How Rare are Gold and Silver?

Have you ever wondered why gold, silver and platinum are often referred to as precious metals? We know that these metals are used frequently in jewelry and investment-grade bullion, but what makes these metals precious?

Well, they are precious because they are rare. But, how rare is gold and how rare is silver?

Before precious metals are sold to consumers, they had to be mined from the earth’s crust. They cannot be printed at the flick of a switch like currencies.

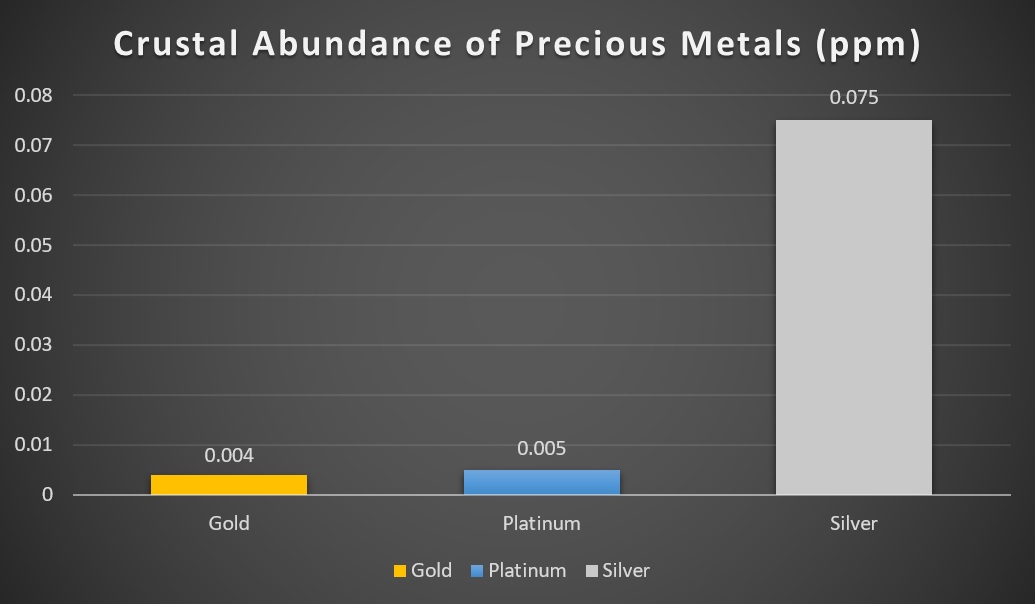

The abundance of elements in the earth's crust is often measured in parts per million (ppm). The best-known precious metals such as gold, silver, and platinum are naturally occurring elements in the earth's crust. Of the three precious metals (gold, silver and platinum), gold is the rarest (0.004 ppm), followed by platinum (0.005 ppm) and silver (0.075 ppm).

Here is how each precious metal compares on a chart.

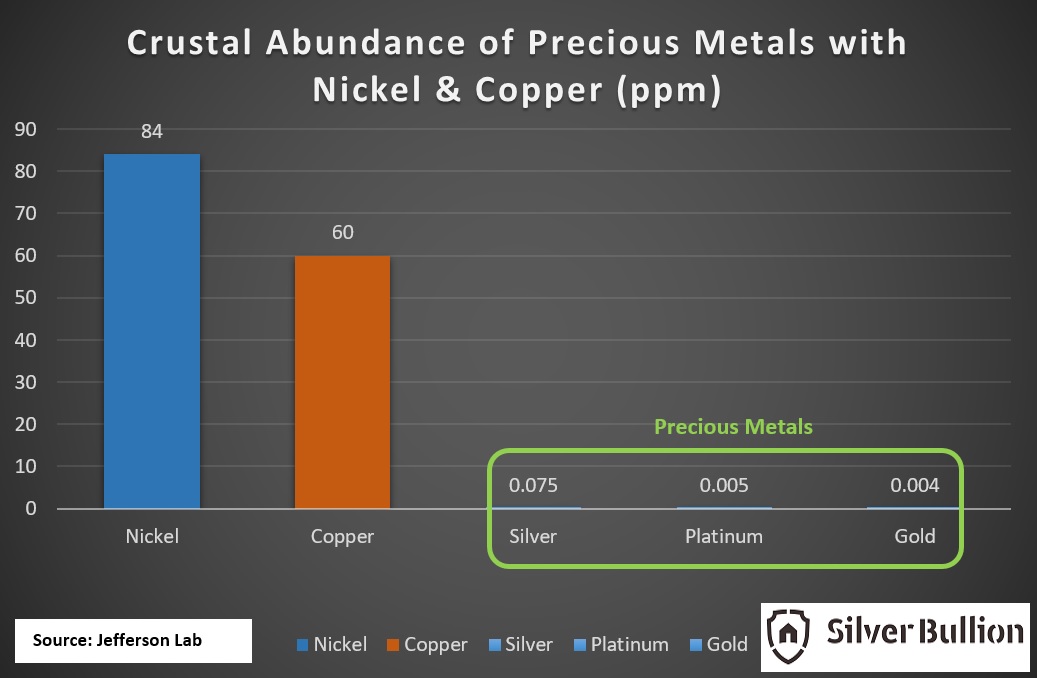

Silver seems to stick out like a sore thumb and looks hardly precious in the chart above until base metals such as nickel and copper are also included in the chart below. Currently, nickel and copper are often used to mint circulating coins – they have now completely replaced silver and gold in circulation coins.

Now, all three precious metals are just represented as thin lines on the chart. Gold, silver, and platinum are that rare!

