|

Dear Subscriber

With the chinese new year approaching we are running silver specials on 2016 Maple Leaf coins, 100 oz Nadir bars and 1 kg Perth Mint Monkey coins. We have also enabled credit card payments of up to 20,000 SGD per transaction for bullion purchases, extension and transfer-ins.

Bullion availability is generally good but we are increasingly hearing from refiners that procuring raw silver granules is getting more difficult, which is a potential sign of upcoming raw material scarcity. Make sure to read silver shortages explained if you have not already done so.

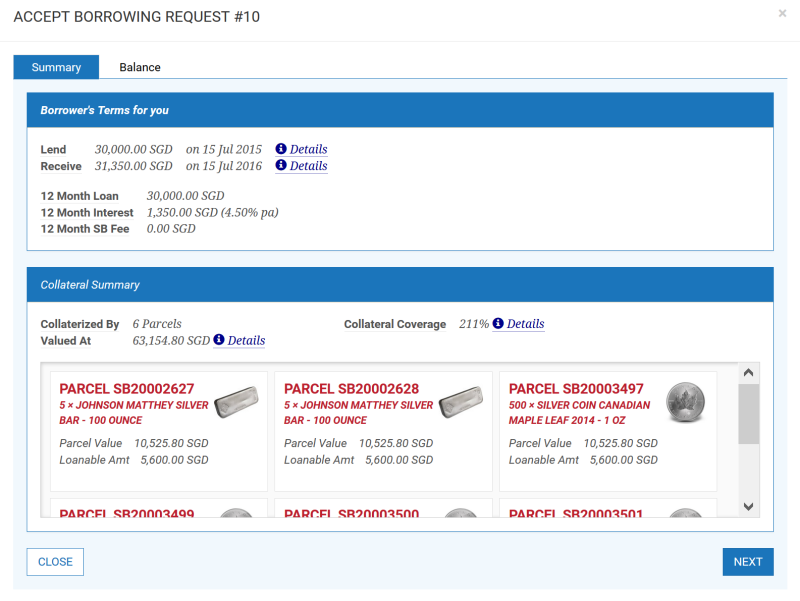

Our article this month is on our Secured Peer to Peer (P2P) Lending, the people who designed it, and how parcelized bullion collateral is ideal to virtually eliminate the possibility of defaults while benefiting both lenders and borrowers.

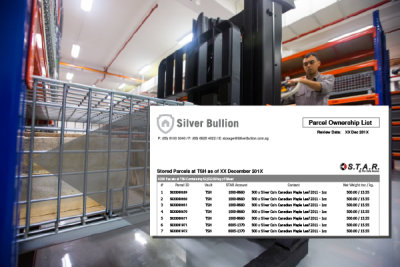

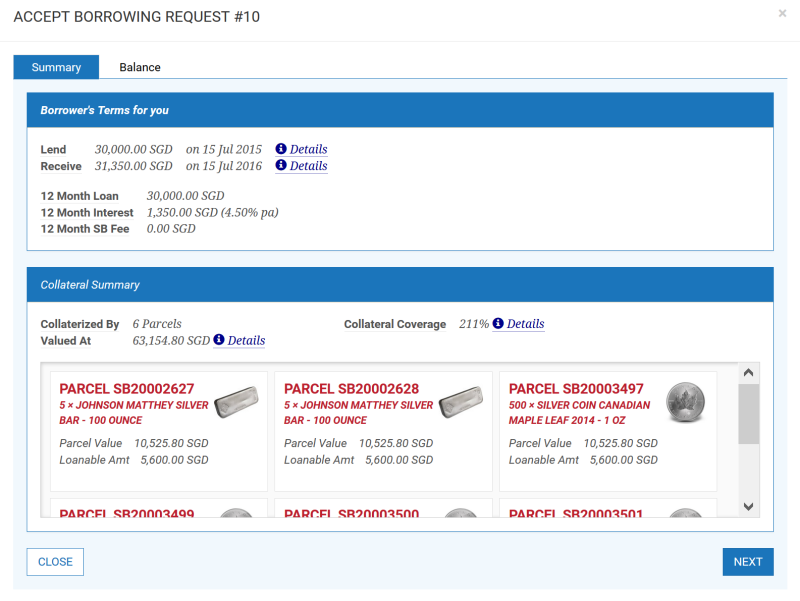

On a related note, PricewaterhouseCoopers (PwC) Singapore, our financial auditor, completed a full physical inspection of all 10,300 parcels in the parcel ownership list and concluded that all parcels are present. The full 166 page report is now available for download for our storage clients.

| Peer to Peer Lending and Systemic Wealth Protection |

Why Bullion Secured Peer to Peer Lending is Safer than Bank Credit

My parents spent most of their lives building holiday homes in the Tuscan countryside in Italy. After 25 years, we owned three picturesque villas and 42 apartments surrounded by 2,000 olive trees. It was 2006 and they were ready to retire.

By 2007, a year before the US subprime bubble burst we had sold the villas. The following six years Italian home prices kept falling, forcing many property owners to forfeit their properties back to the banks, which typically had financed about 80% of the purchase price.

