Insights

Displaying 81 to 90 of 104

-

23 Apr 2017

How Geopolitics Could Make Singapore the Most Important Gold Market

Last year I had the privilege to attend a dinner with Mr. Chan Chun Sing, a Singapore Minister from the Prime Minister's Office...

(Read more) -

12 Apr 2017

How Rare are Gold and Silver?

Have you ever wondered why gold, silver and platinum are often referred to as precious metals? We know that these metals are used frequently in jewelry and bullion, but what makes these metals precious?

(Read more) -

05 Apr 2017

Gold Rate In Singapore

Gold rate refers to the price of gold in a particular region or market, such as in Singapore. It is commonly expressed in terms of price per gram or ounce and is determined by various factors such as supply and demand, global economic trends, political events, and currency values.

(Read more) -

31 Mar 2017

American Eagle Gold Coin Value

American Eagle Gold Coins are one of the most popular gold bullion coins in the market today, known for their patriotic design and high gold content. Produced by the United States Mint, these coins are considered legal tender and are highly sought after by investors and collectors alike.

(Read more) -

01 Feb 2017

How Currencies Depreciate and Gold Appreciates Over Time

Over the last century, gold’s return showed an average 3.9% to 4.5% return in USD terms while the USD had an average 3.2% loss in real terms.

(Read more) -

15 Nov 2016

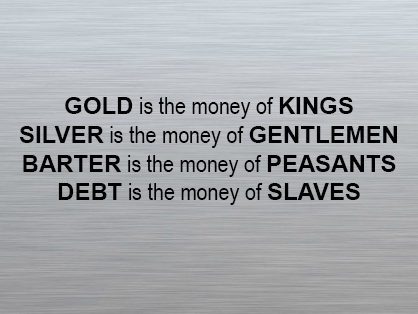

Debt Monetization - an Economic Powder keg

At a time when global debts are 20% of world GDP higher than during the 2008 crisis these negative interest rates are a big warning sign that something is terribly amiss with our financial system. There is simply too much debt which has been artificially made too cheap for too long and it is routinely financed by printing new currency (debt monetization).

(Read more) -

13 Oct 2016

5 Reasons to Buy Silver

If you are new to silver, we share in this article 5 compelling reasons why silver is an important asset today for wealth preservation.

(Read more) -

30 May 2016

The Resurgence of Silver's Monetary Role

Although nothing is a sure bet, silver's fundamentals make a compelling case as it continues to be undervalued despite increasing demand and diminishing supplies. The largest silver hoards are effectively depleted to make billions of industrial and consumer electronic products.

(Read more) -

28 Apr 2016

Currency Names That Still Point to Silver Money

Unbeknownst to many, silver has been used more times as money in history than gold. It was only towards the end of the 19th century that silver was systematically de-monetised from the monetary system by the United States and Great Britain.

In this article, we show you how the names of major existing currencies today were derived from their silver roots. Their link to their silver past reminds us all that silver is money and money should be a store of value cherished for its scarcity.

(Read more) -

29 Mar 2016

The Advent of Powerful Personal Testing Tools

New Precious Metal Testing tools make it easy and much more affordable to reliably test for advanced bullion counterfeits.

(Read more)