|

February 6th, 2026

The high spot-price volatility—particularly in silver, which has declined from a high of 121 USD to 67 USD within a week—has meant that some loans have reached their 110% collateral-to-principal limit. This has triggered collateral liquidations to protect lenders.

Despite the 44% silver spot price crash, thanks to the high collateral requirements (200% collateral for silver loans longer than one month), and the fact that few loans were originated at peak silver prices, the number of liquidations has remained small so far, representing only around 0.07% of loans (by value).

However, given the unprecedented volatility in the precious metals market, further price movements may occur in the short term, which may cause additional loans to reach the 110% liquidation threshold.

- For P2P lender. No action is required. The system is designed to protect lenders by automatically enforcing collateral liquidation in such situations.

- For P2P borrower with active loans. We recommend reviewing your loan collateralization ratios and considering whether additional collateral should be added to loans that may be at risk.

We have introduced a simple mechanism that allows P2P borrowers to pledge additional S.T.A.R. Storage parcels or S.T.A.R. Grams to existing loans in order to increase the collateral coverage ratio and prevent the likelihood of liquidations. The process is illustrated below:

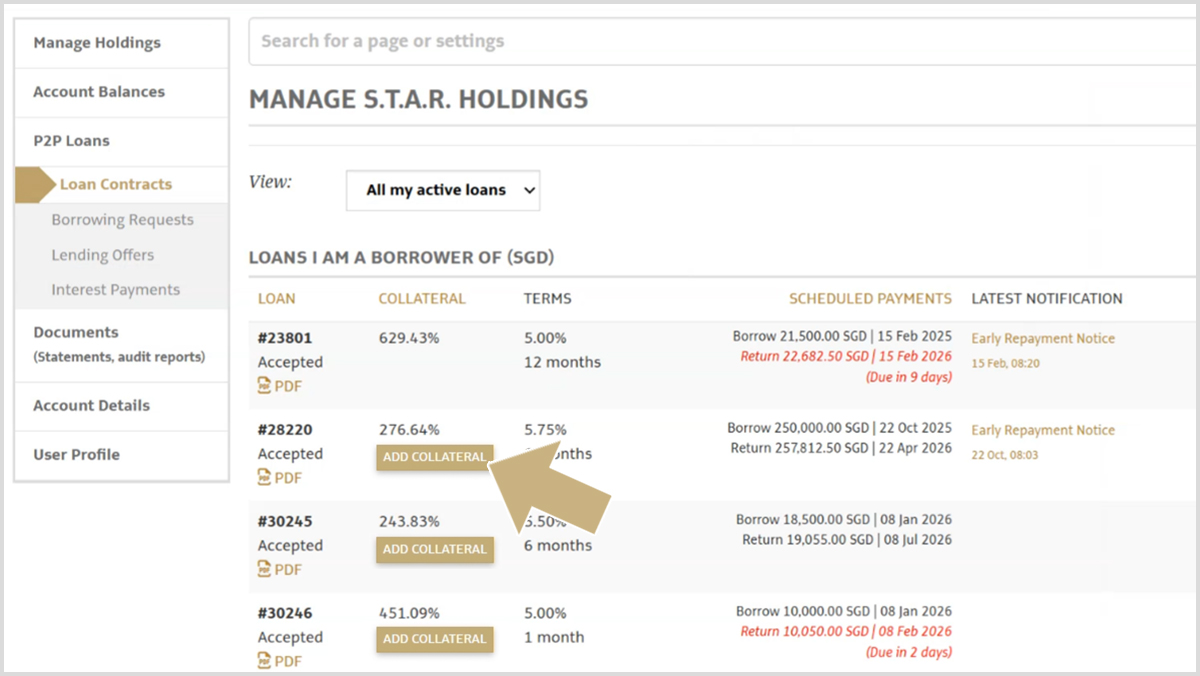

Step 1: Go to Loan Contracts and identify the loan where collateral coverage may be at risk. The "Add Collateral" option will not show for highly collateralized loans.

