How to Invest in Platinum: A Comprehensive Guide

Platinum is a precious metal that offers an exciting investment opportunity for those looking to diversify their portfolios. It is often considered the "rich man's gold" due to its rarity and value. In this article, we'll explore the various reasons to invest in platinum, the market dynamics, the different ways to invest, and tips for making informed investment decisions.

Why Invest in Platinum?

Rarity and Value

Platinum is approximately 30 times rarer than gold, making it a highly sought-after precious metal. Its scarcity contributes to its higher value, which can make it an attractive investment for those looking to profit from its potential price appreciation.

Industrial Applications

Platinum is an essential component in many industries, such as automotive, electronics, and jewelry. Its high melting point and resistance to corrosion make it ideal for various applications. This widespread industrial use creates a consistent demand for platinum, which can help support its value as an investment.

Investment Diversification

Adding platinum to your investment portfolio can help diversify your holdings, potentially reducing risk and increasing potential returns. It often has a low correlation to other asset classes, such as stocks and bonds, making it a useful hedge against economic uncertainty and inflation.

Understanding Platinum Market Dynamics

Supply and Demand Factors

The platinum market is influenced by various factors, including supply constraints, geopolitical tensions, and changes in industrial demand. Investors should be aware of these factors when considering platinum investments, as they can affect the metal's price.

Market Volatility

Like other precious metals, platinum prices can be volatile. This volatility can present both risks and opportunities for investors. Understanding and managing these risks is essential for successful platinum investing.

Different Ways to Invest in Platinum

Physical Platinum

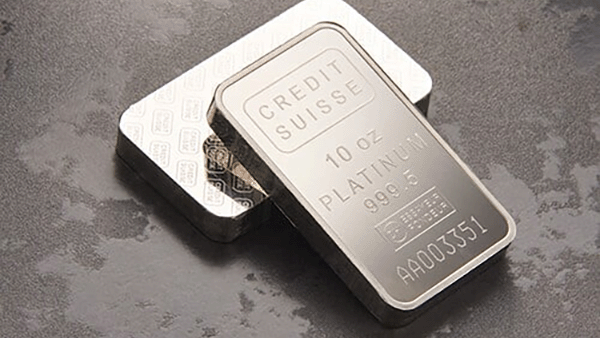

Bars and Coins

One of the most straightforward ways to invest in platinum is to purchase physical bars or coins. These tangible assets can be bought from reputable dealers and come in various sizes and designs. Investors can hold these assets directly or store them in a secure facility.

Storage and Security

When investing in physical platinum, it's essential to consider storage and security. Investors can store their platinum in safe deposit boxes or use professional storage facilities that specialize in precious metals. These facilities often provide insurance, ensuring the safety of your investment.

Platinum ETFs and ETNs

Exchange-traded funds (ETFs) and exchange-traded notes (ETNs) offer a convenient way to invest in platinum without owning the physical metal. These financial products track the price of platinum and can be bought and sold on major stock exchanges. They provide an accessible and liquid means of gaining exposure to platinum prices without the storage and security concerns associated with physical platinum.

Platinum Mining Stocks and Mutual Funds

Investing in platinum mining companies or mutual funds that hold mining stocks is another way to gain exposure to platinum. This option allows investors to profit from the performance of companies involved in platinum mining and production. However, it is essential to remember that investing in mining stocks comes with additional risks, such as company-specific issues and general market fluctuations.

Platinum Futures and Options

Futures and options are more advanced investment vehicles that provide exposure to platinum prices. These financial instruments allow investors to speculate on future platinum prices or hedge their existing platinum holdings. Futures and options trading can be complex and carry a higher level of risk than other investment methods, so it may not be suitable for all investors.

Evaluating Platinum Investment Options

Assessing Risk Tolerance

Before investing in platinum, it is crucial to assess your risk tolerance. Some investment options, such as futures and options, carry higher risks than others like physical platinum or ETFs. Understanding your risk tolerance can help you make more informed decisions about which investment options are right for you.

Diversifying within Platinum Investments

As with any investment, diversifying within your platinum holdings can help manage risk and potentially improve returns. Consider investing in a mix of physical platinum, ETFs, mining stocks, and other options to create a well-rounded platinum investment portfolio.

Tips for Investing in Platinum

- Research the platinum market and understand the factors that influence its price.

- Choose the right investment vehicle based on your risk tolerance and investment objectives.

- Diversify your platinum holdings to manage risk and optimize potential returns.

- Keep an eye on market news and trends that could impact platinum prices.

- Consult with a financial professional if you are unsure about your investment decisions.

Conclusion

Investing in platinum can be a rewarding way to diversify your portfolio and capitalize on the metal's unique properties and market dynamics. By understanding the various investment options available and considering your risk tolerance, you can make informed decisions that align with your financial goals. Remember to monitor market trends and stay informed about factors that could impact your investment.

FAQs

Is platinum a good investment for long-term investors?

Platinum can be a good long-term investment for those looking to diversify their portfolios and hedge against inflation. However, it's essential to consider market factors and your risk tolerance before investing.

How can I ensure the authenticity of physical platinum?

When purchasing physical platinum, it's crucial to buy from a reputable dealer who provides platinum testing, assay certificates or other proof of the metal's authenticity.

Are platinum investments subject to taxes?

Taxes on platinum investments can vary depending on your country of residence and the type of investment vehicle. It's best to consult with a tax professional to understand your specific tax obligations.

How does platinum compare to other precious metals, like gold and silver?

Platinum is rarer than gold and silver, which can make it more valuable. However, its price can also be more volatile due to its relatively smaller market and industrial demand fluctuations.

Can I invest in platinum through my retirement account?

Some retirement accounts, such as precious metals IRAs, allow investors to include certain types of platinum investments, like approved physical platinum or ETFs. It's essential to check the rules and regulations of your specific retirement account to determine if platinum investments are permitted.