One of these villas is now in its third fire sale auction at just 21% of our original 2007 selling price. Similar stories of real estate prices crashing are rife all over Italy. This is terrible for Italian banks, who now own forfeited property that is worth just a fraction of what they originally lent and they are unable to sell them.

When I visited Italy last December, four local banks had just gone bankrupt, affecting about 100,000 families. Public radio broadcasts messages were full of anger and desperation from those affected, many of whom did not qualify for depositor insurance and lost everything, “I thought a bank is safe!” was the typical comment.

What is often misunderstood is that you lose ownership of your cash the moment funds are deposited into a bank and that instead of an owner you have just become a bank creditor. Banks essentially operate an unallocated shared cash pool which is extensively leveraged and invested by the bank as they see fit.

So when banks struggle and face performance issues, liquidity issues or capitalisation issues for instance as a consequence of loading up with excessive non-performing loans in an overleveraged financial system, it is only prudent for you to diversify some of your holdings out of this credit based system. Since banks pay very little interest on bank deposits there is little foregone interest loss anyway.

Well insured physical gold and silver, owned – not owed - outside the financial system in a safe jurisdiction is a great wealth insurance. It may make you even very wealthy in case of a systemic crisis.

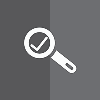

A neat alternative for your cash is to lend directly to bullion owners who need liquidity and who are willing to pledge their bullion as collateral. Thereby you obtain a secured return that is higher and your loan is safer than a typical bank deposit. This secured P2P system might sound too good to be true at first, but its advantages are simple to explain.

Specific bullion parcels of the lender, revalued every 5 minutes based international spot prices, serve as collateral to secure loans

Read the full article...

|

| Your stored bullion property by parcel |

Full PwC Report by Parcel

PricewaterhouseCoopers (PwC) Singapore, our financial auditors, did a full physical trace of every parcel of the parcel ownership list as of Dec 31st, 2015.

Five PwC auditor teams checked that each of the 10,300 silver, gold and platinum tamper evident parcels (about 100 tons) on the 162 page Parcel Ownership list is present, undamaged and stored as per specification.

Every individual parcel was accounted for and properly stored, with no exceptions found. You may peruse the full 166 page PwC report for download, by logging in, clicking on your username and then clicking on ‘Manage Parcels’. |

|

| Faster Order Processing and Credit Cards |

New Credit Card Payment Options

Credit cards can now be used to pay for bullion (up to 20,000 SGD), storage extensions as well as transfer-ins. This is a good alternative for smaller payment amounts because the 3% fee is typically less costly than bank wire transfer fees.

Customers may pay with their Visa or MasterCard by selecting "credit card" as the payment option. Upon submitting the order, you will be taken to our payment processor’s page to finalize payment. |

|

| Chinese New Year Specials |

Chinese New Year Silver Specials

|

|

|

Silver Nadir 100 oz Bars :

1.08 USD premium per oz - tier 1

1.03 USD premium per oz - tier 2 (cumulative 1,500 oz purchased*)

0.98 USD premium per oz - tier 3 (cumulative 3,000 oz purchased*)

0.93 USD premium per oz - tier 4 (cumulative 5,000 oz purchased*)

0.88 USD premium per oz - tier 5 (cumulative 10,000 oz purchased*)

|

|

|

Silver Maple Leaf Coins 2016:

2.29 USD premium per oz - tier 1

2.24 USD premium per oz - tier 2 (cumulative 1,500 oz purchased*)

2.19 USD premium per oz - tier 3 (cumulative 3,000 oz purchased*)

2.14 USD premium per oz - tier 4 (cumulative 5,000 oz purchased*)

2.09 USD premium per oz - tier 5 (cumulative 10,000 oz purchased*)

|

|

|

Silver Lunar Coins 2016 - Year of the Monkey - 1 kg:

2.19 USD premium per oz - tier 1

2.14 USD premium per oz - tier 2 (cumulative 1,500 oz purchased*)

2.09 USD premium per oz - tier 3 (cumulative 3,000 oz purchased*)

2.04 USD premium per oz - tier 4 (cumulative 5,000 oz purchased*)

1.99 USD premium per oz - tier 5 (cumulative 10,000 oz purchased*)

|

| |

*All your current and past purchases, in ounce terms - with gold and platinum counting as 10x, are summed to determine your tier so your discount keeps growing over time.

|

| In Cinemas - The Big Short |

|

|

The Big Short - A Movie Worth Watching

Based on true events, the movie gives you a raw and realistic sense of how greed, ineptitude and systemic fraud perverted our financial system and caused the near collapse in 2008.

Its rawness makes it awesomely authentic and the movie is well worth the time to view. The PGA (Producers Guild of America) awarded "The Big Short" the top film prize.

We feel a real kinship to the characters played by Brad Pitt and Steve Carell as the very issues and experiences addressed in the movie spurred us to "opt out of the system" in late 2008 and create Silver Bullion, The Safe House and our secured peer to peer lending program.

|

|