Matt Bohlsen - Nickel & Cobalt And The Shift to Electric Vehicles

We had the privilege to speak with Matt Bohlsen who is a veteran contributor at Seeking Alpha. Some of the trends Matt follows include electric vehicles, lithium/cobalt/nickel/copper miners, renewable energy, autonomous vehicles and energy storage. He has 30 years of personal investing experience, and 17 years of professional financial advising experience. As a global investor, Matt uses a macro thematic approach searching for good value and/or high growth. He hosts a marketplace service called Trend Investing on Seeking Alpha.

SBTV: How real and how big is the trend of shifting from petrol/diesel engine vehicles(EV) to electric vehicles globally?

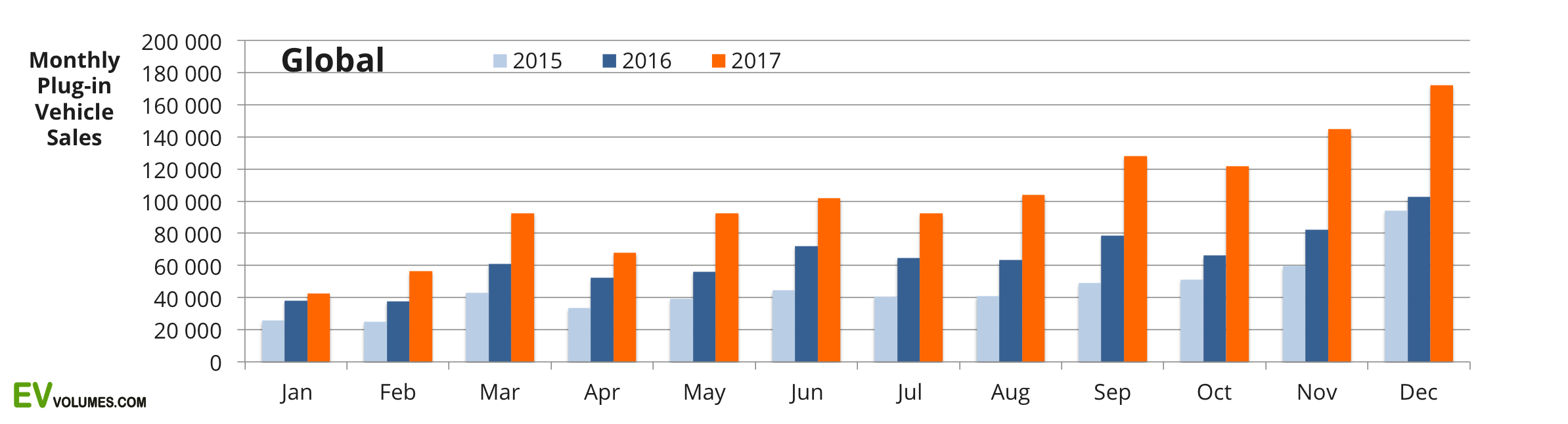

MB: The trend/shift to EVs is very real and growing stronger every year. For example, global EV sales finished 2016 at 774,000 for the year, up 40% on the prior year, and representing 0.85% of the global market share of new car sales. In 2017, total year sales ended at a record 1,223,000, up 58% on 2016, and reaching 1.4% market share. Electric car sales continue to set new records in Q1 2018, with sales up 59% on last year.

