How to Buy Silver: A Comprehensive Guide

Silver is a popular precious metal synonymous with money since ancient times. Even today's currencies continue to have silver origins in their names. Silver was the world's money throughout history more times than gold. Besides having investment potential, it is also a versatile metal that has a wide range of industrial uses. Whether you're a seasoned investor or new to silver, this silver buying guide will provide you with everything you need to know to make an informed purchase.

In this guide, we'll cover the following topics:

- Why Buy Silver?

- Types of Silver Products

- Factors to Consider When Buying Silver

- Where to Buy Silver

- How to Store Your Silver

- How Easily Can You Sell Your Silver

- Conclusion

Why Buy Silver?

Silver has been a cornerstone of wealth and trade for thousands of years, serving as a reliable form of money throughout most of human history. Its intrinsic value, derived from its rarity and practical uses, has stood the test of time, making it a trusted medium of exchange and store of value. Unlike paper currencies, which are subject to the whims of governments and central banks, silver's worth is anchored in its physical properties and utility.

Hedge Against Inflation

According to Austrian Economics, inflation is a result of central bank money printing, which causes more currency to circulate without a corresponding increase in the amount of goods available. This results in more currency chasing after a smaller quantity of goods, causing prices to rise, due to the greater demand.

More accurately, this phenomenon stems from each currency unit having lesser purchasing power as central banks create more out of thin air.

Like gold, silver is a monetary metal that has been an inflation hedge in times past. While paper money is useful only when its recipients have confidence in it, physical silver and gold have always been the fall-back safe-haven assets when currencies lose purchasing power and the confidence of the world.

No Counterparty Risk

Physical silver, like gold, is free of counterparty risks from financial crises and bank collapses, especially if they are stored securely. In a world where central bank money printing is in overdrive and major superpowers, like the U.S., are in trillions of unrepayable debt, the failure risks in the financial system are becoming very real.

When a financial crisis on par or worse than the 2008 Great Financial Crisis happens eventually, paper and digital assets that are reliant on counterparties like banks and other financial institutions could be in serious trouble, causing their value to plummet.

Diversifying into physical silver extricates your wealth from a financial system, that could already be teetering on collapse from years of mismanagement. With silver bullion coins or bars safely stored in your safe or a reputable precious metals vault, your wealth can escape a systemic crisis in the financial system since they are free from counterparty risks.

Highly Liquid

Silver is an internationally traded commodity that has a transparently published price. Unlike diamonds or art, which must be appraised individually, spot silver prices can be found online easily. Silver is traded internationally and is highly liquid.

Someone owning silver can easily lock sell back prices with reputable precious metals dealers online and bring their silver bars or coins to the dealer to be sold. Singapore, where Silver Bullion is headquartered, is one market where silver is bought and sold easily. The same cannot be said of other physical assets, such as real estate, which may take months to transact after prices are negotiated.

At Silver Bullion, our clients sell back physical silver almost with no questions asked. In fact, Silver Bullion is one of the largest buyers of silver in the market. Our company holds silver, gold, and cash as long-term assets - much like a country's central bank!

Significant Price Rise Potential

It is well-documented that silver prices appreciate much more than gold prices in a bull market. The first reason is that silver is a much smaller market than gold on the international stage. The same amount of global funds pouring into the silver market will push silver prices significantly higher than the gold market.

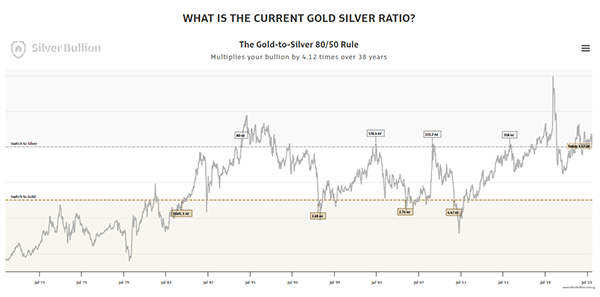

The second and main reason is that silver is currently extremely undervalued. The long-term gold-to-silver ratio chart demonstrates this clearly. The gold-silver ratio shows the amount of corresponding ounces of silver required to buy 1 troy ounce of gold at any point in time and is derived by dividing the gold price by the silver price.

