5 Reasons to Buy Silver

#1 - Silver Was Money

History tell us that silver was used more often than gold as money in the past.

Silver became the people’s choice for money not because of any government decree. It was chosen by people because it was found to be a fair medium of exchange that held its value very well over long periods of time.

Along with gold, silver continues to be one of the very few elements that fulfil the characteristics of money which are: durable, portable, divisible, uniform and limited supply.

The best form of money should be …

Durable: Silver does not corrode, decay or have a limited lifespan.

Portable: Silver is portable in the form of coins and bars.

Divisible: Silver money can be divided into smaller units to accommodate transactions of different sizes.

Uniform: Each unit of silver money does not differ from another similar unit. This uniformity persists even when silver is divided into smaller units.

Limited Supply: For money to be sought after and hold value, it should not be as plentiful in supply as the sand on the beach or easily created out of thin air. Silver is rare and takes productive effort to mine. For every ounce of gold extracted from the earth’s crust, only 8 ounces of silver are mined today.

Although world currencies today are no longer backed by precious metals, we continue to see their silver ‘roots’ in the names of currencies and words used for money in many languages.

The names of currencies such as the dollar, yuan, yen, pound sterling, peso, rupee were derived from their silver origins.

Silver continued to have a monetary role even in the 20th century. Between 1878 to 1964, the United States Treasury issued U.S dollars that were redeemable in silver. Known as silver certificates which allowed certificate holders to redeem silver coins from a bank. This redeemability ended in 1968 as the U.S government did not have enough silver to cover the massively printed dollars.

#2 - Silver has no counterparty risks

When you own physical silver bullion, you would hold the full value of your wealth with you. Your wealth is not owed to you by another party. A silver bar in your possession continues to hold its intrinsic value. Unlike currency deposits in a bank, you are owed the amount of deposit by the bank and the value of the currency is dependent on state that issues it.

It is ideal to hold some wealth in physical bullion especially if you see the fundamentals of currencies deteriorating. Central banks around the world today are furiously printing currencies to address a ballooning debt problem. Each unit of currency depreciates with each new unit created.

Currencies are a promise of payment by the governments issuing them. Without any gold or silver backing today, confidence in currencies is entirely based on faith. This faith is increasingly being questioned in view that the issuer of the world’s reserve currency, the United States, is piling on debt faster with each new year.

Should a run on banks happen in your country, you do not need to join other depositors to queue at the ATMs for the wealth you have put in physical silver. Rather, that wealth is now segregated from the risky and debt-laden financial system. You would have minimised counterparty risks from banks and currencies.

Against such a global environment, it is reassuring to know that wealth held in physical silver bullion is unaffected when an economic crisis on a scale equal to or more severe than the Financial Recession of 2008 happens.

#3 - Silver is indispensable

When you buy physical silver, you are buying a metal that has a myriad of uses. Silver continues to be the best conductor of heat and electricity. No other element on the periodic table is able to beat silver in these two areas.

In a world that is increasingly reliant on technology, silver continues to be used in every electronic device. Given its low price and unsurpassed electrical conductivity, silver is difficult to replace. As a result, small amounts of silver are found in millions of products such as mobile phones, computers, cameras, motor vehicles, electrical switches, RFID tags and industrial machines.

With the trend of renewable energy gaining traction, silver’s efficient thermal conductivity has seen the white metal used in photovoltaic cells for solar panels, engines and silver-zinc batteries.

Silver also has a role in medicine for thousands of years due to its non-toxic antibiotic property. Silver foils have been wrapped around wounds to aid healing. Colloidal silver continue to be applied or ingested to fight illnesses. Surfaces and medical equipment coated with small amounts of silver also prevent the spread of pathogens.

It is believed that the phrase ‘born with a silver spoon in the mouth’, which is used to describe a child born into a wealthy family, came about when the children of wealthy families were instructed to suck on silver spoons in an attempt to ward off the bubonic plague in Europe in the 14th century.

Like gold, silver will always be in demand because of its many useful applications. This naturally results in silver retaining its value over long periods of time.

