Is Platinum a Good Investment? - Weighing the Pros and Cons

Platinum, an extremely rare and valuable precious metal, has caught the attention of investors worldwide. As a highly sought-after alternative to gold and silver, platinum offers unique properties and potential benefits. But is platinum a good investment? We explore the world of platinum and compare it to its counterparts, gold, and silver, to help you make an informed decision.

Short Summary

-

Platinum is a valuable investment asset due to its rarity and wide usage, although it has limited demand compared to gold and silver.

-

Investing in platinum can provide a higher return potential, diversification, and inflation hedging for investors.

-

Investors should consider factors such as risk tolerance, portfolio strategy & liquidity when evaluating an investment in platinum.

Understanding Platinum as an Investment Asset

Platinum is a precious metal with an impressive array of properties, making it highly desirable in various industries and applications. Its rarity and wide usage make it a valuable investment asset. Platinum is often referred to as the "Rich Man's Gold" and is considered undervalued compared to gold.

However, unlike gold and silver, platinum's investment demand is limited, due to its use primarily in industrial applications.

Properties of Platinum

Once known as 'white gold', platinum is a silver-white precious metal almost similar to silver. Although it is less malleable than gold, platinum is still considered a soft metal that can be easily shaped. Platinum is ductile, allowing the metal to be stretched into a wire. Like gold, platinum is highly unreactive and extremely resistant to tarnishing and corrosion. These unique properties make platinum an excellent choice for jewelry making. Platinum jewelry, for instance, is often made of 95% pure platinum, making it a popular choice for those seeking a more valuable and durable alternative to other jewelry like white gold rings.

One of the key advantages of platinum over other precious metals is its hypoallergenic nature. Platinum is an excellent choice for individuals with sensitive skin or allergies, as it does not contain allergenic metals like nickel, commonly found in white gold jewelry. When considering platinum or white gold, it's essential to weigh the benefits of each to make an informed decision.

Platinum is also one of the densest elements at 12.4 ounces per cubic inch (21.45 grams per cubic centimeter), a little more than 21 times the density of water or 6 times the density of a diamond. The density of platinum makes it an excellent investment asset because a kilogram platinum bar, slightly smaller than a mobile phone, could be worth between USD $30,000 to $40,000. Like gold bars, platinum bars are a highly portable store of value.

How Rare is Platinum?

Platinum is significantly rarer than both gold and silver. In fact, it's so rare that all the platinum ever mined could potentially fit into your home. South Africa holds over 80% of the world's platinum reserves, with the other countries also owning significant platinum reserves being Russia, Zimbabwe, Canada, and the United States.

Platinum is found in relatively low concentrations in the Earth's crust and is almost as rare as gold. It is often associated with other metals, such as palladium, rhodium, and iridium, in ore deposits. Mining platinum is a challenging and expensive process due to its low concentrations in ore deposits, deep underground mining operations, and the need for specialized equipment and techniques. This limits the amount of platinum that can be extracted and produced.

What is Platinum Used For?

Platinum is a valuable and versatile metal with several important industrial uses that include:

-

Vehicle Emissions Devices - The metal is primarily used in the automotive industry as a catalyst in various chemical reactions in devices such as catalytic converters. In this respect, platinum is an increasingly common replacement for palladium, which is currently more expensive.

-

Petroleum and Petrochemical Industry - Platinum-based catalysts play a crucial role in refining crude oil and producing high-octane gasoline and other petrochemical products. They are used in processes like hydrocracking and reforming.

-

Chemical Industry - Platinum catalysts are used in the production of chemicals, including the manufacturing of nitric acid, sulfuric acid, and various organic chemicals.

-

Glass Manufacturing - Platinum is used in the glass industry for making glass fibers, optical lenses, and high-temperature glassware. It can withstand extreme temperatures without melting or reacting with the glass.

-

Medical Industry - Due to its hypoallergenic properties, platinum is also used in the healthcare industry in pacemakers, dentistry equipment, and important chemotherapy drugs used to treat cancers.

-

Jewelry - Platinum is also highly valued for its aesthetic appeal and is commonly used in high-quality jewelry due to its durability and rarity. The precious metal is commonly used to make platinum engagement rings, platinum necklaces, and bracelets.

