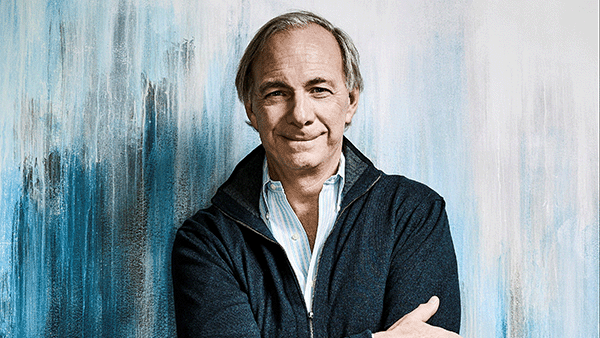

The Declining Phase of Empires According to Ray Dalio’s Changing World Order

Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates, and author of the book ‘Principles for Dealing with the Changing World Order’, meticulously studied the cyclical patterns of changing world orders and credit cycles over the last hundred years. He identified a common big cycle where an empire goes through three pivotal phases: the rise, the top, and the decline.

Dominant empires in history, like the Western Roman Empire, having reached the zenith of their power and influence, will encounter internal conflicts and eventually move toward the declining phase, which is marked by a gradual erosion of power, influence, and prosperity, eventually leading to the transformation of the global order. This article examines the empire’s declining phase using common signs as observed in the Dutch, English, and U.S. empires.

The fall of empires according to Ray Dalio

The Consequences of Economic Decline and Financial Crises

As the reigning empire slips down toward the end of the Top Phase of the Big Cycle after years of overspending and overconsumption, it often faces economic contraction and stagnation, and experiences periodic bouts of financial crises.

Saddled with large debts, the empire is faced with two choices – to default on debt or repay the debt through printing money. As seen in many instances in history, the empire always chose the easier way - to print money out of big debt crises. This devalues the currency in the long term, raising inflation and decimating the purchasing power of its citizens’ savings and foreign holders.

Over time, foreign nations lose confidence in the reserve currency’s purchasing power and divest their reserves into the next stronger international currency.

The Decline of the Dutch Guilder

This economic pattern of rise and decline can be seen in the Dutch Empire, which reached its golden age in the mid-seventeenth century. Its currency, the Dutch guilder, became the world’s first reserve currency. This happened because of the empire's global reach, leading to the Dutch guilder’s broad acceptance in trade.

After years of wars with the English, the Dutch East India Company had become increasingly unprofitable. Since the influential company was really the Dutch economy and military wrapped together, the Bank of Amsterdam funded it aggressively with freshly printed guilders without an equivalent increase in the empire’s gold and silver holdings.

As depositors caught wind of the Bank of Amsterdam’s excessive money printing to save the Dutch East India Company, they began to exchange devalued guilders for gold at the Bank. When the Dutch increasingly looked to be losing the Fourth Anglo-Dutch War, confidence in the guilder continued to fall, and a run on the bank ensued as more depositors exchanged paper money for gold and silver.

The printing of guilders did not stop even after the Bank of Amsterdam’s precious metals holders were exhausted. Eventually, the guilder ceased to be a reliable store of value in people’s minds, and the market adopted the British pound as the next world reserve currency.

Losing the Fourth Dutch Anglo War led to the Dutch Empire's decline

The Decline of the British Pound

The British pound gradually attained the reserve currency status in the late 1700s in tandem with the growing British economy and military prowess. According to Dalio, though only 2.5% of the world’s population, the British population produced 20% of the world’s income and controlled over 40% of global exports at the peak of the British Empire in the 19th century.

Britain’s involvement in World War I and World War II in the 20th century resulted in the empire having large debts despite emerging as a victor in both wars. Its ally, the United States, was increasingly a challenger, especially after the United States emerged as the victor in both the European and Pacific theatres of World War II.

The invention of the atomic bomb also cemented the United States as the most technologically advanced nation in people’s minds.

Compared to post-World War II Britain, which was heavily indebted and desperately needed funds to rebuild its devastated cities, post-World War II America held the most gold reserves, had a strong economy, and was a net creditor nation. The prospect of holding US dollars was looking increasingly favorable to foreign nations and investors.

According to Dalio, it took more than 20 years after the war for the British pound to be dethroned by the US dollar as the world’s reserve currency.