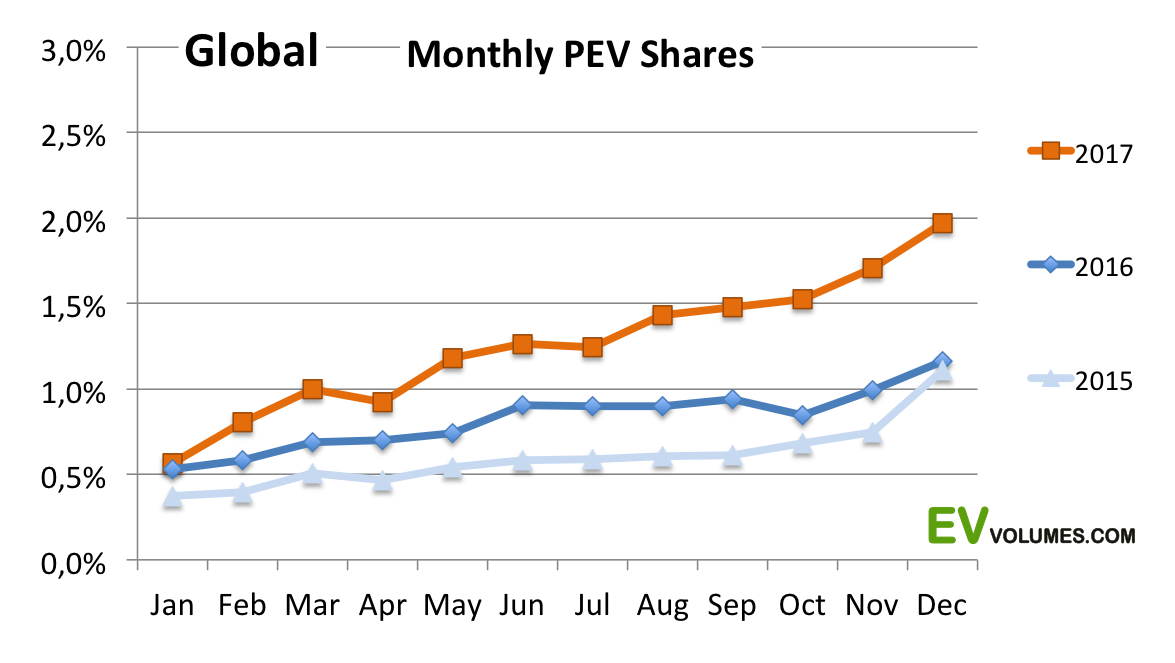

By end 2017, electric car sales had reached a 2% global market share. Usually, once a trend goes beyond 1% market share then it will continue and accelerate. The graph below gives a nice summary. The trend to EVs can in many ways be as big and as rapid as the Internet trend. In fact, it could be bigger given most people in the world like to have a vehicle or use a shared vehicle to move from A to B.

Global electric cars sales grew 58% in 2017

Global electric car market share in 2017 - averaged ~1.4% and peaked at 2% in December

Source: EV-Volumes

SBTV: What challenges do you see right now that proponents of electric vehicles would need to address before we can see increased mainstream adoption of electric vehicles?

MB: The main challenges have been cost, range and a charging network. By the end of 2022, I forecast an EV will be cheaper than a conventional car to buy based on purchase price. Based on total lifetime cost of ownership some EVs are now cheaper especially given the subsidies. Range is improving each year with many models now offering over 200 miles of range. This will only get better as battery energy density increases and battery prices decrease.

The 25 global gigafactories now on the way by 2021 will bring scale and significant further battery cost reductions. Charging networks are being improved each year and led by Tesla. China has huge targets in this area as does Europe. One area that needs improving is to help high rise unit owners charge their vehicles at their home. This is starting to be addressed now in China. I expect by 2020 to 2022 all of the above challenges will have been solved and we will see a strong surge in EV sales.

SBTV: What advantages do you see electric vehicles have over petrol/diesel engine vehicles?

Matt: EVs have many advantages. The engine is more efficient, so there is greater acceleration and less noise. An EV has much less moving parts so maintenance costs can be manyfold lower. Fuel cost (electricity cost per mile) is also much lower than gasoline. If you have solar panels then your fuel source is essentially free after the initial purchase cost of your panels. Since electric vehicles have no emissions, the pollution in cities from diesel and gasoline cars will be removed. This has many benefits for society especially in the very polluted global mega cities.

