Insights

Displaying 41 to 50 of 89

-

03 May 2022

How Singapore Bought Its First Gold Reserves

Two Singaporeans and a South African met in a Washington hotel room during the 1968 World Bank summit. The South African, careful to prevent their subsequent conversation from being eavesdropped on by some intelligence agency, said, “Before we talk, we must switch on the TV very loud.”

(Read more) -

22 Dec 2021

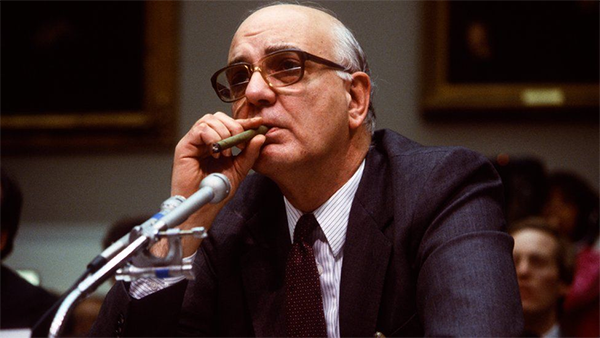

Where is the New Volcker, and Why Should We Care?

History occasionally sees the right people in power rescue their country from calamity. Paul Volcker, the Federal Reserve Chairman who beat inflation in the early 1980s, was one of these people.

(Read more) -

29 Oct 2021

Hyperinflation Happens When People Lose Trust

Politicians seem to assume that the public’s confidence in the currency is always guaranteed but history has clearly shown that this is not to be the case.

(Read more) -

01 Oct 2021

The Virtuous & Vicious Cycle

The virtuous cycle puts nations on the road to prosperity while the vicious cycle sends them spiralling into disaster. We compare the difference in outcomes between Singapore and Europe given the government policies implemented.

(Read more) -

21 Jun 2021

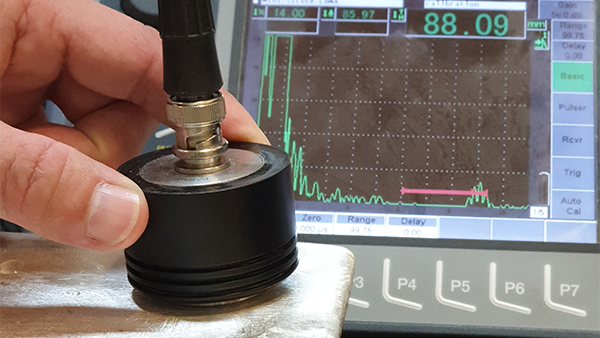

The Difference with Storing Bullion With an Entity That Tests and Guarantees the Genuinity of Your Precious Metals

The practice of counterfeiting is as old as money itself and is sometimes regarded as the world’s second-oldest profession. Counterfeiting gold continues today.

(Read more) -

17 May 2021

Singapore's Approach to Defense: From a Poisoned Shrimp to the Dolphin

How prepared is Singapore against military attacks? What is the city-state's defense strategy? We answer these questions and more about Singapore as an excellent jurisdiction for wealth in this newsletter.

(Read more) -

12 Apr 2021

Own Gold & Silver Before the World Scrambles For Them

The recent furor questioning the ability of the GLD and SLV to deliver physical bullion outside of normal market conditions brought to mind the advice from Kyle Bass to UTIMCO to convert their GLD shares into $1 billion worth of solid gold bars in 2011.

(Read more) -

02 Mar 2021

Is Your Gold Storage Program Making You an Owner of Bullion or Creditor?

The gold industry frequently misuses the word ‘ownership.’ There are many ‘gold ownership’ programs that claim to offer customers the opportunity to buy gold with the 'lowest cost of ownership.' The use of the word ‘ownership’ gives the impression that the buyer owns the gold bought but is this true? Let us delve deeper.

(Read more) -

21 Dec 2020

Relocation of The Safe House to The Reserve

(Read more)Here is a peek into the relocation of our vault, The Safe House, to our new building - The Reserve.

-

21 Dec 2020

Gregor Gregersen: Taking Wealth Protection to the Next Level

(Read more)Silver Bullion's CEO, Gregor Gregersen, shares his vision for the future and gives S.T.A.R. Storage customers an update on the relocation of The Safe House vault to The Reserve.