Platinum Supply and Demand

According to the World Platinum Investment Council's (WPIC) Q2 2023 Platinum Quarterly report:

The platinum deficit is now projected to total 1,005 koz, 2% higher than the deficit presented in the last Platinum Quarterly. The updated deficit equates to a material 12% of projected full-year demand in 2023, the highest percentage on record. Demand in 2023 is expected to total 8,230 koz (+27% year-on-year), with automotive demand up 381 koz (year-on-year), industrial demand up 336 koz (to a record level in our series), and investment demand improving from net-negative to positive 386 koz. The outlook for jewelry remains muted, with demand effectively flat year-on-year.

The WPIC report also estimates that industrial demand is looking to be the strongest on record, particularly in chemical and glass production in China.

Comparing Platinum to Gold and Silver

When comparing platinum to gold and silver, we must consider their respective rarity, value, and industrial applications. Although all three metals are precious metals, they differ greatly in terms of their market dynamics.

In terms of global market size, the gold market is the largest, followed by silver and platinum. According to the CME Group, the annual supply of gold is around 120 million troy ounces per year, or around 3,700 metric tons, valued in the order of $150 billion. At an excess of 30,000 metric tons per annum, silver has the largest supply volume of the three precious metals. Silver's annual supply is valued in the order of $17 billion. The annual production supply of platinum is around 230 metric tons.

Among the three precious metals, the price of platinum is the most impacted by industrial supply and demand. Given that gold and silver have been monetary metals for most of humankind's history, they are also highly sought-after for investment in the form of bars, coins, and jewelry. Global central banks also hold substantial gold tonnage in reserves today. Gold and silver's investment demand makes both metals less susceptible to economic recessions since they are also safe haven assets to hold during times of crisis.

In terms of liquidity, both gold and silver are popular metals and are easy to sell, with a high volume of trading occurring daily on a global scale, given their larger market sizes. Despite platinum's smaller market size, platinum bullion is very liquid today, especially in mature bullion markets like Singapore. One can easily sell platinum to a bullion dealer, like Silver Bullion, at our retail store.

Pros of Investing in Platinum

Investing in platinum offers several advantages. Due to its volatility, it has the potential to yield higher returns compared to other precious metals. Additionally, investing in platinum can help diversify a long-term portfolio and provide a hedge against inflation.

Diversification is another significant advantage of investing in platinum. By incorporating platinum into a portfolio alongside other investments such as stocks, bonds, and other precious metals, investors can minimize risk and achieve a more balanced investment strategy.

Cons of Investing in Platinum

Despite the potential benefits, investing in platinum also comes with certain drawbacks. Platinum's higher volatility, compared to gold and silver, may be frowned upon by investors with a lower risk appetite.

Additionally, platinum's liquidity is lower than that of gold and silver, making it more challenging to purchase and sell in countries with smaller precious metal markets. Platinum's lower liquidity often results in fewer available platinum products, longer pre-order waiting times, and wider spreads when buying or selling.

A large portion of platinum demand comes from industrial uses, particularly the automotive industry for catalytic converters. Any downturn in this sector can adversely affect platinum prices.

Investment Options for Platinum

Investment options for platinum are varied, allowing investors to choose the best approach based on their individual preferences and financial goals. The most common investment options include physical platinum, platinum ETFs and stocks, and digital platinum.

Physical Platinum

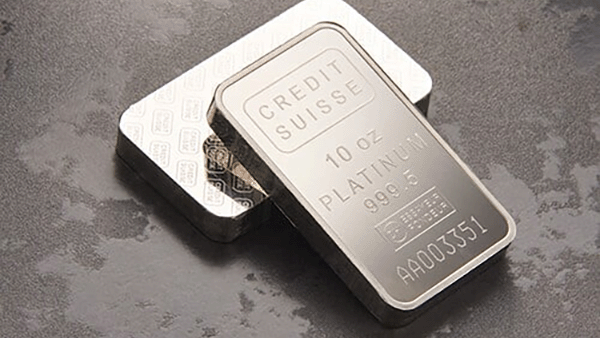

Investing in physical platinum, such as coins, bars, and jewelry, offers a tangible asset that can be held and stored. Popular platinum bullion coins include the Queen's Beasts and Britannia coins, while platinum bars are available in various sizes, such as 1kg, 500g, 100g, and one ounce from reputable sources like The Royal Mint.

