This is When Gold and Silver Do Well

Introduction

Our economy is really determined in many ways by the amount of inflation that is present relative to the amount of growth. By the interest rates the central bank uses to regulate the changes. And, if you get it wrong, you can get into a lot of trouble.

For example, prior to the COVID pandemic, Silicon Valley Bank invested heavily in long-term government bonds, perhaps believing we were in a recession. But a few years later, it turned out that the economy was showing uncertainties between stagflation and overheating. Interest rates went up, and the value of the government bonds dropped immensely, causing Silicon Valley Bank to have to declare bankruptcy eventually.

To do that, we need to identify what the current state of the economy is, and where we’re likely to be headed.

Reining inflation in with interest

If you know where things are now, and where the economy is heading, then you can make the right investment decisions and profit. But how do you do that?

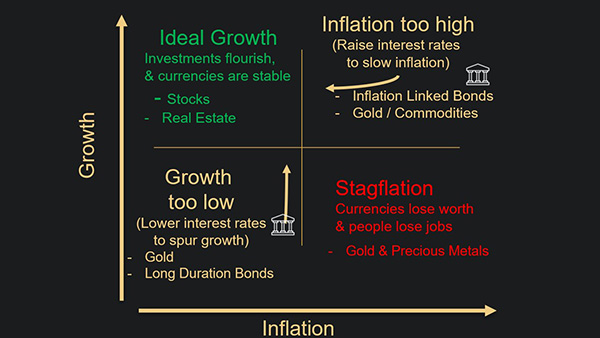

The key thing to understand is that there is inflation, and there is growth (which is a proxy for employment). Central banks will try to balance things so inflation stays around 2%, while growth goes as high as possible, and unemployment stays relatively low. For simplicity’s sake, we can consider that high growth will follow low unemployment. Then, it becomes a question of balancing inflation against growth.

If you put them on a chart, you’ll get four quadrants:

- The top-left quadrant is where you have high growth and low inflation. Stocks and real estate tend to do well because the cost of financing isn’t high. Companies are doing well, so salaries are higher, and people can afford to buy bigger houses at low mortgage rates. Overall, the cost of financing isn’t very high, and people are willing to spend, so that drives everything forward.

- With the bottom-left quadrant, you have a scenario where the economy isn’t doing so well.

Typically, this is when you end up in a recession, where there is low growth and low inflation. This is generally when central banks will try to lower interest rates further to make money cheap so people spend more. Because of that, it’s usually a good idea to buy long-term governmental bonds, because these tend to increase in value when interest rates fall. Defensive assets like gold and defensive stocks also tend to do well.

- Next, we move to the bottom-right quadrant, where we have stagflation. Usually considered the worst of all worlds, this is when you have low growth and high inflation.

Stocks don’t do well because the company earnings aren’t very good. The cost of financing is high because central banks are forced to push up the price of money to keep inflation at bay. Bankruptcies and unemployment are common, and spending drops because of the loss of income. During this period, gold and precious metals tend to be at their best.

- Finally, in the top right quadrant, we have an overheating scenario.

That’s when inflation is high, but you also have good growth. This is when central banks will have to raise interest rates to keep prices from rising too quickly. You can also have overheating if the supply of goods is too low, because then there is more money chasing too little goods.

Gold and the quadrants

Now, let’s look at how this applies to gold.

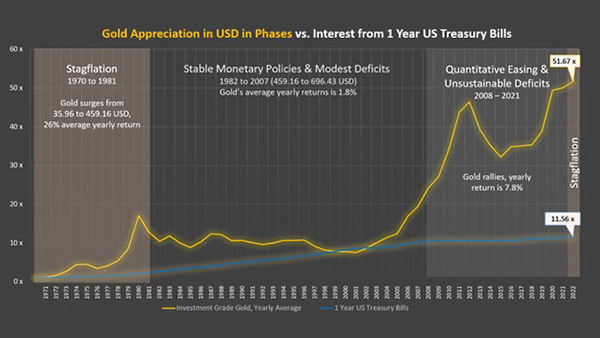

If we look at the chart above, we see the performance of gold compared to 1-year US Treasury Bills.