SBTV: A key technology in the electric vehicle revolution is the Lithium-ion battery which powers the vehicles. There are different cathode chemistry formulations for batteries such as NMC111, NMC622 and NMC811, etc. Which of these formulations do you think will be used in EV batteries for mass adoption?

Matt: For now the most common is NCA (Tesla/Panasonic) and NMC (most others). The GM Chevy Bolt uses NMC 111. We are already seeing a move to reduce cobalt and towards NMC 532 and NMC622. We may see more NMC 811 by 2020 if testing proves it is safe. My view is we are more likely to see the NMC 622 as the mass adoption choice along with NCA.

SBTV: Could you explain why cobalt is seen as a key component in Lithium-ion batteries?

Matt: Cobalt is a key component for thermal stability. Put simply, cobalt helps to stop the battery from catching fire. It is also important for life cycles – meaning cobalt in the battery extends the battery life.

SBTV: What are the mining challenges with cobalt today?

Matt: The main mining challenges are that cobalt is a by-product metal of copper and nickel, and hence mining decisions will be made primarily based on copper and nickel (not cobalt prices). The other key supply issue involves 60% coming from the very corrupt DRC, where new prohibitive mining taxes and royalties will cause a backlash from the mining companies, who will slowly relocate their operations elsewhere.

SBTV: Do you think that cobalt can be designed completely out of the batteries any time soon?

Matt: I think it is highly unlikely we will see no cobalt in light weight EVs in the foreseeable future. As we saw with the Samsung Galaxy phone explosions, it is not wise to move to quickly and make big changes in battery chemistry until thoroughly tested. For heavy EVs such as buses, Lithium Iron Phosphate batteries have been the dominant choice led by China.

SBTV: Given that the price of cobalt has risen substantially in the last few years, do you think that the price of cobalt could still have more upside?

Matt: My view is we will see new supply from DRC coming online which will take the market from deficit to balance. If this happens, the cobalt price may drop back somewhere between USD30-40 to find a new range. By 2022, assuming continued EV take up, my model is forecasting we will need about 4 new cobalt juniors to come online each year just to keep up with demand. If this does not happen, a deficit and cobalt price spike will occur. My view is new juniors mostly from Australia, and some from Canada will fill the supply needs post 2022.

SBTV: Could you share with us the role of nickel in Lithium-ion batteries?

Matt: Nickel is a key component in the Li-ion battery and it is situated as part of the cathode. It primarily helps with energy density which in turn helps with power and range.

SBTV: What is your view of the nickel market and do you foresee any supply challenges for the electric vehicle market?

Matt: The nickel market is a much larger market than say cobalt or lithium. However, the nickel needed for batteries (nickel sulphate) is a smaller subset of that market and clearly demand will grow very strongly. I expect we will see the nickel sulphate market sourced from nickel sulphide deposits globally which are rare. This means we may run into deficits and higher nickel sulphate prices. This will become more of an issue beyond 2020 as battery chemistry moves to NMC 622 with more nickel and less cobalt. You can read more here.

SBTV: The price of nickel is still afar off from the peak in 2007. Do you think the shift towards electric vehicles will push the nickel price higher than that peak?

Matt: Yes, for nickel sulphate pricing but not for ferronickel and nickel pig iron metal used in stainless steel. Again, especially beyond 2020.

SBTV: Tell us more about Trend Investing.

Matt: Trend Investing is my subscriber service on Seeking Alpha. The goal is to find early stage trends and then the best stocks so that investors can make multi-bagger returns. So far this has been very successfully done with one stock making (Katanga Mining – Buy at CAD 0.13, Reduce at CAD 2.89) a 22 fold return in 2017, as well as about 10 stocks making over 100% returns. So far in 2018 another stock (Cobalt Blue) has made investors a 5 fold return since I recommended them in November at AUD 0.23. My service is very affordable and very popular. You can learn more by following the links below.