The 2018 In Gold We Trust Report

The highly anticipated 12th edition of the annual “In Gold We Trust” report was released on May 29th. The report, authored by Ronald Peter Stoeferle and Mark Valek of Incrementum AG, focuses on gold’s performance in the monetary turmoil of the current times. Silver Bullion is a premium sponsor of this year’s report. We provide a summary of the report below.

This year’s report continues to have a positive outlook for gold. This follows the outlook of the 2017 report which analyzed ‘the everything bubble’ and the long term unsustainability of the ‘status quo’ of the growing stock, bond and real estate markets.

The authors have ‘chosen the image of the turning of the tide as the leitmotif of this year’s In Gold we Trust report’. The tide metaphor was used to highlight the 3 main changes that are currently taking place which are the underlying reasons for the report’s bullish outlook for gold in the coming years. Each of these three tidal changes holds ‘the potential of inflicting fundamental transformation on the world’. In short these three changing ‘tides’ are:

Change of the tide in monetary policy - The reversal from Quantitative Easing (QE) to Quantitative Tightening (QT) by central banks. For example, the total balance sheet of the FED is expected to be reduced by USD 420bn in 2018 and by USD 600bn in 2019. This will be a real test for the financial system as it remains to be seen how this reduced liquidity will go along with the excessive public global debt and the allegedly less risky capital market environment today that investors have grown familiar with. The so called ‘everything bubble’ will be in much more risk of bursting as the liquidity tightens since only one asset class (stocks, bonds or real estate) is enough to crash the entire financial system.

Change of the tide in the global monetary order – There are continuing efforts to move away from the US dollar as a result of increasing geopolitical polarization and tensions; and the ascendance of strong emerging market economies such as China.

It is no secret that China intends to create its own markets around the yuan, increase usage of yuan for payment settlement and stop amassing more US dollars. This is aggravated by threats of trade wars from the US towards China.

The report views de-dollarization not to be a currency war but as a reorganization of an outdated monetary architecture toward a new system that is ‘balanced from the perspective of all major powers’.

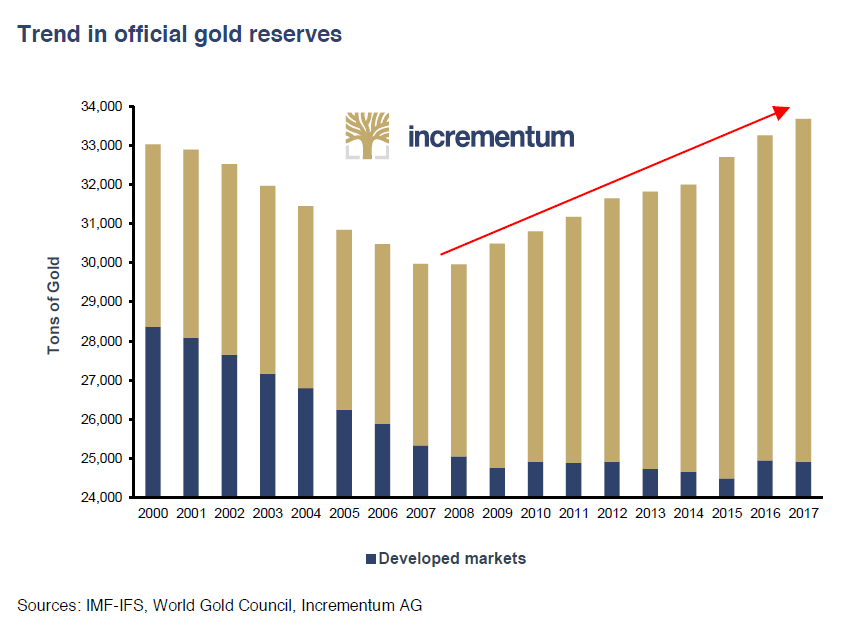

Gold is a great indicator that supports this ‘changing tide’. Most central banks still hold gold as part of their reserve portfolio, despite the fact that it has been almost 50 years since the suspension of the Bretton Woods system in 1971, when the last tie between government money and gold was severed. In addition, although most developed countries keep their gold reserves at similar levels to those of 2007, the emerging economies – particularly China, Russia, Turkey, and India - have boosted their gold holdings significantly (especially) since the economic crisis of 2008 (see chart). From a total of 4,596 tons in 2006, the gold reserves in central banks of emerging economies rose to 8,755 tons in 2017. This is a significant 90.82% increase. As the authors conclude ‘this increase in gold reserves [from emerging economies] should be seen as strong evidence of growing distrust in the dominance of the US dollar and the global monetary and credit system associated with it.’

Change of the tide in technology – We are witnessing a technological revolution related to the digitalization of money, which is being driven by the cryptocurrencies and the underlying blockchain technology. Also, more and more financial transactions are being executed via smartphones and the Internet. With regards to cryptocurrencies, the authors are ‘convinced of two truths: (1) Cryptocurrencies and especially the underlying decentralized ledger technologies will fundamentally change business and possibly the reality of the global monetary order, and (2), gold and cryptocurrencies are friends, not foes. In fact, a collaborative approach would play to the strengths of both.’

What are the expected effects of these tides?

The report remains bullish on gold which held its ground in 2017, despite rising interest rates, monetary policy normalization, and a solidly performing stock market. Gold recorded a positive result across all major currencies with the exception of the euro, where it incurred a relatively minor loss of 1%. However, against the US Dollar gold still went up 13.64% and on average gold yielded 6.30% across currencies.

Macro Outlook

The authors kept their contrarian views to the prevailing optimistic forecasts; according to a Bloomberg survey of 78 analysts, not even one expected the US GDP to contract over the next three years with median expected growth rates ranging between 2.1% and 2.8%. They suggest several facts that point to increasing recessionary tendencies.

- Rising rates & Quantitative Tightening

- Record high consumer confidence

- M&A boom

- Rising default rates

- Rising write-offs on credit card debt

- Weakening consumption rates

- Significantly flattening yield curve that could invert within a matter of months

- Strongly rising private and public debt ratios

- Sharp rise in oil prices

The report believes that the global boom in the “everything bubble” is on shaky ground given that it is fueled by ultra-low interest rates and the never-ending expansion of the money supply and credit.

Gold will stay strong!

With the current status quo in the financial markets, there are still some challenges that gold faces and gold owners should not be expecting excessive price gains as long as those headwinds prevail.

Some of these challenges are:

• Equities are still in a bull market and are trading close to their all-time highs.

• Volatility remains relatively low.

• Real estate is regarded as the asset sans alternative in many places.

• Robust economic growth

However, the report offers additional key findings that make a strong case for gold in the coming years. In summary these findings are:

• Technical analysis gives us a positive outlook on the gold price.

• An excellent reward/risk profile for the mining sector.

• A vast array of different potential crisis triggers.

• Increased gold in reserve portfolios of central banks (from emerging markets).

• Indication of rising inflationary tendencies since September 2017.

The report goes further on and analyzes 4 different scenarios for gold; the most likely one being the Inflationary Boom scenario with growth and inflation of over 3% per annum. In this scenario the report predicts the gold price to rise between 1400 and 2300 USD.

In conclusion, the authors are adamant in their positive outlook for gold: “We stick to our statement made last year that gold is in the early stages of a new bull market. The signs of a weak dollar accompanying that bull market are becoming more plentiful as we speak. We feel it is particularly worth noting the depreciation of the dollar within the context of trade wars…”

The complete In Gold We Trust 2018 report can be found at the links below: