Dear Subscriber

As silver and gold prices hover at 6 year lows physical demand has skyrocketed. We registered our second and fifth best months in terms of revenue for June and July while bullion supplies are dwindling globally due to high demand.

At present around 80% of our traditional supply is unavailable as the US Mint, Royal Canadian Mint and Johnson Matthey have either stopped accepting orders, are on allocation, or can no longer give firm delivery dates.

Silver supplies in particular are shrinking as GFMS Thomson Reuters is pointing out in the latest Silver Institute update that:

The silver market is expected to be in a deficit of 57.7 million ounces in 2015, as supply contracts and physical demand grows. This would mark the third consecutive year that the market is in a physical deficit.

Given that Global Known Above Ground Silver Reserves were estimated to be only 40,000 tons by GFMS Thomson Reuters this would mean a nearly 5% fall in global reserves this year. Despite low supplies silver prices have fallen to 6 year lows.

See how tighter silver suppplies affects bullion availability later in this newsletter.

Silver Bullion Malaysia Opens

On April 2015 Malaysia adopted the same Investment Precious Metal (IPM) sales tax exemptions that Singapore adopted in 2012. Given the clear regulatory guidelines and the under served market in Malaysia, we have opened a Silver Bullion retail outlet located at level 26, Public Bank Tower, Jalan Wong Ah Fook, Johor Bahru, Malaysia.

Silver Bullion Malaysia accepts Malaysian Ringgit (as well as US dollars) for payment and ships bullion fully insured throughout the entire Peninsular Malaysia, Sabah and Sarawak. Our Johor office allows in-stock bullion pickups. It has three full-time staff, headed by Mr William Patrick and we have already delivered and shipped around 15,000 oz worth of silver and gold.

In other news:

| Physical Silver & Gold Supply Constraints |

|

Supply constraints started in July when the US mint announced that it would not accept new orders due to excessive demand. The Royal Canadian Mint began production allocations of Maple Leaf coins shortly thereafter. Supply has gotten considerable worse since then.

Until recently Silver Bullion - as we sell about 1% of global Silver Maple Leaf coin production - was still able to get maples but this changed two days ago when we received a notice that no reliable delivery date can be obtained for new orders. We have 40,000 coins due to arrive by mid to late August but currently cannot order more.

|

Maple Leaf Coins are now unavailable for pre-order.

|

|

In addition, about a month ago, we were informed that 100 oz Johnson Matthey (JM) branded silver bar production will cease permanently as JM sold their foundry business. JM bars were our most popular 100 silver bars representing about 30% of our silver sales.

With 10 oz and 100 oz RCM bars also being on allocation, 100 oz Nadir bars are now the most reliable supply option. Nadir is an LBMA approved refiner and these bars are similar to RCM or Perth Mint bars.

|

JM bars used to be our most popular silver bars, we sold 1,401,000 oz

|

|

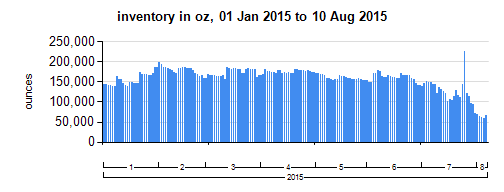

As North American sourcing has become more difficult and delivery times increase our in-stock inventory is gradually reducing as we await supply shipments in the coming weeks.

The chart shows how our average inventory of around 180,000 ounces has been steadily depleted over the last 40 days as the longer supply lead times are delaying inventory replacements. (The the 225K spike was the arrival and closure of a large customer order).

|

|

On the flip side we are expecting a full 4 metric tons (128,000 oz) of shipments to arrive between middle to late August and replenish inventory stocks temporarily. This will be a good buying opportunity, especially should supply diminish further in the next few months.

