Latest

Displaying 1 to 10 of 1132

-

06 May 2024

Jordan Roy-Byrne - Gold Will Go Higher Then Even Higher

Jordan Roy-Byrne sees gold breaching $5,000-$6,000 in 2-3 years after its breakout from a 13-year cup-and-handle pattern, while silver could reach $40 by year-end if it clears $29-$30 resistance zone.

(Read more) -

03 May 2024

Matthew Piepenburg - U.S. Dollar and Debt Crossing the Rubicon

Physical precious metals provide a reliable wealth insurance and inflation hedge, preserving value across generations without relying on third parties or governments.

(Read more) -

29 Apr 2024

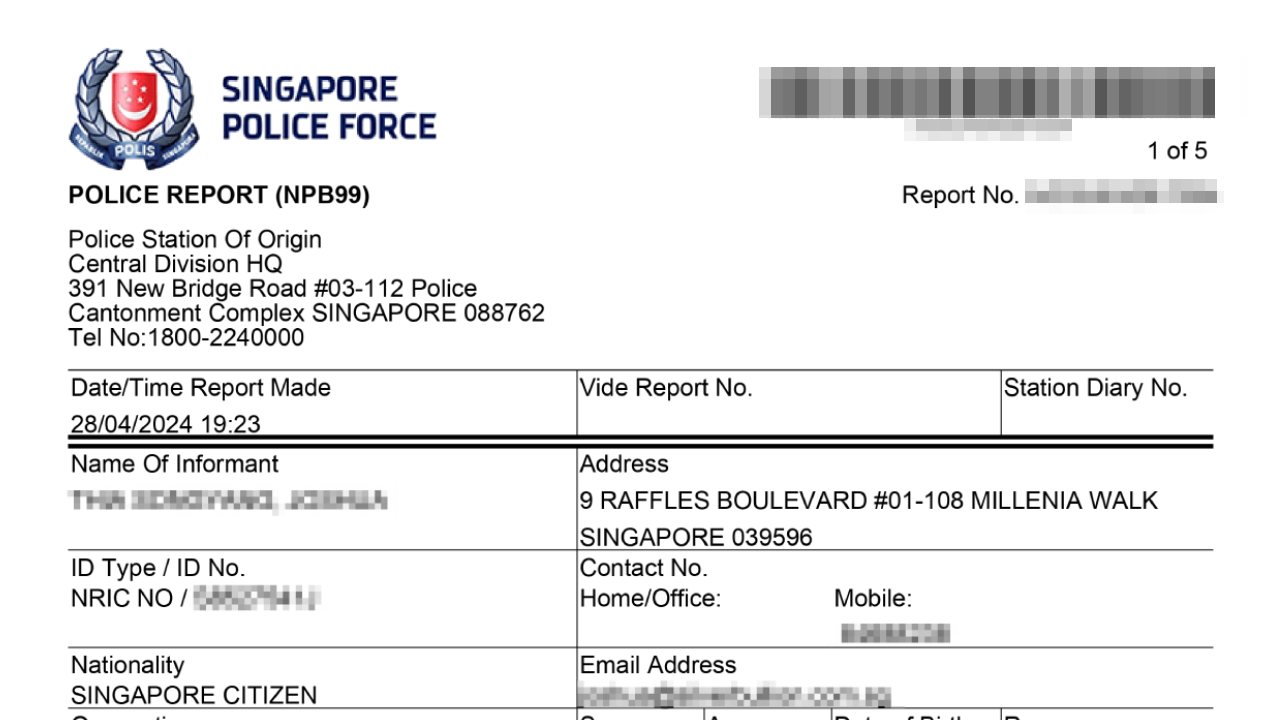

Fraud Alert: Warning Against Impersonation Scams

Silver Bullion has filed a police report, alerting clients to online impersonation scams. We urge vigilance and reporting of suspicious activities to enhance security.

(Read more) -

26 Apr 2024

Frank Holmes - #HODL #Gold, #Silver, and #Bitcoin

Frank Holmes discusses market forces driving gold, silver, and Bitcoin volatility, plus central bank gold buying, global elections' currency impact, and bridging the divide between "gold bugs" and "crypto babies."

(Read more) -

23 Apr 2024

Stefan Gleason - U.S. States Seeking Shelter From the U.S. Dollar

Stefan Gleason, CEO of Money Metals Exchange, discusses the growing state-level sound money movement embracing gold and silver as legal tender, while the federal government explores CBDCs, setting up an ideological clash.

(Read more) -

22 Apr 2024

Benefits of Having Gold in Your Wealth Portfolio

Gold has always been the fulcrum of economic activity and the financial system for most of mankind’s history, having been used as money as a medium of exchange in commerce and a store of value for savings. There are many reasons to own gold. Its safe-haven status and other attributes have benefited investor portfolios with a long-term allocation.

(Read more) -

20 Apr 2024

Alasdair Macleod - Gold is Winning!

Alasdair McLeod delivers a riveting analysis, asserting fiat currencies are crumbling against gold, dissecting the U.S. debt trap, and exploring geopolitical shifts reshaping the global monetary system.

(Read more) -

18 Apr 2024

Peter Krauth - Silver Market May Be Tightening More Than We Know

Silver prices surging, inventories being drained by industrial users standing for delivery on futures/ETFs, potentially leading to a $300 peak mania price.

(Read more) -

18 Apr 2024

Francis Hunt - Gold and Silver Look to Bring Extreme Wealth

Francis Hunt analyzed gold breaking $2,000, forecasting $7,500+ prices driven by debt devaluation. For silver, he predicted eventual single-digit gold/silver ratios implying $1,000+ prices.

(Read more) -

15 Apr 2024

WPIC: Platinum Demand to Benefit From Artificial Intelligence’s Rise

A March 2024 ‘60 Seconds in Platinum’ article from the World Platinum Investment Council (WPIC) reported that platinum demand is expected to increase in the coming years due to the growth of artificial intelligence (AI) applications.

(Read more)