Widening Wealth Gap Fuels Domestic Discontent and Disorder

An empire’s citizens often face the brunt of hardships when its currency is devalued, and the economy is ravaged by high inflation and an economic downturn. The wealth gap often widens at such times, creating discontent in the populace as their standards of living fall.

Conflict between the rich and poor rises, and so does political extremism showing up as populism. Very often, the left seeks to redistribute wealth while the right wants to maintain the wealth of the rich. As the society’s wealthy are increasingly demonized as the cause of the empire’s misery, the government may accede to public pressure to tax the rich heavily.

Widening wealth gap between those who have and those who have not

Wealth Flight and Shrinking Resources

This sets off a chain of events where the rich begin to leave the empire for friendlier jurisdictions or convert their wealth into safer assets such as gold or foreign currencies, causing capital flight and reduced tax revenue in an already dire economic environment. As heavier taxes cause more capital flight, it becomes a self-reinforcing hollowing-out process of the economy, causing the economic pie to shrink, which reduces employment opportunities. The empire’s productivity also declines as people fight over shrinking resources.

According to Dalio, governments will resort to outlawing further wealth outflows when the situation becomes bad enough.

Rise of Populist Leaders and Civil Wars

As the left and the right increasingly clash, anarchy is likely to trump democracy and increase the likelihood of a strong populist leader emerging who will bring order. Depending on the actions of the leader and the people, civil wars and revolutions, both peaceful and violent, may break out at this stage.

Besides economic reasons, clashes could also come from widening values about social issues like education, ethnicity, personal rights, and political views.

“We are now seeing this manifest in increasing populism of the right and of the left and intensifying conflicts between these populists. Populists are people who will fight to win at all costs, not people who will work with the other side to compromise by following the rules to govern in the way democracy has worked for the many years it has worked.”

- Ray Dalio

Dalio cites the French, Russian, and Chinese revolutions as examples of violent revolutions that brought about a new order and the Roosevelt revolution as an example of a peaceful revolution.

A Rising Empire Challenges the Incumbent

As the incumbent superpower experiences domestic strife and disorder, it opens an opportunity for a rising empire to challenge it. However, this does not mean that it will be a military conflict.

According to Ray Dalio, an “intense economic war” will ensue before there is a “shooting war.” As the dominant empire is threatened by the rising power, it may retaliate with measures such as asset freezes or seizures, blocking access to capital markets, and economic embargoes. If these sound familiar, we are currently witnessing these measures on the international stage between the U.S. and China.

In its effort to resist these measures or to protect its interests, the rising power will begin to increase defense spending to improve its military strength. At this stage, other nations watching the rivalry on the sidelines may also spend more to strengthen themselves militarily.

According to Dalio, large increases in military spending are “classic early warning signals” of an impending military conflict. He also notes that the greatest risk of a war is when both empires have comparable military strength and “irreconcilable and existential” differences.

Dalio expects a period where both major empires’ military strength will be continuously tested. Should a bolder challenge happen, leading to military confrontation, the incumbent power has a choice – to fight or take flight. Its worst outcome is to fight and lose the war as it quickens its influence loss on the global stage, compared to a more gradual decline should it back down from the fight.

Depending on the confrontation’s outcome, other nations pick sides that best align with their national interests. If more countries choose to be in the challenger’s camp should it prevail, it will further diminish the incumbent’s influence.

Credit: Ray Dalio Changing World Order

Winners Decide on the New World Order

The end of an empire's declining phase is often marked by the de-escalation of domestic and international conflicts, as nobody wants to fight or challenge the new dominant power. The winners, the new dominant empire and its allies, then come together to establish the new world order.

A changing world order involves the restructuring of the old system and the introduction of a new system. According to Ray Dalio, this process may take about 10 to 20 years. During this period, the incumbent empire's declining phase overlaps with the new superpower's rising phase. Thus, a new Big Cycle begins.

As seen in history, as World War II drew to a close, 44 nations convened in 1944 for the Bretton Woods Conference, which led to the signing of the Bretton Woods Agreement to restructure the global financial system. The Bretton Woods Agreement cemented the U.S. dollar’s world reserve currency status as it was the only currency linked to gold, with all other currencies linked to the U.S. dollar.

