Credit Suisse Gold Bars: A Guide to Their History and Product Range

Gold has long been one of the most sought-after and valuable assets in the world. With its universal appeal and reputation as a safe haven investment, it is no surprise that many investors choose to buy gold. One of the most popular ways to invest in gold is through purchasing gold bars, and Credit Suisse is one of the most reputable names in the gold bar market. In this article, we will take a closer look at Credit Suisse gold bars and explore everything you need to know before investing in this asset.

History of Credit Suisse

Credit Suisse was a leading Swiss investment bank that offered private banking, investment banking, and wealth management services. Before its acquisition by UBS in 2023, Credit Suisse was one of the top three renowned Swiss banks globally.

Founded on July 5, 1856, as "Schweizerische Kreditanstalt" (SKA) by prominent politician and business leader Alfred Escher, the SKA bank was meant to finance Switzerland's expansion of its railroad network and further industrialization.

Revered as one of the founders of modern Switzerland, Alfred Escher was also involved in establishing the federal technical university ETH Zurich, pension provider Swiss Life, the reinsurance company Swiss Re, and the Swiss Northeastern Railway, which was eventually absorbed into the Swiss national railway system.

In 1997, the SKA name was dropped in a reorganization, which rebranded the bank as Credit Suisse. Despite this, Credit Suisse-branded gold bars were first introduced in the 1970s, minted by Swiss refiner Valcambi SA. Credit Suisse had 80% ownership of Valcambi until 1980 when the bank fully acquired it.

Credit Suisse Gold Bar Design and Physical Characteristics

Gold Bar Sizes

Like PAMP Suisse gold bars, Credit Suisse gold bars are produced with two types of finishing: cast and minted gold bars. Cast gold bars are made directly from melted gold poured into a mold from a crucible. Therefore, they are usually rough-looking with blemishes like scratches and indentations on their surfaces. Minted gold bars are produced using blanks cut from cast bars rolled to a uniform thickness. Therefore, minted gold bars have straight edges, well-polished surfaces, and bear artistic designs.

Credit Suisse cast gold bar sizes: 1,000 grams, 500 grams

Credit Suisse minted gold bar sizes: 10 oz, 250 grams, 10 tola, 100 grams, 50 grams, 1 oz, 20 grams, 10 grams, 5 grams, 2.5 grams, 1 gram

Gold Bar Design

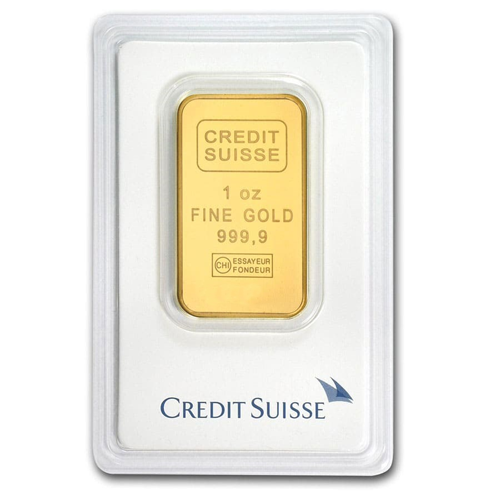

Unlike other investment-grade gold bars, Credit Suisse gold bars have simple, no-frills designs. Whether a cast or minted gold bar, the front of the bar bears the bank's name, "Credit Suisse," in a rounded rectangle, along with the bar's weight, metal type, and purity. Credit Suisse gold bars are always produced to 99.99% purity or fineness.

As mentioned, the Swiss refiner Valcambi SA produces Credit Suisse gold bars, and its certification mark appears below the bar's purity. As each gold refiner's certification mark is unique, Valcambi's certification mark bears the "CHI" melter's mark and assayer mark comprising the words "ESSAYEUR FONDEUR" in a rectangle. Under Swiss Law, trade assayers that also hold a melter's license may register a combined assayer/melter's mark, like that of Valcambi's.

