The Topping Phase of Empires According to Ray Dalio’s Changing World Order

Ray Dalio's Big Cycle of Changing World Orders

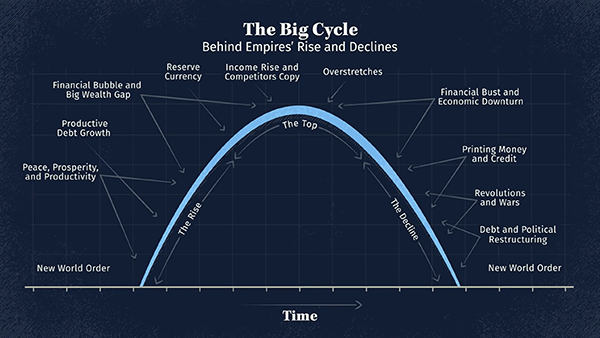

In his book 'Principles for Dealing with the Changing World Order,' Ray Dalio, founder of the world’s largest hedge fund, Bridgewater Associates, extensively studied the cyclical nature of world orders, dividing them into three distinct phases: the rise, the top, and the decline.

We previously covered Dalio’s assessment of how empires rise. This article compares Dalio’s research regarding the Dutch, English, and American empires when they reached the Topping Phase, a period that is particularly intriguing as it marks the zenith of an empire's power and influence, also known as 'golden ages', but also sows the seeds of its eventual decline.

Attainment of Reserve Currency

When an empire transitions into the topping phase or golden age, one of the defining characteristics is often its currency becoming the world’s reserve currency. This phenomenon is a reflection of the empire's economic dominance, stability, and the widespread use of its currency in international trade and finance.

An empire at its zenith usually has a robust and thriving economy, marked by high productivity, innovation, and extensive trade networks. This economic dominance instills confidence in the empire's currency, making it a preferred choice for international transactions.

The stability of the government and its institutions also plays a crucial role, as it assures other nations of the currency’s reliability and resilience against economic shocks.

When a country's currency is used extensively in international trade, it becomes more attractive as a reserve currency. Countries prefer to hold reserves in a currency that they can use to conduct trade and settle international debts. The more widespread the use of a currency in international trade, the more likely it is to become a reserve currency.

While the concept of a "world reserve currency" as it is understood today did not exist during the time of the Western Roman Empire, the Roman currency, particularly the denarius and later the solidus, was widely used and accepted throughout the Western Roman Empire and beyond its borders due to the empire's extensive trade networks and vast territorial reach.

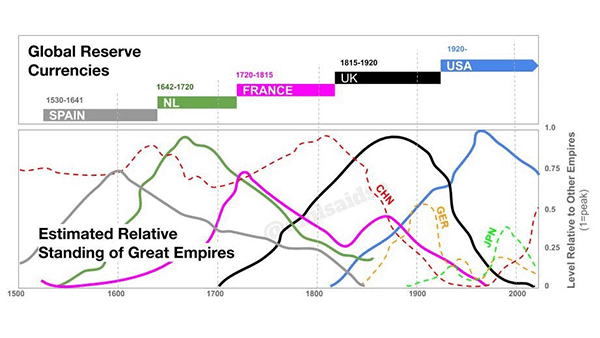

Historical Instances of Reserve Currencies

Historically, the Dutch guilder, the British pound, and the U.S. dollar have all achieved the status of the world's reserve currency during the topping phases of their respective empires.

With its extensive trade networks and financial innovations, the Dutch Empire saw the guilder become a dominant currency in the 17th and 18th centuries.

The British pound achieved similar status in the 19th and early 20th centuries, reflecting the British Empire's global economic and trade dominance.

Currently, the U.S. dollar holds the status of the world's primary reserve currency, symbolizing the economic and financial might of the United States.

Implications and Challenges of Having the World’s Reserve Currency

Having the world’s reserve currency comes with substantial implications, serving as both a privilege and a responsibility for the nation wielding it. Given the global demand for its currency, the country whose currency holds this esteemed status enjoys several advantages, such as lower transaction costs in international trade and the ability to borrow at more favorable interest rates. This status also often results in lower exchange rate risk for the nations holding this currency in their foreign exchange reserves, as it is considered a ‘safe-haven’ asset.

Furthermore, it allows the issuer country to run trade deficits and consume more than it produces, as other countries are willing to hold its currency. The global demand for the reserve currency also typically leads to its appreciation, making imported goods and overseas travel cheaper for citizens of the issuing country.

