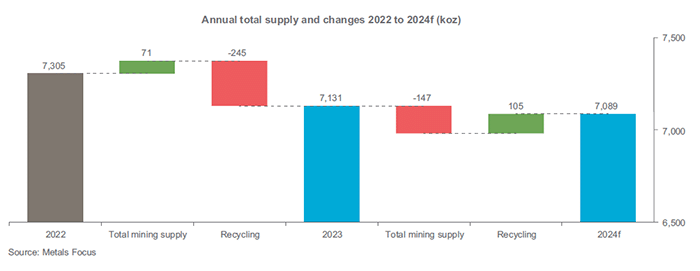

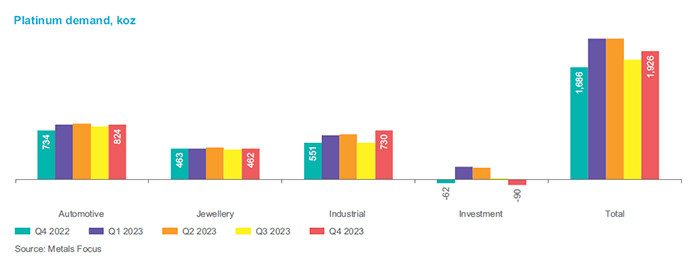

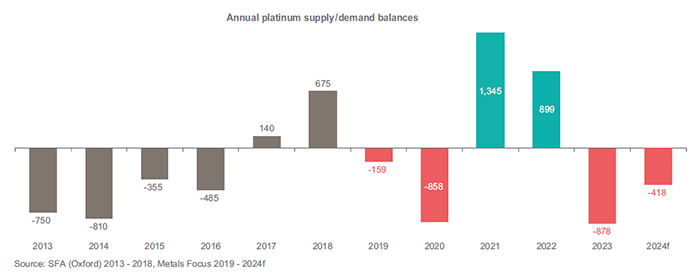

The WPIC Platinum Quarterly (Q4 2023) report showed that the platinum market recorded a deficit of 878 koz in 2023, the largest within WPIC’s data series. Total platinum supply decreased by 2% in 2023.

The year also marked the second time there have been four consecutive quarterly market deficits since WPIC’s quarterly data began in Q3 2014. Demand growth from the automotive and industrial sectors contributed to the persisting deficit.

Source: World Platinum Investment Council

Platinum Supply at Historically Depressed Levels

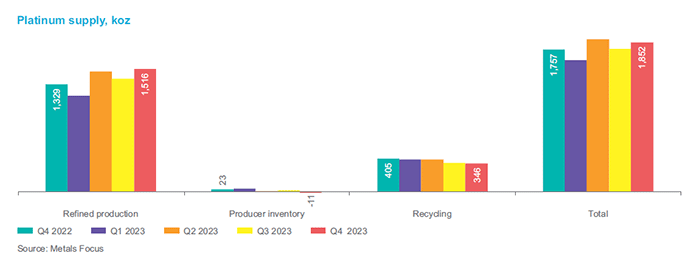

Going deeper into the platinum supply details, mine supply finished the year on a “seasonally strong note,” increasing by 1% year-on-year in 2023 to 5,636 koz. Despite all major platinum-producing regions increasing mine supply, led by South Africa and Zimbabwe, mine supply remained at depressed levels when compared to historical output. Notable headwinds contributing to platinum processing constraints include ongoing South African electricity supply shortages, worker strikes, safety stoppages, and planned closures.

Platinum recycling supply declined to its lowest annual level in WPIC data. In particular, low end-of-life vehicles available resulted in a 17% year-on-year decline in 2023. Weaker palladium and rhodium prices have disincentivized autocatalyst collectors and caused some scrap yards to hold back stock in hopes of a price recovery. Regulations introduced to curb catalyst thefts also disrupted the flow of spent autocatalyst material.

Platinum jewelry scrap supply declined by 6% due to weak platinum prices and lackluster jewelry demand in China.

Overall total platinum supply in 2023 was 7,131 koz, or 2% lower than in 2022.

Source: Metals Focus

Source: Metals Focus

Platinum Demand in 2023

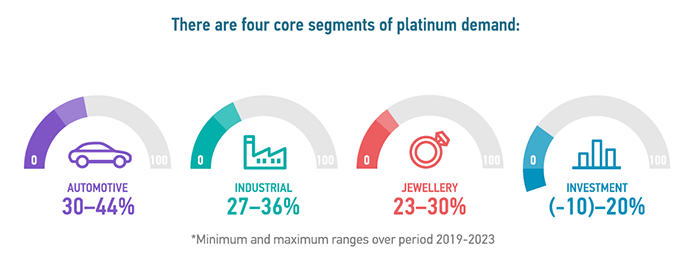

According to the WPIC, the four core segments of platinum demand are automotive, industrial, jewelry, and investment. Automotive demand for platinum was the largest accumulatively over the past four years, followed by the industrial, jewelry, and investment sectors.

Total platinum demand in 2023 was 8,009 koz, up 25% year-on-year, led by automotive (3,272 koz) and industrial demand (2,622 koz).