There’s a period of stagflation from 1970 to 1981, which means high inflation and low growth. During these periods, stocks don’t perform well. But we see from the chart that gold does very well – it had an average increase of 26% per year.

To counter inflation in 1981, Federal Reserve chairman Paul A. Volcker raised interest rates to as much as 20% in June. It caused a recession but restored trust in the US Dollar, and brought in a period of stable growth.

Between 1981-2007, inflation was kept at an average of 3.7%, and this was coupled with good growth. During this period, the economy moved mainly between good growth, overheating, and recession. At the same time, gold didn’t do very well. It only went up an average of 1.8%, and this saw a lot of people lose interest in gold.

Then came the financial crisis of 2007/2008. When the banks were at real risk of going bankrupt, people realized how much counterparty risk they were taking on. Suddenly, physical assets that can’t be defaulted on (like gold and silver) made more sense. One other interesting thing that happened during this period is that inflation virtually disappeared. And part of the reason for that is dollar sterilization.

Globalization made supply chains much more efficient, and this brought the prices of a lot of goods down. That allowed central banks to keep interest rates very low, so the economy essentially moved between good growth and recession during the period. In fact, in Europe, we even had negative interest rates to keep growth up.

Then in 2022, inflation came roaring back, and dollar sterilization is one of the reasons why. The after-effects of years of dollar sterilization sent the global economy towards the overheating and sustained stagflation quadrants. That’s why banks like Silicon Valley Bank went wrong. In thinking the economy was still in a recession, they bought heavily into long-term government bonds, only for the central bank to take measures against stagflation. Interest rates were raised, eliminating demand for bonds in the process.

It just goes to show how precious metals and gold can either do very well or be a rather stagnant asset. In the long term, gold and silver will always do well, but if you can correctly identify which state the economy is in, then you’ll know just how to adjust your allocation to gold and silver for maximum returns.

Impact of Trump's tariffs

In his bid to reduce the U.S. trade deficit and amend "long-standing imbalances in international trade," President Trump announced broad-based tariffs on imports on 2 April 2025, expecting the move to increase domestically manufactured goods and boost American jobs.

Trump's tariffs will likely be paid by the importing company, which in turn raises the prices of its goods, passing some or most of the tariffs' cost to consumers. Faced with price increases, consumers are likely to delay purchases, thus slowing economic activity. This, in turn, impacts the revenue of businesses, leading to them holding off on hiring as well as other capital-type investments.

With higher prices and low growth, the U.S. economy is in danger of being entrenched in stagflation in the coming years. In view that gold performed very well during the period of stagflation from 1970 to 1981, it is no surprise why gold prices are persistently reaching record highs in the current stagflationary environment.

The true value of gold and silver

Gold and silver aren’t really seen as mainstream investments, but sophisticated entities are buying a lot of gold now. Even central banks, who have been net sellers of gold for a long period are now buying gold in a large way.

Central bank gold buying in 2024 topped 1,000 metric tons for the third year in a row, confirming central banks' increasingly favourable view of gold as a reserve asset. The World Gold Council's 2024 Central Bank Gold Reserves Survey echoed this sentiment, which noted that 81% of respondents expect central banks to increase gold holdings over the next 12 months. Additionally, respondents' top reason for central banks to hold gold was "long-term store of value/inflation hedge," which matches stagflation's high inflation and low growth environment.

In 2019, the Dutch National Bank put it very clearly when they said: “Gold is... the trust anchor for the financial system. If the whole system collapses, the gold stock provides collateral to start over. Gold gives confidence in the power of the central bank's balance sheet.”

Gold gives confidence that a central bank’s balance sheet is sound. So, if the whole system were to undergo a reset (as has happened many times in history), then gold will be a good starting point. It is something people can trust, is inherently valuable, and is not dependent on somebody else’s solvency.