Silver Supply Update - February 12th, 2026

The January 30, 2026 silver price crash has created new supply complexities—and potentially a ticking time bomb.

Below we provide an overview of the situation, a current supply update, and our outlook for prices. For additional background, please read: “The Jan 30th Silver & Gold Price Crash Is Set to Worsen Physical Shortages.”

Overview

There are two distinct physical silver supply chains:

- Retail system – Coins and smaller bars available in smaller quantities. These are relatively accessible and premiums adjust quickly.

- Institutional system – Large-scale bars requiring substantial capital (e.g., USD 20 million+ orders). Access is more restricted and premiums tend to be more stable.

Large industrial users, exchanges, ETFs, and bullion banks operate primarily within the institutional system. Some entities—such as LBMA refiners—operate in both systems, producing retail products as well as Good Delivery bars. We are active in both, which gives us broader insight into evolving supply conditions.

While rising retail premiums have occurred many times over the past 15 years, rising institutional premiums are far more concerning, as they signal systemic physical tightness.

To understand institutional supply, it is helpful to review inventories across the three major physical exchange systems: the SGE, LBMA, and COMEX.

Shanghai Gold Exchange (SGE) – China

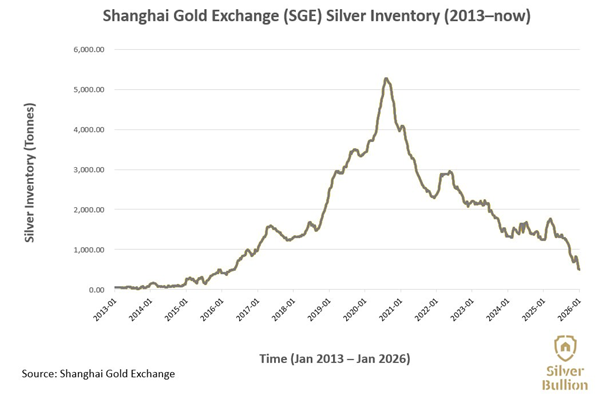

As of January 30, 2026—just before the New York price crash—silver inventories had already fallen to 493 tonnes, representing a 91% decline from the 5,280-tonne peak in 2020.

This is extraordinarily low for a major exchange—especially considering that we are vaulting over 600 tonnes of silver for clients at The Reserve in Singapore.

As of February 10, inventories declined further to just 450 tonnes. This confirms what we are observing directly: the January 30 paper price crash is accelerating the shift from paper to physical silver.

London Bullion Market Association (LBMA) – London

As of January 31, LBMA-approved London vaults report 27,729 tonnes (891 million troy ounces).

Important considerations:

- LBMA reports monthly. February withdrawal data will only be available in early March. Current allocation requests suggest strong withdrawal demand.

- The reported figures do not distinguish between:

- Allocated metal (stored for third parties, not available), and

- Free float metal (available, potentially withdrawable, and backing unallocated trading).

The free float is the critical metric. It is widely understood that at least two-thirds of reported metal is allocated. This likely leaves less than one-third as free float.

That free float underpins billions of ounces in unallocated silver trading between the four LPMCL banks (ICBCS, JPM, HSBC, UBS). It represents the physical silver that can actually be withdrawn and upon which much of the market relies.

It was low LBMA free float inventories that forced the spectacular October 2025 silver price rally. As a consequence, in Q4 2025, vast amounts of silver were transferred from the SGE (China) and COMEX (USA) to support LBMA free float inventories.

LBMA free float remains a primary institutional supply source, and we are actively seeking withdrawal allocations ourselves.

COMEX – USA

COMEX warehouse inventories have declined 27% since October and stood at 12,005 tonnes (386 million troy ounces) as of February 10.

Unlike the LBMA, COMEX provides a breakdown between their registered (available and redeemable) and eligible (held by private party / not deliverable) inventories.