For example, if the gold price is $2,000 and the silver price is $25, then the gold-silver ratio is 80.

At the time of writing this article, the ratio is at 85. On our long-term gold silver ratio chart spanning about 30 years, we can observe that the ratio bounces between 40 and 80 every few years. When the ratio is above 80, silver is very undervalued and is a better buy compared to gold. When the ratio is below 40, the opposite is true.

When the ratio eventually lowers towards 40 and lower, silver could rise exponentially in a bull market. This happened in April 2011 when silver prices reached a high of $50, causing the gold-silver ratio to reach a low of 31.6.

Imagine if the gold-to-silver ratio reached 40 and the price of gold was at a conservative $2,200 per troy ounce, the silver price would be $55 - doubling current prices.

30-year Gold Silver Ratio Chart

Tax Benefits

In some countries, there are also tax benefits when it comes to silver investment, as value-added taxes (VAT) or sales taxes are exempted when buying physical silver bullion.

For example, investment-grade precious metals like silver are exempted from the VAT or sales tax when buying silver coins or silver bars from a Singaporean bullion dealer. Moreover, should you store physical silver in a Singapore vault and sell silver upon making a profit, there are also no capital gains taxes in Singapore.

In addition, some countries' retirement accounts allow purchasing silver and other precious metals. An example is the self-directed Silver IRA for Americans, which allows the use of retirement funds to purchase IRA-approved silver bullion with tax deferment.

Myriad of Industrial Uses

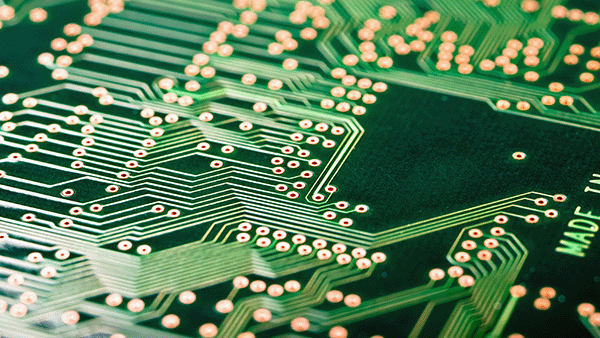

Silver continues to be the most conductive metal for heat and electricity. Used in electronics, solar panels, and medical equipment, the demand for silver in various industries underpins its price. Every mobile phone and laptop has a few grams of silver in it.

When buying silver coins and bars, you are not buying a base metal or any worthless metal. You are buying and owning silver that is highly sought after in industries making products for everyday use. This demand will likely grow as technology advances, potentially increasing silver's worth.

Silver is used in electronics

Types Of Silver Products

There are many ways to invest in silver in the market, from paper silver to physical silver products. Deciding the right silver investment product for you requires research and an understanding of your risk appetite. For example, while paper or digital silver products may have smaller buy-sell spreads and no storage costs, you will have counterparty risks as an investor since you rely on the other party for buy or sell transactions. On the other hand, buying physical silver bullion will require storage. Still, it does not have counterparty risks since the physical silver bar or coin is always in your possession, and it can be easily sold to many bullion dealers.

In our opinion, buying physical precious metals, like silver bars or silver coins, is undoubtedly one of the safest ways to invest in silver. At a time when global central banks are excessively printing money and stoking monetary inflation, physical silver becomes a wealth insurance against currency debasement. Moreover, suppose you are already invested in several paper assets, such as stocks or bonds. In that case, adding a hard asset like silver can be an excellent way to diversify your investment portfolio.