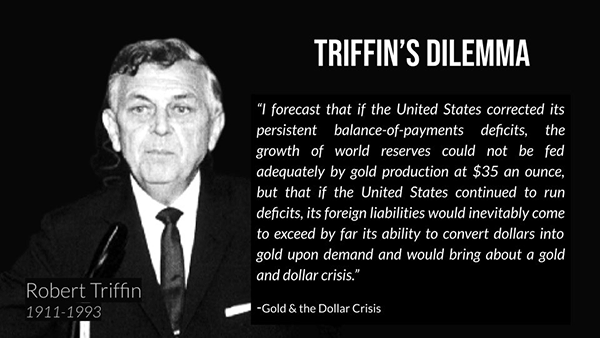

However, the challenges accompanying this privilege are significant. The issuing country must balance its domestic monetary policy needs with international demand for its currency, a phenomenon known as the ‘Triffin Dilemma’. This implies that the country must supply liquidity to the rest of the world, which can lead to trade imbalances and may necessitate running persistent current account deficits, potentially leading to domestic economic instability.

Additionally, there is constant pressure to maintain economic stability, transparency, and a high level of confidence in the currency’s value, as any perceived economic mismanagement or instability could lead to diminished demand for the currency on the international stage. Lastly, an overvalued currency, due to its reserve status, can harm the domestic industries of the issuing country by making its exports more expensive and less competitive in international markets.

Rise of China’s Renminbi

In recent times, there has been growing speculation about the Chinese renminbi (RMB) becoming a world reserve currency, reflecting China's rising economic power and influence. The inclusion of the RMB in the International Monetary Fund's basket of reserve currencies in 2016 is a significant step in this direction.

However, for the RMB to fully attain this status, China would need to continue its economic liberalization, enhance the transparency of its financial institutions, and expand the use of the RMB in international trade and finance.

How the Leading Empire’s Competitiveness Declines

According to Ray Dalio, as an empire reaches the topping phase and its currency becomes the world’s reserve currency, a series of economic and societal shifts occur, often leading to the empire becoming uncompetitive on the global stage.

The elevated status of the currency makes the nation's labor and products more expensive and, consequently, less competitive in international markets.

This, coupled with the widespread adoption and copying of its technologies and methods by rising powers, further erodes the competitive edge once held by the empire.

Dalio shared the example of the then-dominant Dutch empire’s shipbuilders becoming more expensive than English shipbuilders. Shipbuilding companies would hire the Dutch to design better ships but employ English shipbuilders to build them. Therefore, ships built outside of the Netherlands were cheaper, reducing the Dutch empire’s competitiveness in this industry.

In modern times, China has been the world’s manufacturing factory for several decades. Like the Japanese before them, the Chinese started copying American technologies and products, but have evolved to improve their products and create new innovative products.

Having reaped the benefits of economic prosperity, the affluent society often experiences a shift in values, with hard work and innovation being deprioritized in favor of leisure and consumption. Following generations who are accustomed to better living standards and inheriting the fruits of labor of the preceding generations become less battle-hardened and are more vulnerable to challenges.

Dalio cited the Dutch Golden Era and the British Victorian Era as decadent periods where the populace was accustomed to the finer things of life and becoming less productive and uncompetitive.

This change in societal values leads to a decline in productivity and innovation, further diminishing the empire’s competitiveness.

A Widening Wealth Gap and Onset of Financial Bubbles

This shift in values and priorities also contributes to a widening wealth gap within the society. The affluent classes, with their access to resources and capital, are able to further enrich themselves, often through speculative investments, leading to the creation of financial bubbles.

The less affluent, on the other hand, face stagnating wages and diminishing economic prospects, leading to increased economic inequality. This widening wealth gap and the ensuing social tensions can lead to political instability and societal unrest, further weakening the fabric of the empire.

The financial bubbles created in this environment of speculation and inequality eventually burst, leading to economic crises that further exacerbated social disparities and undermined the stability and strength of the empire.

In this way, the topping phase, marked by uncompetitiveness, societal shifts, and economic excesses, sows the seeds of decline for the once-dominant empire.