However, investing in physical platinum also requires secure storage. Silver Bullion's S.T.A.R. Storage program, for instance, offers on-site storage for platinum bullion at their vault, The Safe House.

Platinum ETFs and Stocks

Platinum ETFs and stocks provide investors with exposure to the metal without the need to physically possess it. By investing in ETFs and stocks that track the price of platinum, investors can gain access to the platinum market and diversify their portfolios.

However, investing in platinum stocks also comes with its own set of challenges, such as market volatility, illiquidity, and the risk of investing in a single entity. Before investing in platinum ETFs and stocks, it is important to consider the associated costs, potential volatility, market liquidity, and the risk of investing in a single company.

By carefully evaluating these factors, investors can make informed decisions about whether platinum ETFs and stocks are the right investment option for them.

Digital Platinum

Digital platinum offers customers platinum buying without the need to manage platinum storage and can be backed by physical platinum, offering another avenue for investment in the precious metal. As the World Platinum Investment Council highlights, digital platinum is a digital asset that can be used to purchase goods and services, providing investors with a secure and easily accessible investment option without the need for physical possession.

The Royal Mint offers one such platform for investing in digital platinum, which allows for the purchase of fractional ownership of larger bullion bars. Investing in digital platinum can benefit from the ease of storage while still gaining exposure to the valuable precious metal.

Factors to Consider Before Investing in Platinum

Before diving into the world of platinum investment, it is crucial to consider several factors, such as risk tolerance, portfolio strategy, and investment amount. Understanding the differences between traditional trading and CFD trading is also essential when considering investment options.

Researching the market, assessing risk levels, examining investment tenure, evaluating tax implications, assessing liquidity, and gauging volatility are all pertinent factors to consider before investing in platinum. By carefully evaluating these aspects, investors can make informed decisions about whether investing in platinum is the right choice for their financial goals and risk tolerance.

Summary

In conclusion, platinum is a rare and valuable precious metal with unique properties and diverse investment options. While it offers potential benefits such as higher returns and diversification, it also comes with certain risks, including high volatility and low liquidity. By carefully considering the factors outlined in this blog post and evaluating the various investment options available, investors can make informed decisions about whether investing in platinum is the right choice for their financial goals and risk tolerance. Ultimately, the decision to invest in platinum lies in the hands of each individual investor, and a well-informed approach is key to success.

Frequently Asked Questions

Is it better to buy platinum or gold?

When it comes to choosing between investing in gold or platinum, it really depends on the individual's investment goals. Those looking for a safe haven asset with a reliable return over time should consider investing in gold, whereas those seeking higher returns may prefer investing in platinum. The platinum gold ratio can be useful to assess which precious metal is more undervalued.

Should I invest in platinum right now?

Precious metals like gold, silver and platinum are excellent long-term investments, especially with increasing global currency debasement and debt. Physical precious metals are often the go-to safe haven assets investors turn to during periods of market uncertainty and economic turmoil.

Platinum, like gold and silver, is certainly a wise investment choice and is an excellent metal for portfolio diversification.

Does platinum hold its value?

Yes, platinum holds its value due to its rarity as a precious metal. While gold is a more commonly used precious metal for jewelry, the annual consumption of platinum creates a high demand and maintains its value over time.

This demand is further driven by the fact that platinum is used in a variety of industries, such as automotive, electronics, and medical.

Does platinum have a future?

Platinum has a promising future, primarily due to its unique properties and diverse range of applications. Known for its high melting point, exceptional corrosion resistance, and excellent catalytic abilities, platinum is indispensable in various industries, including automotive, medical, and renewable energy sectors.

What makes platinum a valuable investment asset?

The relative scarcity of platinum compared to other precious metals, combined with its use in a variety of industrial and technological applications, make it an attractive investment option.