As one of the largest bullion dealers in Singapore, having operated for more than a decade, we share our knowledge from years of experience assisting thousands of international clients.

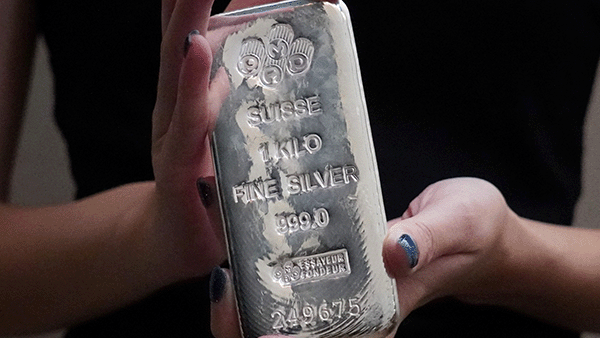

Why Buy Silver Bars?

One of the biggest reasons why precious metal investors buy silver bullion bars is the lower premium compared to coins. The premium is the amount you have to pay above the spot price of silver. This principle is often true when it comes to gold and silver investment: the larger the bullion, the lower the premium.

Bullion coins are often minted to a weight of 1 troy ounce, although there are some exceptions, like the Perth Mint Koala and Kookaburra silver coins that are available up to 1 kilogram. On the other hand, silver bars are commonly produced in higher weights, such as the 100 troy-ounce bar, 15-kilogram bar and even the largest traded bar in the silver market, the LBMA 1,000 troy-ounce silver bar.

LBMA 1000 oz silver bars at The Safe House vault

The production costs of coins are also often higher than those of silver bars, given the round-shaped mold, intricate designs, and degree of polish needed. Silver bars, especially those from 1 kilogram and up, are often produced with minimal to no designs and appear rough with many blemishes on them. With investment-grade bars, aesthetics take a backseat since the important details are the fineness and weight.

The amount you pay per troy ounce over the silver spot price will be significantly lower when you buy silver bars compared to purchasing coins. Buying silver bars is the most efficient way to accumulate silver without overpaying on premiums. The lowest-premium silver bar is, hands down, the LBMA 1,000 troy-ounce silver bar.

Why Buy Silver Coins?

While silver coins have a higher price premium compared to silver bars, they are popular among silver investors as an option to trade for everyday goods should there be a catastrophic failure in the financial system, rendering currencies worthless.

The advantage of silver coins is that they are highly portable and can be easily exchanged for lower-priced goods such as food, water, passage, or other necessities. While some people may find such scenarios farfetched, the prospect of currency collapse is very real, given how central banks print money as a solution to every economic problem.

The term 'coin' also has a specific meaning in the precious metals market - it refers to bullion coins produced by sovereign mints or government mints. Such coins are also legal tender, having a face value on them. For example, the 1 oz Silver Maple Leaf coin produced by the Royal Canadian Mint has a 5 CAD face value. The 1 oz UK Britannia silver coin minted by the Royal Mint has a 2 GBP face value. A coin's legal tender status does give certain silver investors assurance that their bullion coins are internationally recognized, making them highly liquid.

Canadian Maple Leaf silver coins

Coins produced by private mints are officially referred to as silver rounds. Unlike coins, silver rounds are not legal tender and do not have a face value. While a 1 oz silver round and coin may have the same silver purity and weight, a coin may be more internationally recognizable than a round since government mints are better known worldwide, thus giving them better acceptability outside of the minting country.

Silver coins and rounds

Factors To Consider When Buying Silver

Before buying silver, there are several factors to consider, including:

Purity

The purity of silver is measured in terms of its fineness, which represents the percentage of silver in the product. The higher the fineness, the more pure the silver.

Silver bullion bars and coins are often minted to a purity of 99.9% fineness, a common VAT or sales tax exemption criteria in many countries.