Military Overreach

Military overreach exhibited by leading empires, like the Roman Empire, is a phenomenon that often serves as a precursor to their decline in human history. This occurs when an empire, at the height of its power, extends its military commitments beyond its means, engaging in numerous conflicts and maintaining a vast network of military bases and alliances around the world.

This overextension is often closely connected to the rise and fall of an empire as it strains the empire's resources, undermines its economic stability, and sows the seeds of discontent both within its territories and among its subjects and allies. While we are only assessing Dutch, British, and American military power in this article, it is worth noting that military overreach is also a contributing factor to why the Roman Empire fell.

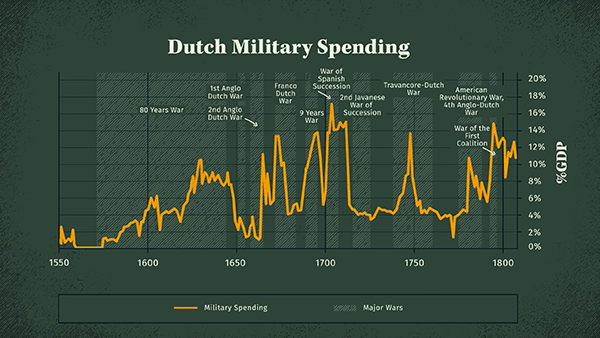

The Dutch Empire Military Overreach

In the case of the Dutch Empire, the Golden Age saw extensive naval expeditions and conflicts aimed at establishing and protecting its vast trading network and colonial possessions. The Dutch engaged in protracted naval wars, notably with England and Portugal, to secure their trade routes and monopolize lucrative commodities. However, the continuous military engagements and the costs associated with maintaining naval dominance eventually led to the depletion of Dutch resources and weakened their economic standing, contributing to the decline of the Dutch Empire.

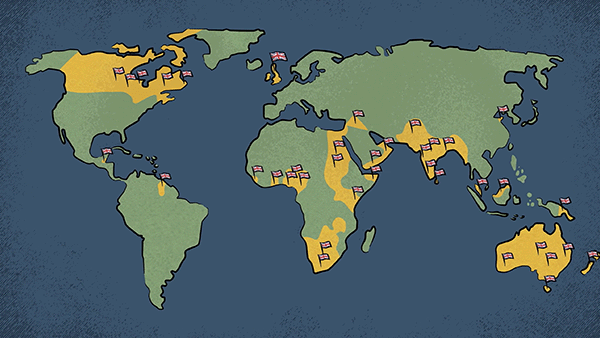

Credit: Ray Dalio's Principles for Dealing with the Changing World Order

The British Empire Military Overreach

Similarly, the English Empire, at its zenith, was embroiled in numerous wars and conflicts to expand and protect its colonial territories. The empire maintained a formidable navy to safeguard its trade routes and colonial possessions, engaging in conflicts such as the Napoleonic Wars and the Seven Years' War. The military overreach and the ensuing economic strain, coupled with rising nationalist movements in the colonies, led to the gradual dissolution of the British Empire.

Vast English Empire. Credit: Ray Dalio's Principles for Dealing with the Changing World Order

The American Empire Military Overreach

The United States, particularly post-World War II, exemplifies military overreach with its extensive network of 70 military bases around the globe and its involvement in protracted conflicts like the Korean War, the invasion of Panama and Grenada, the Vietnam War, the Iraq War, and the War in Afghanistan.

The U.S. has maintained a global military presence and intervention policy to preserve its geopolitical interests and prevent rival powers' rise.

The enormous economic and human costs associated with maintaining global military dominance have led to domestic discontent and raised questions about American military hegemony's sustainability.

The Empire Overstretches and Its Debt Increases

An empire in the topping phase often exhibits a pattern of financial overstretching, characterized by excessive spending, speculative investments, and escalating debt levels, which can significantly undermine the stability and confidence in its finances and currency, ultimately leading to its decline.

This financial overreach is typically driven by a combination of ambitious military endeavors, expansive public works, and social welfare programs, often funded through extensive borrowing. The empire, basking in the glory of its zenith, tends to overlook the long-term implications of its financial imprudence, believing in the perpetual sustainability of its economic dominance.

With the reserve currency exorbitant privilege, foreign goods become cheaper to import as global trade is conducted predominantly in the dominant empire’s currency. The leading empire can borrow its currency through bond issuance to other countries and print currency to pay its debts.

