|

Dear Subscriber

Physical bullion demand is easing from the recent record highs, allowing mints to fulfill more of their back-orders, before they re-tool and prepare to mint 2016 coins. Coin premiums are falling back to near pre-shortage levels and we are taking pre-orders on American Eagles and Maple Leaf coins again. A metric ton of Vienna Philharmonics coins will be arriving soon and we have good availability of 100 oz Nadir bars that are already in Singapore.

This month we are announcing a new set of greatly enhanced reports for S.T.A.R. Storage customers, we are writing on the importance of counterparty risk and we are publishing a high-quality infographic on Sovereign Debts and how governments kept on borrowing over the last seven years.

If a picture is worth a thousand words then this infographic was money well spent as it gives a vision and feeling to our debt problems by stacking US (and other countries) debt into huge stacks made out of 100 USD bills and placing them, to scale, next to their respective national monuments. Make sure to view the high-resolution version.

Last Month, Silver Bullion’s Peer to Peer loan lending activity recorded a record 34 loans worth around 1,850,000 SGD (1.3 Million USD) being made between clients. The increased borrower demand and transaction liquidity caused interest rates to climb from a 3% low back to around 5% now. Currently the seems to be a clear borrower preference for 24 month USD loans. You can post your own lending offers or borrowing request at the Peer to Peer loan Listings page.

Lastly, if you will be in Switzerland consider visiting us at the Shorex Wealth Management Forum Geneva 2015 this December 2nd where we will be speaking on the subjects of physical bullion and counterparty risks.

Why it all boils down to Counterparty Risk

In late 2008 I sat in the trading room of a major German bank and witnessed first hand the trader's eerie nervousness as Lehman's default rippled through the financial system.

The fear was that a large bank's insolvency can, through its counterparty chains, bankrupt other institutions and thereby cause a self-reinforcing cycle which our overleveraged and undercapitalized banks are ill equipped to survive.

Nowadays a major bank default is akin to starting a game of Russian banking roulette, whereby each time a sizable bank default occurs two new bullets are added in the figurative revolver until we run out of defaults or no bank is left standing.

KfW Bankengruppe, named "Germany's dumbest bank" by the media caught such a bullet in late 2008 as it transferred 300 million Euros to Lehman Brothers as part of a Euro for Dollar swap agreement on the very same day that Lehman declared insolvency, leaving KfW in big trouble.

So it was no wonder that for a few days in late 2008 the financial system was nearly paralyzed by counterparty fears, as bankers waited to see who would default next and hoped that the public would not lose confidence as well.

Quick thinkers however had already eliminated much of their banking counterparty risk and purchased physical gold and silver as a hedge. I was not among the quick and by the time I tried to buy physical bullion myself in late 2008, dealers and banks in Frankfurt were already sold out. Confusingly, silver and gold spot prices at the time kept falling despite the physical shortages, You can read Silver Shortages Explained - How Physical Demand has Little Effect on Prices to understand why this happens.

The feared financial Armageddon was ultimately postponed through massive governmental bailouts thereby restoring the banker's fragile faith in each other.

Large banks had become "too big to fail" because they owed too much money and governments could not afford this Russian roulette game to run its course. But how expensive were these bailouts and what will happen when the next crisis requires even larger bailouts? Hence the question:

Can governments bail out these financial institutions again?

Have a look at the vertiginous governmental debt increase since the 2008 crisis:

|

|

|

An accountant's nightmare. Each tiny money pallet square represents 100 million dollars, US debt pillars represent 1 trillion USD each, in actual scale next to the Statue of Liberty.

|

As the infographic shows US sovereign debts have nearly doubled from their 2008 levels while the UK managed to triple its public debts burden in these seven short years. The numbers exclude the massive regional/state level debt and the municipal/city level debts which have also skyrocketed.

An even bigger budget problem is the lack of funds for pensions and medical promises, these are referred to as unfunded liabilities and, in the case of the USA, are estimated to be a staggering 60 to 100 trillion USD. Watch I.O.U.S.A.: Byte-Sized - The 30 Minute Version - to get a great overview of these problems.

So should governments bail out these financial institutions again?

Read the Full Article...

|

New Storage Reports

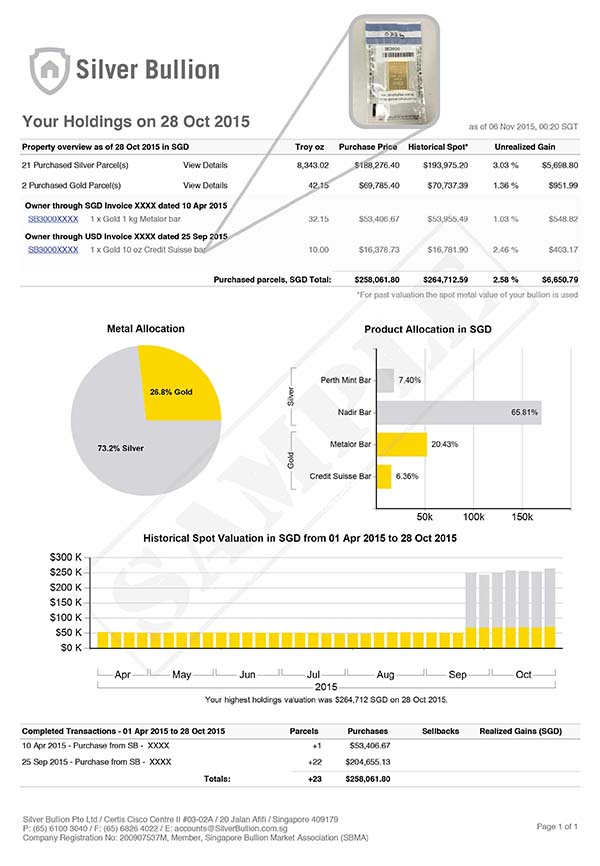

The new drill-down reports in your storage interface allow you to view photographs, history and eventual test results of each parcel you store under S.T.A.R. Storage. The parcels are sub-grouped by their respective invoices which evidence ownership transfer under Singapore commercial law.

Each parcel's purchase price is also conveniently tracked within the report so that you can optimize eventual gains/losses depending on which individual parcels you decide to sell. Note that, in case of transferred-in bullion, no purchase cost can be provided as the bullion was not purchased from us.

You can view Metal Allocation and Product Allocation at any point in time and the Historical Valuation Chart will give you a good overview of your holdings valuation changes over time. Reports can also be downloaded into MS. Excel format if needed.

|

|

|

The new drill-down storage reports [sample]

|

User Agreement Clarifications

A number of small clarifications were added to make version v. 20151105 of the user agreement. These additions were made in response to questions from users; The most relevant additions are summarized as follows:

- Storage, clause 7.5, 7.6- A Parcel can be transferred between accounts if the accounts have the same beneficiary owner.

- P2P Loan, clause 8.13 - You cannot transfer loan contracts or their payouts to a third party or use them as security with a third party without a prior written agreement from SB.

- P2P Loan, clause 12.2 - be advised that if you have a corporate account and your company primarily lends out funds then you might be required to have a Singapore a money lending license.

|

|