It is important to note that COMEX withdrawal mechanisms include practical constraints. Following the 1998 episode when Warren Buffett requested delivery of 130 million ounces, procedures were structured in ways that make large-scale withdrawals less straightforward.

Our Main Silver Vault (MSV) now holds over 600 tonnes of silver for clients, exceeding SGE holdings.

The Key Silver Flows of 2025

We observed three major developments in the past 12 months:

1. Trump Tariff Threats (Jan–Apr 2025)

Vast amounts of silver flowed from LBMA vaults to COMEX/US vaults to pre-empt a potential US silver tariff by importing silver as quickly as possible. This caused COMEX inventories to surge while LBMA inventories dipped by 3,570 tonnes (115 million troy ounces) in Q1 2025. During this period, SGE silver moved to London to replace part of the withdrawals.

2. LBMA Free Float Tightness (Oct–Dec 2025)

Silver flows reversed as metal moves from COMEX and SGE to LBMA Vaults to address "Free Float" shortages. This was widely reported and can be infered by the inventory changes during the period.

- COMEX: −2,800 tonnes (90 million oz)

- SGE: −500 tonnes (16 million oz; 34% decline)

- London: +3,110+ tonnes (100+ million oz)

3. The Paper Spot Crash (Jan 30, 2026)

Despite tightening physical supply, leveraged paper selling drove silver down as much as 40% within two days. This triggered:

- A renewed shift from paper to physical.

- Silver flows toward higher-priced jurisdictions (India, China, Dubai).

The full consequences of the paper crash are not yet clear. However, the increase in physical demand has been immediate, and institutional—not just retail—premiums are rising. This is a clear indicator that physical shortages are worsening globally.

Physical Silver Availability Update

Market Availability

Retail availability in Asia is poor (especially for small bars), and even institutional availability is becoming increasingly spotty. Retail premiums remain high, and Good Delivery bar premiums have also been rising. However, silver prices have stabilized are trending steadily higher, creating somewhat greater pricing stability.

Our Availability

We have secured approximately 30 tonnes of Good Delivery silver for the month of February. A substantial shipment arriving early next week should provide at least 5 tonnes of in-stock silver, with an additional 20 tonnes due to arrive in late February / early March. This represents nearly one million troy ounces of secured and/or incoming supply in the form of LBMA 1,000 troy ounce good delivery bars.

Longer term availability remains unclear.

Silver Price Expectations

We expect a post–January 30 drain on LBMA inventories as physical metal can fetch better prices in countries such as India and investors shift toward physical ownership.

The LBMA free float silver inventory is likely somewhere between 200 and 300 million troy ounces today. This inventory must be sufficient to:

- Underpin London Precious Metal Clearing Limited (LPMCL) paper trading between bullion banks, which trade in excess of 200 million ounces per day—nearly turning over the free float reserves each trading day.

- Help satisfy physical industrial demand, whose average yearly supply deficit has been 200 million troy ounces – a cumulative 800 million troy ounce deficit between 2022 and 2025.

- Ensure that physical silver remains deliverable and avoid a systemic default.

While the above figures contain some assumptions, physical silver supplies have indeed become very tight. Therefore:

- If spot prices are allowed to align physical supply with physical demand, we expect prices having to move significantly higher, albeit gradually.

- If prices are kept artificially lower by certain paper market participants, as occurred on January 30th, we expect a repeat of the October 2025 LBMA free float shortages, triggering acute price spikes again.

The key difference compared to October 2025 is that COMEX now has significantly less inventory available to support London, and the SGE has very little inventory. Since leverage short sellers don’t create physical supplies, it would seem that physical shortages will likely drive higher silver prices in the near-term future.

It is also important to note that a large portion of the approximately 60% of global metal refining capacity (in China) is about to pause for roughly two weeks as Chinese New Year approaches. This will likely further tighten near-term physical supplies at what is already a critical time.

Regards,

Gregor J. Gregersen