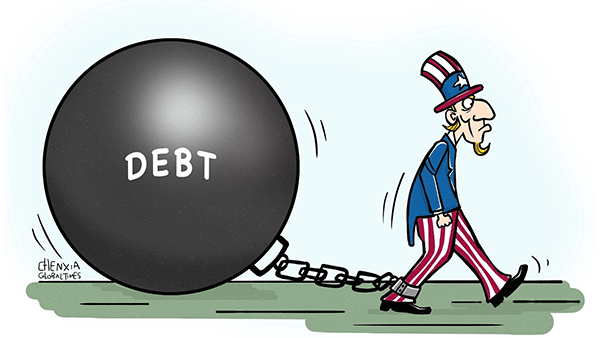

Ray Dalio notes that the leading empire appears very strong when its borrowing and lending are strong in the short term at the expense of its longer-term fiscal health, which is being weakened.

Credit: Chen Xia/Global Times

Confidence in the Empire Wanes

At the initial stage, the rest of the world lends and accepts the reserve currency as it is liquid and a good store of wealth. However, as the empire continues to overextend its finances, the accumulating debt begins to weigh heavily on its economy. Servicing this debt consumes a growing portion of the empire’s resources, diverting funds from productive investments and innovation.

The burgeoning debt levels can lead to a loss of confidence among investors and trading partners in the empire’s ability to meet its financial obligations. This loss of confidence can manifest in the devaluation of the empire’s currency, increased interest rates, and reduced foreign investments, further straining the empire’s finances.

The diminishing confidence in the empire’s financial stability and the devaluation of its currency can trigger capital flight, as investors seek safer havens for their assets. This can lead to a vicious cycle of financial instability, economic contraction, and social unrest.

Such developments are common in history. An example is the loss in confidence in the British pound, which led to the collapse of the Gold Exchange Standard in 1931.

The empire’s subjects, facing economic hardships and diminishing prospects, may question their rulers' competence and legitimacy, leading to political instability and societal fractures.

The financial instability and loss of confidence in the empire’s currency and governance can significantly erode its global influence and power. Trading partners and allies may start looking for alternative alliances and reserve currencies, further isolating the empire.

Why Empires Fall

Ray Dalio’s concept of the topping phase of an empire offers a profound and insightful framework for understanding the intricate dynamics that govern the rise and fall of great powers. This phase, marked by economic excesses, military overreach, societal shifts, and financial overstretching, paints a vivid picture of empires at the zenith of their power, yet teetering on the brink of decline.

As empires rise and enter their golden ages, attitudes within their populations evolve. People become accustomed to the newfound influence and wealth. In time, this often leads to competition for power, resulting in growing internal conflicts and even civil wars.

The historical narratives of the Dutch, English, American, and potentially, the Chinese empires, underscore the universal patterns and lessons embedded in this concept. If we look further back into human history, this pattern is also seen in other past empires, such as the transition of the Roman Republic to the Emperor-led Roman Empire.

Internal conflicts weaken major empires, erode the empire's global influence, and begin its inevitable decline, a poignant reminder of the transient and cyclical nature of power and dominance in the global world order.

Ray Dalio, author of "Principles for Dealing with the Changing World Order".

"To be clear, when I say that I believe we are on the brink of civil and/or international war, I am not saying that we will necessarily go into them or that, if we do, it will happen very soon. What I am saying is that the different sides in domestic and international conflicts are preparing for war and if events are allowed to progress as they typically do, there is a dangerously high probability of us being in at least one of these wars if not both in about five years, give or take about three (with the highest risk point being in 2025-26)."

- Ray Dalio

Protect Your Wealth With Physical Precious Metals Amidst Global Uncertainty

The topping phase of empires eventually reveals patterns of economic excesses, military overreach, and financial overstretching, all of which can lead to the decline of once-dominant powers. While wealth could be created from the first half of an empire’s rising phase, it is increasingly important to prioritize protecting wealth in the latter half as the financial overstretching in the topping phase can eventually lead to a loss of confidence in the reserve currency, impacting asset values.

The importance of financial prudence and the value of stable, tangible assets like precious metals cannot be overstated. Protect your wealth from geopolitical uncertainty by buying gold bullion bars and silver bullion bars. Alternatively, you can buy gold coins and silver coins as well. Reach out to us to explore your options and find the right solutions to fortify your financial future amidst the cyclical nature of changing world orders.

<< Read "The Rising Phase of Empires"