#4 - The demand for silver exceeds supply

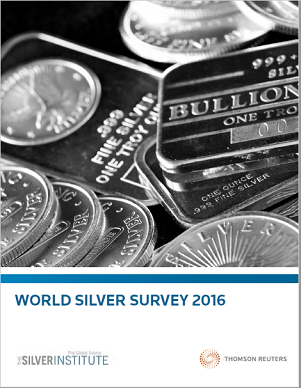

The World Silver Survey for 2016, produced by GFMS Thomson Reuters, reported that global silver supply in 2015 was 1,032.8 Moz (or 32,124 tons) – 886.7 Moz came from mine production and 146.1 Moz came from scrap.

Despite worldwide silver mine production increasing for a 13th consecutive year, the rate of growth (at 2%) was less than half that of previous three years. The multi-year lows in the silver price since 2011 also saw it taking a toll on scrap supply – it fell to its lowest since 1992.

Despite multi-year lows in the silver price, total physical silver demand rose to a record high of 1,170.5 Moz in 2015. The report noted that “the largest contributor to total demand growth was coin and bar investment, which surged 24% last year to reach a record high of 292.3 Moz”.

The silver market continues to have an annual physical deficit for the past three consecutive years.

In the middle of 2015, the acceleration of physical purchases from silver coin and silver bar investment depleted the supplies of the U.S Mint, Royal Canadian Mint, Australian Perth Mint and the Austrian Mint. During this period, precious metals dealers were unable to obtain ample supply of silver coins and silver bars to meet the purchase demand of their customers.

Looking back at the year 2015, the price of silver bottomed slightly under USD 14/oz in December 2015. It was a year where sentiments on buying silver were very negative. Mainstream media was trumpeting stocks and other investment assets.

Despite these factors, it was interesting that some astute investors were accumulating physical silver coins and silver bars which contributed to the record surge in demand. These investors are likely to form only a small percentage of the investment crowd as well as the investable funds. From this perspective, we can see how tight the physical precious metals market is if this small group of investors can deplete physical stocks of global mints in a year that is probably the most negative for precious metals.

What will happen then when the media starts heralding the return of the precious metals bull market and the majority of the investment crowd jumps onto the bandwagon? Surely, the price would have to rise to absorb this greater surge in demand for physical coins and bars.

#5 - Silver is undervalued versus gold

The abundance of silver in the earth’s crust is estimated to be about 0.075 ppm(parts per million). Compare this to gold’s crustal abundance of 0.004 ppm. In other words, there is roughly 19 times more silver than gold in the earth’s crust.

The gold-silver ratio shows the number of ounces of silver it takes to equal the value of an ounce of gold. This ratio has fluctuated between 12 and 100 since the time of the Roman Empire. More recently, the gold-silver ratio averaged 47 for the entire 20th century. At the time of writing this article, the ratio is 72 – one ounce of gold could buy 72 ounces of silver.

It is obvious that silver is more undervalued versus gold despite it being 19 times more abundant than gold in the earth’s crust and both elements are considered precious metals. Silver becomes even more undervalued if you consider that for every 1 unit of gold mined, only an estimated 8 units of silver is mined.

This wide difference in value between both metals is further accentuated if you consider that most industrial-used silver ends up in landfills together with the end-of-life of computers or electrical components. Silver in electrical components are seldom recycled given the low price of silver and the cost of recycling.

So while above ground gold is mostly hoarded as a store of wealth, much industrial used silver is used and lost. The GFMS Thomson Reuter’s World Silver Survey 2016 estimates that there are 71,578 tons of “identifiable worldwide above ground silver reserves”. These reserves could cover only 25 months of physical demand. The value of this amount of silver is only 38 billion U.S dollars. Compare this to the 183,600 tons of equivalent gold reserves valued at 7,344 billion U.S dollars.

We can see that although there is more silver than gold mined, the physical above ground stock of silver is much less than gold. Despite being a precious metal with a lower reserves supply and more industrial applications, the price of silver continues to differ greatly from that of gold today.

Now Is The Right Time To Buy

It is now a good opportunity to buy silver while it is undervalued. In addition to the compelling reasons to buy silver, we are witnessing the deteriorating of the global financial system – there is a constant wave of news about central bank money printing, rising levels of debt, over-leveraged banks teetering on collapse and the introduction of negative interest rates that confound the laws of economics. Never before has the need to preserve wealth been so important.