More Gold Than Silver Above-ground

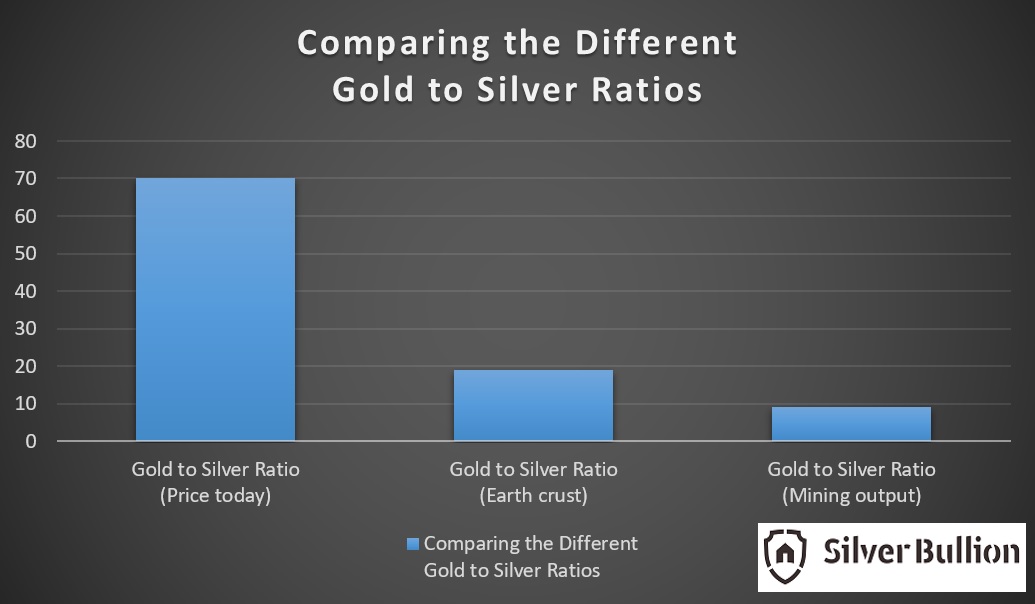

From the crustal abundance of precious metals, we can also see that the gold-to-silver ratio in the earth’s crust is about 1:19. This means that there is roughly 19 times more silver than gold in the ground.

However, the mining gold-to-silver ratio is about 1:9 – only 9 troy ounces of silver are mined for every one troy ounce of gold. The reality of mining is stark difference from scientific estimates.

According to the annual survey reports from Thomson Reuters, there are 71,578 tons of ‘identifiable above-ground’ silver stocks. Compare this to the 187,200 tons of above-ground gold stocks. There is actually lesser identifiable silver than gold above-ground.

Despite this, the gold-to-silver ratio, when comparing the prices of both metals, is about 1:70 at the time of writing. In other words, the value of an ounce of gold is equivalent to 70 ounces of silver!

From this perspective, silver is evidently and substantially more undervalued compared to gold.

Silver Market in Deficit for 13 Consecutive Years

From the Thomson Reuters 2014 Silver Survey, we can see that the global supply of silver has been steadily increasing since 2004. The same report also shows that global demand for silver has also been consistently higher than the supply resulting in deficits in the physical silver market for at least 13 consecutive years.

The gold market on the other hand has seen surplus in gold supply consecutively since 2013. In the same 13-year period of comparison with silver, there were seven years that ended with gold in surplus.

Evidently, the supply of silver is not keeping pace with its demand. It does not help that the silver supply continues to be decimated when silver is used.

Gold is Hoarded While Silver Is Used

Studies have shown that 98% of all gold mined throughout history is still hoarded in the form of coins, bars, jewelry or artifacts. This means that gold possessed by ancient empires is highly likely to still be around albeit possibly fashioned into a different form.

However, this is different for silver.

Silver continues to be a popular choice in industrial applications given that it is the best element to conduct heat and electricity. This gives silver a myriad of uses.

It is no wonder that silver can be found in thousands of products produced by tech industries: printed circuit boards in computers and mobile phones, batteries, electronic switches, solar panels, television screens, RFID chips, etc.

Unbeknownst to many, photographic applications used to be the No. 1 industrial use for silver. In 1999, silver's photographic applications peaked and represented 25% of total fabrication. With the advent of digital cameras, silver's use in photography has dropped substantially.

Silver is also used as an antimicrobial agent in medical applications. Its applications include silver being incorporated into wound dressings, treatment of mercury poisoning, use as a cauterizing agent, etc.

Unfortunately, these industrial and medical uses of silver in products also see a large quantity of silver being discarded when these products are used and thrown away. They end up in landfills and are deemed uneconomical to recycle.

It is no wonder then that there is less silver than gold above-ground today.

Silver: A Monetary Metal That Is Rare and Undervalued

Between gold, silver and platinum, only gold and silver have been used as money on a large scale over long periods of time throughout history. When minted into coins, they were portable wealth and were highly sought for their rarity.

Although rare, platinum was deemed impractical since it resembled many less expensive metals and it was difficult to work with since it was less malleable than gold or silver.

Silver's malleability is also the reason why this precious metal is used to craft jewelry by all cultures across the world. 92.50% pure silver, also known as sterling silver, is mixed with other alloys such as copper, zinc, or palladium to make it stronger and more durable overall.

Silver was used as money more often than gold throughout history. This can still be seen in the names of currencies today that point to their silver roots in the past.

Considering that the gold-to-silver ratio is hovering at 1:70 at the moment, silver is still undervalued and unloved.

Think about it. When you buy silver, you are buying a precious metal that has been used as money, has great industrial and medical utility, has a limited supply and is undervalued at this moment!

It is truly a unique moment now that we witness such a confluence of these factors.