Common Signs When Declining Empires Gave Way to Rising Empires

Ray Dalio’s research also revealed common signs and themes when the Dutch Empire gave way to the English and when the English Empire gave way to the U.S. Empire. These signs are:

-

Debt restructuring and debt crisis

-

Internal revolution that leads to large wealth transfers

-

External war

-

Major currency crisis

-

New domestic and world order

Signs of Declining Empires Today

Ray Dalio observes that today's three major reserve currency empires, the United States, Europe, and Japan, are in poor financial shape. These three major countries have been mired in at least one currency or debt crisis in the last two decades.

Their governments continue to spend more than their tax revenues and resort to borrowing, by issuing a lot of government debt, to make up the difference. Demand for their debt has been waning and will continue to decline, given the unattractive returns after compensating for inflation.

Holders of these empires’ financial assets have experienced large asset value depreciations as a result of price declines and the purchasing power loss in their currencies. This is largely due to their central banks printing a lot of money to stave off economic crises that come their way.

Despite the U.S. dollar's reserve currency exorbitant privilege, the United States government resorted to raising or suspending the nation's debt limit to prevent a government shutdown many times, due to rising government debt. In 2023, Fitch Ratings downgraded the United States' credit rating from AAA to AA+ due to a deteriorating financial condition, escalating U.S. government debt load, and declining governance standards.

Fitch Ratings downgraded U.S. credit rating from AAA to AA+ in 2023

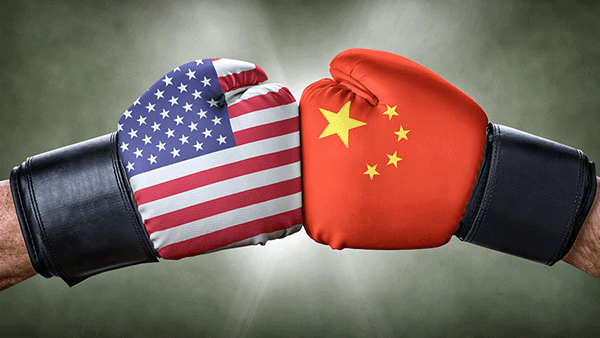

The U.S. versus China

The United States, the incumbent superpower with poor financial shape, is now challenged by China, which Dalio described as “a true rival power.” In his assessment, China’s rise is more significant than the United States’ rivalry with the Soviet Union during the Cold War era because the Soviet Union was only a military rival and “never a significant economic one.”

China has built up its financial center, Shanghai, to rival New York in the financial world. Today, Shanghai is the world's largest and busiest container port.

As with past incumbent empires, the United States has been taking measures to contain China’s rise and influence internationally. The United States has resorted to trade wars through the imposing of tariffs on Chinese goods, accusations of intellectual property theft, and unfair trade practices.

The United States has also imposed sanctions on Chinese companies and individuals, citing various reasons, such as human rights violations and national security concerns. Chinese investments in American companies, particularly in sensitive sectors like technology and infrastructure, are increasingly scrutinized.

The United States and China have only been saber-rattling when it comes to military confrontations, with the former strengthening alliances in the Indo-Pacific region to counterbalance China’s influence in the region. Despite both countries exerting their military presence in the region, they have yet to be involved in a direct military conflict.

"We are now going to have the major powers and their allies form economic, currency, and military blocs."

- Ray Dalio

Protect Your Wealth With Physical Precious Metals Amidst Global Uncertainty

Ray Dalio's Principles for Dealing with the Changing World Order shed light on the declining phase of empires and reveal the cyclical nature of rise and fall is deeply embedded in the historical fabric of global powers. By researching the decline of past empires and understanding the transpired events, we can see the common developments in incumbent empires during the declining phase in the Big Cycle.

As major empires accumulate greater debts and chatter about the world reserve currency’s decline increases, it is prudent to consider physical assets like gold, silver, and platinum to protect wealth. Precious metals have been proven stores of wealth for most of humankind’s history. They have little to no counterparty risks to the global financial system when held securely.

Protect your wealth from geopolitical uncertainty by buying gold bullion bars and silver bullion bars. Alternatively, you can buy gold coins and silver coins as well. Reach out to us to explore your options and find the right solutions to fortify your financial future amidst the cyclical nature of changing world orders.

Legendary investor Ray Dalio, author of "Principles for Dealing with the Changing World Order".

<< Read "The Topping Phase of Empires"