For silver volume orders we currently recommend 100 oz Nadir bars as they still have fast and reliable ordering timelines and low premiums, allowing to efficiently take advantage of the 6 year price lows.

|

Serialized 100 oz Silver Nadir Bars, minted in this size at our request.

|

|

See our April 2013 newsletter on how we can have such persistently falling prices while seeing record physical demand and shortages.

|

|

| Silver Bullion Malaysia |

Is located within the Public Bank tower in Johor, Malaysia. The location is about 30 km from our Singapore office across the Straits dividing Singapore and Malaysia.

Silver Bullion Malaysia is a subsidiary of Silver Bullion and was established to make it easier for Malaysians to purchase tax free investment grade bullion at very competitive prices.

Silver Bullion Malaysia provides four key benefits to Malaysian residents:

- Local Inventory for immediate pickup. We are stocking gold, silver and platinum at our Johor location, customers can lock in orders online at www.silverbullion.com.my.

- Bullion Shipping. We can now ship fully insured bullion throughout the Peninsular Malaysia, Sabah and Sarawak from our Malaysian Office. Shipments can range from a few tubes of silver to 10,000+ oz shipments.

- Payments in Malaysian Ringgit. The Ringgit is controlled currency and subject to capital controls. By opening a physical outlet in Malaysia we are now able to accept Malaysian Ringgits, and US dollars, for Gold, Silver and Platinum purchases.

- Good buyback rates on IPM Gold and Silver. You can view buyback rates online.

|

| We are Looking for additional Trusted, Talented Staff |

We currently have two new open positions in Singapore, both of which will be based in our Certis Cisco office location:

- Technical Analyst / Developer. Will be supporting, optimizing and design new software applications. Will work closely with existing developers, must have a background in C# and .NET. Refer to our careers section for details.

- Marketing and Branding Executive. Will be supporting our marketing efforts and work closely with our Marketing Manager. Refer to our careers section for details.

|

| AVAILABILITY & SERVICES |

Bullion Secured Peer to Peer Lending

Empowers customers to securely lend to each other : |

|

3 bidding days left

next loan starts on:

August 15th

|

1 Borrowing Request(s)

highest rate:

4.75% p.a.

(24 months SGD)

|

17 Lending Offer(s)

lowest rate:

4.25% p.a.

(6 months USD)

|

|

Currently an abundance of P2P lenders are competing for loan funding and have pushed lending rates down by 2% over the last month.

One way to take advantage of the low lending rates is to accept an August 15th lending offer and purchase bullion with it, which can be locked-in immediately. See other popular uses.

|

Transfer-In your Existing Bullion

See why we are the safest place for your gold and silver:

Option 1: Transfer your existing bullion to Silver Bullion, in which case it will be Authenticated and can then be sold, used to obtain a P2P Loan or taken delivery of at will.

Option 2: Transfer your existing bullion directly into TSH Safe Deposit Boxes by packing it yourself or have it deposited remotely by us. Once sealed the box contents are not accessible by us.

Note: Before importing bullion into Singapore ensure your bullion is classified as Tax Free Singapore IPM so you are not burdened with unnecessary import taxes.

|

Best Regards

The Silver Bullion Team

Silver Bullion Pte Ltd

Registration Nr: 200907537M

Floor #03-02A Certis CISCO Center II

20 Jalan Afifi, Singapore 409179

Singapore

Phone: (65) 6100-3040

Fax: (65) 6826-4022

Email: [email protected]

|

|

Information provided here should not be considered as advice or as an offer or enticement to buy, sell or trade. The contents of this publication, including any opinions and analysis, are strictly intended for educational use. Opinions expressed in bylined articles are those of the individual author and do not necessarily reflect the views of Silver Bullion Pte Ltd.

Silver Bullion Pte Ltd. makes no warranties, whether expressed or implied, as to the accuracy of the information provided or for eventual results obtained by using the information. In no case shall Silver Bullion Pte Ltd. be liable for direct, indirect, or incidental damages resulting from the use of the information.

If you prefer not to receive newsletters edit your profile online directly.

if you have changed your e-mail address, please reply to this e-mail and let us know.

|

|