Valcambi certification mark

As Valcambi is a Swiss refiner accredited by the London Bullion Market Association (LBMA), Credit Suisse gold bars are also exempt from sales tax in certain countries that base their precious metal tax exemption policies on the LBMA's Good Delivery List. For example, Credit Suisse gold bars are exempt from the Goods and Services Tax (GST) in Singapore, as outlined in their Investment Precious Metal (IPM) policy.

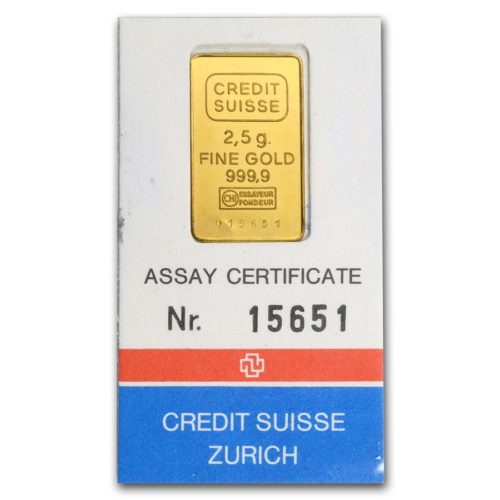

Below the Valcambi certification mark is the bar serial number.

Similar to other Swiss-branded gold cast bars, the back side of Credit Suisse gold cast bars does not have designs or markings. However, the back side of Credit Suisse minted gold bars features diagonally repeating Credit Suisse logos.

Gold Bar Packaging

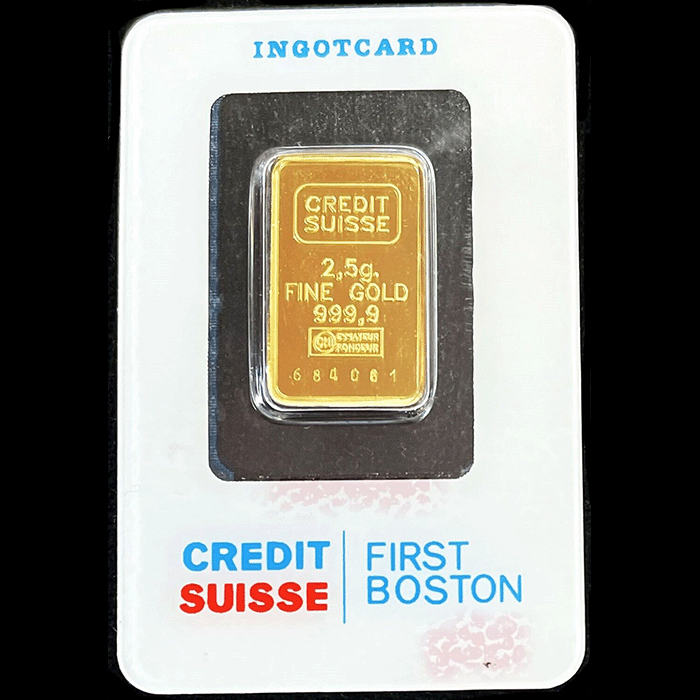

Only Credit Suisse minted gold bars have the packaging, while its cast bars do not come in original packaging, similar to the Swiss brands' cast bars. Minted gold bar packaging has changed over the years and may not be consistent worldwide. The simplest packaging we have seen is a sealed transparent plastic sleeve.

Below are some variations of Credit Suisse minted gold bars.

In 1988, the Credit Suisse Group merged with First Boston Corporation to form the Credit Suisse First Boston company. As seen below, some minted gold bars produced during this company's tenure bore the Credit Suisse First Boston name on their plastic packaging. Credit Suisse retired the "First Boston" name in 2006.

While Credit Suisse gold bars often come with accompanying certificates of authenticity, they are also sold at different retail outlets without certificates. Regardless, the absence of the certificates should not adversely affect the gold bar's resale.

Impact of the UBS Acquisition of Credit Suisse in 2023

Credit Suisse's 2022 annual report noted "material weaknesses" in internal controls over financial reporting.

