Why, that's just plain stealing, isn't it, Mr. President?

Hong Kong is 8,000 miles from the U.S., but that did not stop the U.S. government from disallowing U.S. banks from transacting with eleven Hong Kong officials it sanctioned. Hong Kong Chief Executive Carrie Lam acknowledged in August that the sanctions had caused her some inconvenience with using her credit cards.

"As for myself, of course, it will have a little bit of inconvenience here and there, because we have to use some financial services and we don't know whether that will relate back to an agency that has some American business -- and the use of credit cards is sort of hampered," Carrie Lam said in an interview.

Her remarks in bold underscored how businesses with U.S. exposure are more likely to comply with U.S. government sanctions. These businesses may be non-U.S. companies, but if they have business operations in the U.S or transactions with U.S. banks, there will be substantial leverage for the U.S. government to pressure. One has to consider then if these companies would risk billions of revenue for the sake of a minority of sanctioned clients.

Impact of Jurisdictional Exposure on Your Bullion Holdings

We have always warned against storing gold and silver with banks and vault operators with exposure to the U.S. or within jurisdictions with unsustainable debt growth. Strategies to protect one's wealth in precious metals have to go beyond merely trusting a well-known global company or the much-touted advantages of jurisdictional diversification.

Whatever advantages a jurisdiction may have become ineffective if your vault operator indemnifies itself against foreign governments nationalizing the stored gold and silver. Force majeure clauses in most vaulting agreements are designed to protect vault operators from lawsuits by their clients in the event of gold nationalization or confiscation by "any" government. In this case, it makes little difference whether the gold is stored in Singapore, Switzerland or the USA.

Here is an example of a typical force majeure clause that you should pay attention to when scrutinizing a vault operator's insurance or terms and conditions:

[Vault] SHALL NOT BE LIABLE under any circumstances whatsoever for:

“Shortage or mysterious disappearance or unexplained loss from or damage to the Goods said to be contained in a Parcel(s)”

Most dealers who offer storage programs are clueless about such risks or do not believe gold confiscation by governments will happen again. Many cite that the U.S. 1933 gold confiscation occurred because the U.S. was on a Gold Standard then, and the government needed gold to expand the money supply. They believe that governments today, freed from the constraints of a Gold Standard, would be more inclined to raise taxes or raid pension funds than to confiscate gold.

We disagree, and we believe the chances for bankrupt governments to grab citizens' gold are much higher today.

Will the Government Confiscate Gold?

It is impossible to predict with certainty what actions a government might take in the future. In the past, some governments have confiscated gold holdings, while others have not. The likelihood of gold confiscation depends on various political, economic, and social factors that are specific to each country.

Governments may choose to confiscate gold in order to have control over the country's gold reserves and use the metal as a means of financing government operations, particularly during times of war or economic crisis. Confiscation of gold may also occur as a means of controlling inflation or stabilizing the currency.

Oftentimes, the motivation for every gold confiscation case by fiscally-poor governments can be traced to their desperate need to shore up confidence in fiat currencies.

History has many examples of governments forbidding hoarding gold as a solution to fix economies in recession or teetering on a collapse in investor confidence.

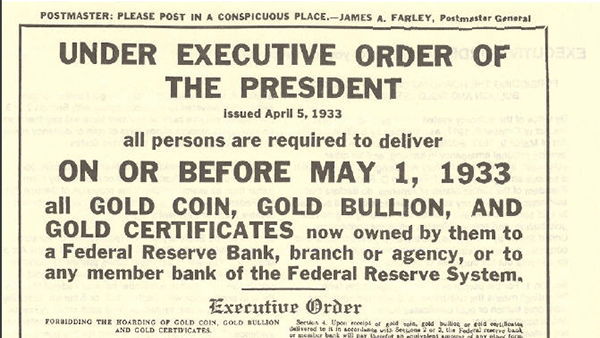

President Franklin Roosevelt's Executive Order 6102

In 1933, the U.S. government wanted to print more money to stimulate the Great Depression-era economy, but the Gold Standard was in its way. However, increasing the currency supply without a corresponding increase in gold reserves would cause confidence in the dollar to plunge.

Therefore, on April 5, 1933, President Roosevelt issued Executive Order 6102 making it illegal for anyone in the U.S. to own or hold any form of monetary gold, be it coins, bullion, or gold certificates.

It was an outright ban on the private ownership of gold.

FDR confiscates gold with Executive Order 6102

Executive Order 6102 specifically states the "forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States."

The executive order applied to "all persons" which means any individual, partnership, association, or corporation. Only the following types of gold were exempted from the executive order:

-

Industrial and dental uses: Gold held for industrial, professional, or artistic uses, or for use in dentistry, was exempt from the order.

-

Collectible coins: Gold coins having a recognized special value to collectors of rare coins and unusual coins were exempt from gold seizure.

-

Jewelry: A limited amount of gold coin and bullion held in the form of jewelry was exempt, not to exceed in the aggregate of $100 per individual.

Executive Order 6102 required compliance with its provisions under the threat of severe penalties. Non-compliance by gold owners was considered a criminal offense and was punishable by a fine of up to $10,000 and/or up to 10 years in prison.