Source: Metals Focus

Platinum Automotive Demand

As vehicle production surpassed pre-pandemic levels for the first time, the number of vehicles requiring platinum group metal (PGM) containing aftertreatment systems increased by 8%.

Higher vehicle production, increased platinum loadings in hybrid vehicles, and stricter emission regulations supported platinum automotive demand growth of 16% - a total of 3,272 koz for 2023.

Platinum Industrial Demand

Platinum industrial demand primarily comes from industries that produce petroleum, chemicals, glass, medical applications, and electrical products. 2023 saw record industrial demand for platinum, with a 12% improvement year-on-year to 2,622 koz, the highest for WPIC's time series.

The use of platinum by the petroleum industry fell 12% year-on-year in 2023 despite rising global oil supply. According to the WPIC, the absence of gas-to-liquid (GTL) catalyst changeouts benefitting platinum offtake in 2023 was the reason. Despite this, the use of platinum in catalytic reforming and isomerization units rose to a four-year high in 2023.

Platinum demand from the chemical industry rose 13% to 771 koz in 2023, led by higher demand for platinum-bearing catalysts as a result of capacity expansions. Nitric acid demand, a key ingredient of fertilizer manufacturing, also rose in 2023. According to WPIC, this increase came on the back of a low 2022 base caused by severe supply disruptions as a result of trade barriers and the Ukraine-Russa war.

Demand for platinum in the silicone industry also declined due to China’s slower-than-expected recovery and high supply chain inventories.

Platinum's high melting point, stability, and high resistance to corrosion make the precious metal suitable for LED screens and glass fiber manufacturing. The use of platinum in the manufacturing of fiberglass, particularly glass tanks, rose to 701 koz in 2023 from 505 koz in the previous year. According to the WPIC, most of the 2023 gains were due to the ramp-up of single-feeder glass tanks replacing multi-feeder tanks in Japan and the doubling of glass tank installations in China.

Platinum is also extensively used in the medical and biomedical industries in permanent, implantable devices such as neuromodulators, pacemakers, and cochlear implants. The ability of platinum compounds to kill off cancer cells has led to the development of platinum-based cancer treatments.

Platinum medical demand has grown by an estimated 4% to 285 koz in 2023, driven by higher healthcare spending and accessibility in emerging markets.

Platinum electrical demand fell 16% in 2023 following a 33% downturn in the hard disk drive (HDD) industry. Despite the narrowing cost differential between solid-state disk (SSD) and HDD technologies, increasing demand for more cost-efficient and larger storage capacities in AI applications supported platinum HDD demand.

Platinum Investment Demand

Overall platinum investment demand rose to 265 koz in 2023 versus a divestment of 644 koz in 2022.

Retail demand for platinum bars and coins rose by 22% year-on-year to 270 koz. Edward Sterck, Director of Research at the World Platinum Investment Council, said in a recent SBTV interview that “over the last four years, platinum bar and coin demand had been extremely robust.”

While retail sales of platinum bars and coins have been positive in the last four years, the same cannot be said of platinum ETF holdings, which have experienced major swings between platinum investments and divestments. For example, 507 koz were recorded for platinum ETF holdings in 2020, but they fell by 241 koz in 2021.

However, WPIC data showed that platinum divestment in exchange-traded fund holdings was the narrowest in 2023 since 2020. Platinum holdings in European and North American exchange-traded funds (ETFs) fell by 3% and 5%, respectively, contributing to the 20 koz decline in overall 2023 platinum exchange-traded funds holdings.

Above-ground Platinum Stocks Sufficient for Only Six Months

According to the WPIC, above-ground platinum stocks declined to 4,000 koz by the end of 2023 due to the 878 koz annual deficit. Compared to above-ground stocks sufficient as demand cover for nine months in 2022, 2023 stocks represented demand cover of six months.

The WPIC defines above-ground platinum stocks as “the year-end estimate of the cumulative platinum holdings not associated with exchange-traded funds, metal held by exchanges or working inventories of mining producers, refiners, fabricators, or end-users.”

WPIC 2024 Outlook: Platinum to Remain in a Deficit

The WPIC believes that economic growth in 2024 will be tempered by slower growth and elevated geopolitical tensions. Therefore, they are forecasting a continued platinum market deficit of 418 koz in 2024.

The 2024 mining supply is also expected to decline by 2%, mainly due to reduced platinum output from South Africa and Russia. In South Africa, platinum producers have announced business restructuring plans, such as labor retrenchments and other cost-cutting measures, due to declining PGM prices. In Russia, geopolitical challenges and an uncertain economic climate are anticipated to reduce platinum production.

Platinum supply from recycling is expected to improve by 7% year-on-year to reach 1,600 koz in 2024.

Regardless, the WPIC report has forecasted an overall 1% decline in total platinum supply in 2024, which is 6% below the average annual supply over the previous five years.

The WPIC expects platinum demand to remain robust in 2024, mainly due to the trend towards increased vehicle hybridization, which is PGM-intensive. This is despite the overall platinum demand expected to decline by 6% in 2024, which is likely caused by a bias towards continuing sideways platinum prices.