In March 2023, the bank's largest shareholder, the Saudi National Bank, declined to provide more financial support, citing regulatory constraints. Viewed as a no confidence vote of the bank's finances, Credit Suisse shares plunged by as much as 30%. The 167-year-old Swiss bank collapsed shortly after years of underperformance, scandals and risk management crisis.

The Swiss central bank subsequently provided Credit Suisse with a $54 billion lifeline, and the Swiss government engineered for UBS, another Swiss bank, to buy the failing bank in June 2023. In May 2024, the merger of UBS and Credit Suisse parent companies was completed, officially relegating Credit Suisse to the annals of history.

Within hours of its state-backed takeover by UBS, memorabilia bearing Credit Suisse's name and logo was being sold on online resale websites. These items include Credit Suisse gold bars, hats, notepads, and bags emblazoned with the bank's logo. Viewed to soon become historical artifacts, fierce bidding wars by buyers willing to pay premiums for the bank's merchandise were reported on Swiss marketplace websites.

We also witnessed an increased interest in Credit Suisse gold bars from customers at our Singapore bullion retail store, selling out these bullion gold bars within days. Customers we spoke with had purchased Credit Suisse gold bars as a collectible to remember the venerable Swiss bank.

Pros of Investing in Credit Suisse Gold Bars

Investing in Credit Suisse gold bars offers several advantages, including:

Purity and Quality

Credit Suisse products are produced by the well-established Valcambi Swiss refinery and are known for their quality. Their gold bars are refined with 99.99% purity (24k), following the industry standard for investment-grade gold bar fineness.

Highly Recognizable

Credit Suisse was one of the most famous investment banks worldwide, and its name is synonymous with the prestige of Swiss banking. Available for purchase since the 1970s, Credit Suisse gold bars have been a staple gold bullion brand for decades and are highly regarded by precious metals investors worldwide.

Liquidity

Given the Swiss bank's global brand recognition and the quality of its gold bars, Credit Suisse gold bars are highly recognizable. They are widely accepted by international gold dealers and investors, making them highly liquid and easy to buy and sell.

Collectability

Despite Credit Suisse ceasing operations in 2023, Credit Suisse gold bars are still circulating in the precious metals market. Given the venerable Swiss bank's long history, Credit Suisse gold bars are still highly sought after, albeit as memorabilia and collectibles by precious metal investors wanting to retain a piece of Swiss banking history.

Cons of Investing in Credit Suisse Gold Bars

There are no major disadvantages to buying Credit Suisse gold bars since they are manufactured with the same quality by one of the largest gold refineries in the world as other Swiss-made gold bullion bars.

While it is unfortunate that Credit Suisse has ceased operations, the bank's demise has promoted its gold bars to become historical collectibles which can potentially fetch a higher price if sold to other collectors.

However, the bank's demise also means that Credit Suisse gold bars will no longer receive innovations and improvements to their bar design, packaging, or anti-counterfeiting features. Regardless, with precious metal non-destructive testing methods provided by reputable bullion dealers like Silver Bullion, Credit Suisse gold bars can still be easily authenticated without affecting their resale prospects.

Buy Credit Suisse Gold Bars From Silver Bullion

You can invest in Credit Suisse gold bars by buying them from Silver Bullion, one of Singapore's premier bullion dealers, subject to their availability.

In Singapore, you can visit our bullion retail store in Millenia Walk to buy Credit Suisse gold bars.

Overseas clients can purchase and store Credit Suisse gold bars in our S.T.A.R. Storage Program or The Safe House's safe deposit boxes.

Selling Credit Suisse Gold Bars

Selling Credit Suisse gold bars is easy, thanks to their high liquidity. You can sell gold bars to Silver Bullion even if they were not purchased from us. We are active buyers of gold and a major market maker for retail investors. Please find our updated buyback prices for gold on our website.

Buyback prices can be locked online via our website 24/7. Please note that online sell orders submitted are binding, and a cancellation charge/market loss charge will be levied if the order is canceled. Please find more information about selling gold to us here.