The executive order authorized the Secretary of the Treasury and Federal Reserve Bank examiners to investigate possible violations and to prosecute individuals and organizations who failed to comply with its provisions. The order effectively gave the US government the power to seize gold from individuals who did not comply with its requirements.

The US government coerced citizens into turning their gold to local Federal Reserve bank branches. A month later, the government escalated its underhandedness by abolishing the gold clause in all past debt obligations, thereby breaking its promise to redeem its paper currency for gold.

When asked by President Roosevelt for his opinion about this new law, Senator Thomas Gore of Oklahoma famously replied: "Why, that's just plain stealing, isn't it, Mr. President?"

The Gold Reserve Act of 1934

The passing of the Gold Reserve Act of 1934 completed this transfer of gold from private hands to the U.S. Treasury.

The act had several key provisions, including:

-

Nationalization of gold: The act nationalized the gold held by the Federal Reserve and transferred it to the control of the U.S. Treasury. This allowed the government to have greater control over the country's gold reserves and to use it as a means of financing government operations.

-

Revaluation of gold: The act revalued the official price of gold from $20.67 per troy ounce to $35 per troy ounce. This increase in the price of gold allowed the government to inflate the US dollar and increase its value relative to other currencies.

-

Control of gold production: The act gave the government greater control over gold production in the country, including the power to regulate the mining, refining, and sale of gold.

The ban on gold ownership would last for 40 years. It led to the joke:

"Of two men walking down Main Street, one with a gold coin in his pocket and the other carrying a bottle of booze, the first was now breaking the law and the second was an upstanding citizen."

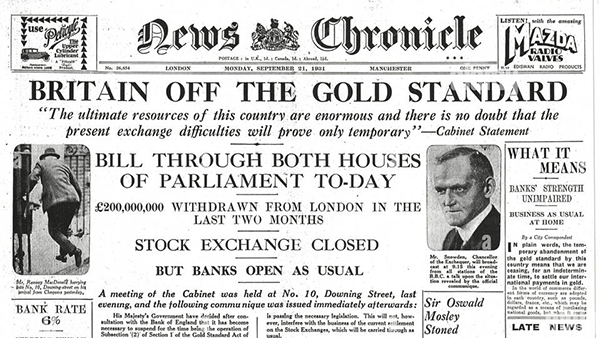

The 1966 UK Gold Ban

More than three decades after FDR's 1933 gold confiscation, the British government in its bid to stem the Pound's slide on the currency markets also enacted laws to forbid the purchase and hoarding of gold.

British citizens were sending money overseas to buy gold as they lost faith in the government's policies to rein in inflation and prevent further currency debasement.

Despite having left the Gold Standard 35 years ago, the British government chose to block imports of gold coins and banned private citizens from owning more than four gold coins. Gold holdings in excess had to be reported to the Bank of England and officials would determine if the owner was a collector or speculator. The latter would result in confiscation.

The enforceability of the law limiting gold ownership to four gold coins was challenged in parliament by Conservative MP Terence L. Higgins:

"Quite simply, how is the Treasury or the Bank of England to discover who has more than four gold coins dated after 1834? They will have no means of ascertaining this, so that the law will fall into disrepute because it will be unenforceable. This is clearly a major objection to the measure. It is not only unnecessary, but it will, we suggest, prove to be unenforceable.

It would appear that the Government will rely largely on individuals coming forward and offering to give up the gold coins which they hold. The unfortunate point about this is that the terms on which the Government offer to take over the gold coins which are surrendered will include an element of confiscation, in the sense that the value of the assets which people hold would he greater if they did not do what the Government are asking them to do. This element of confiscation is another objection to this proposal."

Great Britain's 1966 gold ban is precedence that gold confiscation and expropriation can happen even without gold being part of the monetary system - the UK was already off the Gold Standard since 1931.

Britain went off the Gold Standard in 1931 (Source: Alamy)

What is the Real Reason for Gold Confiscation?

It is time we awake to the real reason why highly indebted governments are likely to confiscate gold – they want the confidence that gold gives! Germany’s hyperinflation in the 1920s destroyed its currency, the Papiermark. Trust was only restored with the introduction of a gold-backed currency - the Goldmark. Governments today have printed record amounts of currencies never seen before in humankind's history. If anything, confidence in fiat currencies is at new lows.

Many economists do not see a suitable currency that can effectively replace the US dollar (a.k.a Federal Reserve Notes) as a reserve currency. In other words, confidence is sorely lacking in currencies. It is a matter of time before the world realizes that gold is the best neutral solution to restore confidence in the global monetary system, and he who has the most gold will have the biggest say at the table.

Protecting one’s wealth has never been more critical. Silver Bullion minimizes counterparty and jurisdictional risks to customers' wealth. We only store precious metals exclusively within Singapore and are not obliged to accede to the laws of foreign governments.

As we operate our vault, our customers are not exposed to counterparty risks between dealers and vault operators. Our user agreement for S.T.A.R. Storage does not have force majeure clauses that accede to potential gold confiscation, expropriation, and nationalization events by foreign governments.

Are your gold holdings at risk from confiscation, expropriation, or nationalization by bankrupt governments? Speak with us to begin the process of minimizing that risk today!