POLICY STATEMENT

It is our mission to procure, protect and to provide liquidity for physical gold, silver and other assets. We do this in good times, but also wish to be prepared to protect in times of financial or systemic distress (such as currency crises, banking collapse, or gold nationalizations). Hence, it is our commitment not to introduce policies or revisions to our terms and conditions that go against this mission. In addition, we undertake to ensure that the property of our customers at any time:

- is physically present, tracked, and deliverable

- is owned by, and only by, the Customer

- is genuine and unencumbered, unless encumbered by the Customer themselves

- is under Singapore jurisdiction

SILVER BULLION TERMS OF SERVICE

Each terms and conditions contained herein (collectively "Terms of Service") are those under which Silver Bullion Pte. Ltd. supply any of the products or services advertised from time to time or listed at our websites www.silverbullion.com.sg , www.stargrams.app and www.save.gold . Please read the terms and conditions carefully as they will form the basis of our contract with you.

ACCOUNT TERMS

Terms for opening, using, and managing your Silver Bullion Account.

SALE, BUYBACK, AND STORAGE TERMS

Terms for buying, selling, and storing of metals with us.

PEER-TO-PEER LOANS TERMS

Terms governing your participation in the Secure Peer-to-Peer Platform.

S.T.A.R. GRAM TERMS

Terms for buying and selling S.T.A.R. Gram products and the use of the Gold Savings App.

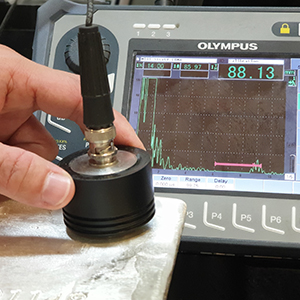

TESTING TERMS

Terms governing your purchase of our bullion testing services.

FUNDING & PAYMENT TERMS

Terms governing payments and funding of your Silver Bullion Account.

Download the full Terms of Service here .