Why Investing in Palladium is a Smart Decision

Introduction

Palladium is a precious metal that has been steadily gaining popularity among investors in recent years. With its unique properties and increasing demand in various industries, investing in palladium can be a wise decision for both short-term and long-term gains. In this article, we will explore the reasons why investing in palladium is a smart decision.

What is Palladium?

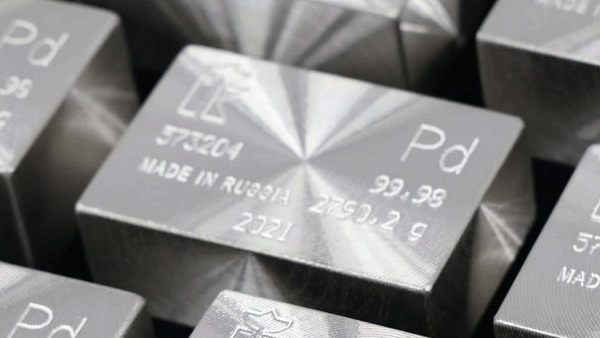

Palladium is a rare and lustrous silvery-white metal that belongs to the platinum group of elements. It was discovered in 1803 by British chemist William Hyde Wollaston. Palladium is known for its excellent catalytic properties, high melting point, and resistance to corrosion. It is widely used in the automotive industry for catalytic converters, in electronics for capacitors and other components, and in jewelry.

Growing Demand for Palladium

The demand for palladium has been steadily increasing in recent years due to its unique properties and various industrial applications. One of the major drivers of palladium demand is the automotive industry. Palladium is used in catalytic converters to reduce harmful emissions from automobiles. As more countries implement stricter emission standards, the demand for palladium in the automotive industry is expected to continue to grow.

Limited Supply

Despite the growing demand for palladium, the supply remains limited. Palladium is primarily mined in Russia and South Africa, which together account for more than 80% of the world's palladium production. Moreover, the supply of palladium is subject to geopolitical risks, as the major producers are located in countries with unstable political climates. This limited supply makes palladium a valuable and sought-after investment.

High Returns on Investment

Investing in palladium can provide high returns on investment, especially in times of economic uncertainty. Palladium prices have been steadily increasing over the past decade, reaching an all-time high of over $2,800 per ounce in 2021. This makes palladium one of the best-performing commodities of the decade. Moreover, palladium prices are less volatile than other precious metals, such as gold and silver, which makes it a more stable investment option.

Diversification of Investment Portfolio

Investing in palladium can provide diversification to an investment portfolio. Palladium is a unique investment option that is not correlated with other assets, such as stocks and bonds. This means that investing in palladium can reduce the overall risk of an investment portfolio and provide a hedge against inflation and economic uncertainty.

Environmental and Social Impact

Investing in palladium can also have a positive environmental and social impact. As mentioned earlier, palladium is used in catalytic converters to reduce harmful emissions from automobiles. By investing in palladium, investors are indirectly contributing to the reduction of air pollution and promoting sustainable practices in the automotive industry. Moreover, palladium mining and production can provide employment opportunities and contribute to the economic development of the producing countries.

Conclusion

In conclusion, investing in palladium can be a smart decision due to its unique properties, growing demand in various industries, limited supply, high returns on investment, diversification of investment portfolio, and positive environmental and social impact.

Investing in palladium can provide a unique and valuable addition to an investment portfolio, offering diversification and potential high returns. However, as with any investment, it is important to conduct thorough research and seek professional advice before investing. By carefully weighing the risks and benefits, investors can make an informed decision about whether investing in palladium is right for them.

FAQs

1. Is palladium a good investment option for beginners?

Palladium can be a good investment option for beginners, but it is important to conduct thorough research and seek professional advice before investing.

2. Can palladium prices be affected by geopolitical risks?

Yes, the supply of palladium is subject to geopolitical risks, as the major producers are located in countries with unstable political climates.

3. How can investing in palladium contribute to the reduction of air pollution?

Palladium is used in catalytic converters to reduce harmful emissions from automobiles. By investing in palladium, investors are indirectly contributing to the reduction of air pollution.

4. What are some risks associated with investing in palladium?

Some risks associated with investing in palladium include geopolitical risks, fluctuations in demand, and changes in government policies and regulations.

5. Can palladium be used as a hedge against inflation?

Yes, investing in palladium can provide a hedge against inflation, as the price of palladium is less affected by inflation compared to other assets such as stocks and bonds.