Weight

The weight of the physical silver product will affect its value, with heavier products typically being more expensive. While larger silver products, like silver bars, offer better price premiums, you will also need to consider how you can transport and store the bullion. The LBMA 1,000 oz silver bar weighs roughly 31 kilograms each and can be challenging to transport and store for some people.

Premium

The premium is the cost of the product over the current spot price of silver. As mentioned previously, silver coins often have higher premiums than bars.

Brand

Silver bullion products are produced by many mints and refineries from around the world. These manufacturers produce bullion products in varying designs and price points.

If you are buying silver as an investment or for wealth protection, it may be better to prioritize the silver product's premium, purity, weight, and recognizability. There is a myriad of silver producers on the London Bullion Market Association (LBMA) Good Delivery List that produce quality silver bullion that meets these four criteria.

Dealer's Reputation

It's important to buy silver from a reputable precious metal dealer to ensure that you're getting a genuine product. In fact, your first line of defense as a consumer is to buy from reputable bullion dealers who have a good track record. In addition, some bullion dealers, like Silver Bullion, can show you the test results for your silver on the spot at their retail stores, giving you peace of mind that your bullion is real.

A reliable precious metal dealer is also likely to offer buy-back of your bullion when you need to sell it.

Where To Buy Silver

Physical silver bullion can be purchased from a reputable precious metal dealer like Silver Bullion, where purchases can be made conveniently online or at a bullion retail store. Today, it is common for bullion dealers to display their bullion prices transparently on their websites.

Silver Bullion's retail store in Singapore

How Can I Place an Order for Silver?

Customers can place an order for physical silver online through the precious metal dealer's website. The price of silver will be locked upon order submission, and the order is binding. Typically, you will have up to 3 banking days to pay for your order. If an order is canceled, cancellation fees may apply.

How Can I Pay for My Silver?

It is increasingly common for bullion dealers to accept cash, bank wires, bank checks and credit cards for payment. With cash payment, you can pay and collect your bullion directly at the store. With the other payment types, payments will need to be confirmed by the recipient before you can collect your bullion.

How To Store Your Silver

In our opinion, investment-grade silver bullion does not need to be aesthetically pristine since the bullion's purity and weight are more important. They are not collectibles! However, proper storage is essential to minimize potential headaches when you sell it in the future.

Like gold, silver does not rust. However, silver will tarnish when exposed to air, but this tarnish will not affect your bullion's value.

Avoid using rubber bands or placing any rubber on your silver since rubber contains sulfur and it may deepen tarnish even through paper or plastic layers. We also advise against cleaning or polishing your silver with chemical cleaners as you may not be fully aware of how the cleaner's ingredients may react to silver.

You can consider purchasing a safe or rent a safety deposit box to store your silver. For extra protection and security, you can choose a vault or bullion storage provider to store your silver for you. This can often be the best option, especially if you have lots of silver to store.

Silver Bullion's S.T.A.R. Storage program

How Easily Can You Sell Your Silver

When you invest in silver, there will come a time in the future when you will want to sell it. You will be pleased to know that silver bullion bars and coins are highly liquid in many countries. For example, in Singapore, where Silver Bullion is based, it is common for bullion dealers to publish their sell-back prices online on their websites.

Larger bullion dealers are incentivized to buy back physical bullion from customers as they can likely acquire additional inventory for resale at lower prices than buying precious metals directly from bullion suppliers. This gives them better margins when they resell the physical silver bullion.

Conclusion

Buying coins and bars is an excellent way to invest in silver, and it is not a complicated process. With your own research and performing due diligence, owning silver bullion can be better than buying silver mining stocks or silver futures, given the lower risks involved. Physical silver securely stored insulates your wealth from bank failures or a financial system collapse. This is why investors often flock to silver, seeking safe haven when financial panics and crises occur.

How Can We Help?

Your first foray into silver investing can be even easier when you email or speak with one of our experienced customer service consultants, who can answer your questions with regard to buying or owning physical silver.