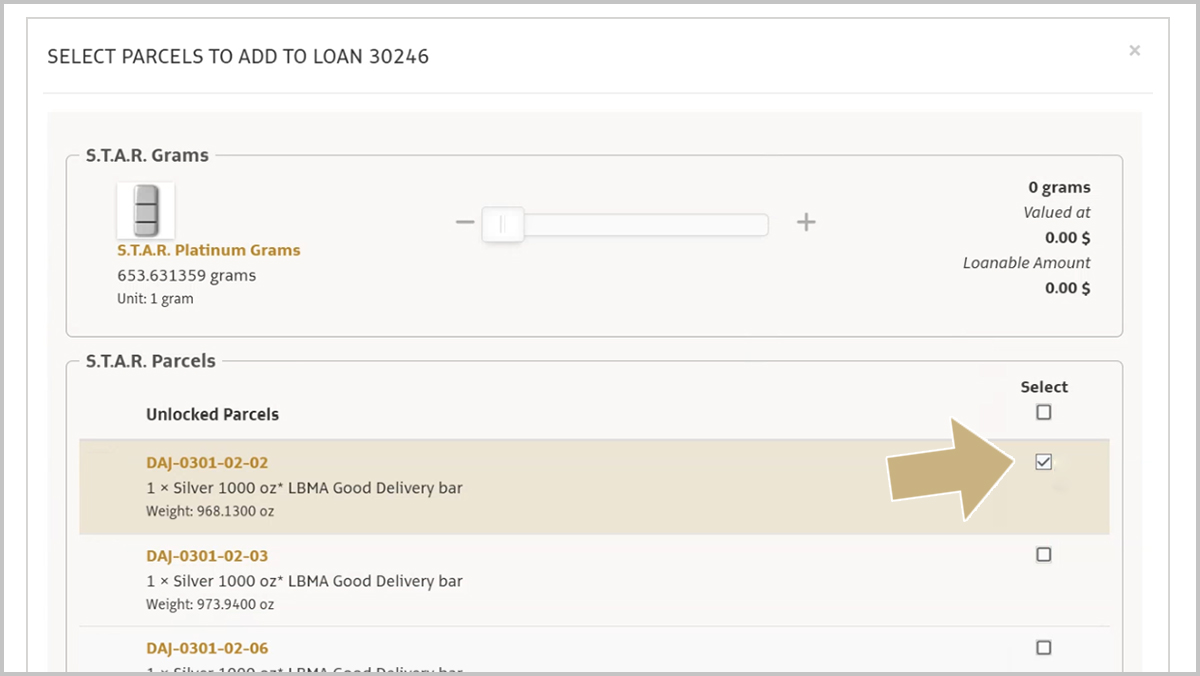

Step 2: Click “Add Collateral” on the loan and select the unencumbered precious metals you wish to designate as collateral for that loan.

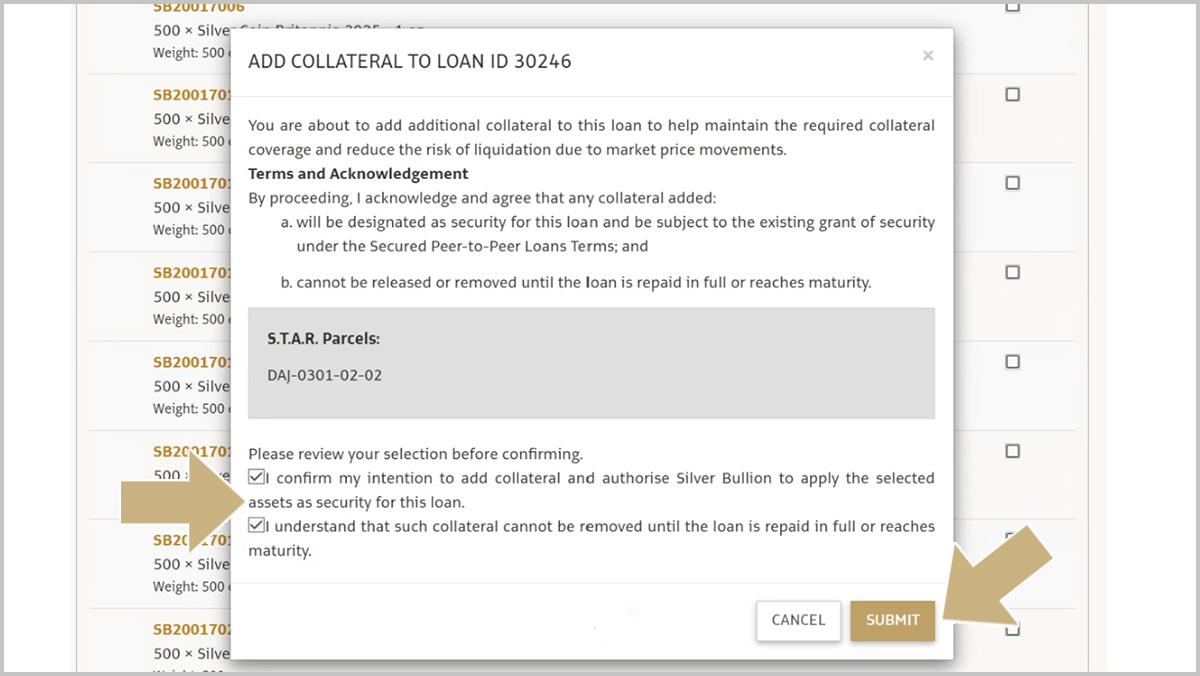

Step 3: Review the terms, confirm your intention, and submit.

Step 4: Confirmation is displayed once additional collateral has been successfully pledged.

You may contact your assigned Relationship Manager or the Customer Service team for guidance on using this feature or understanding your collateral position. Please note that collateral additions must be initiated and confirmed by you through the platform.

Please take note of the following important points:

- Collateral is loan-specific. A S.T.A.R. parcel may only be pledged to a single loan and cannot be split across multiple loans. S.T.A.R. Grams, being divisible holdings, allow smaller quantities to be assigned as collateral to individual loans, but each gram pledged is designated to a specific loan and cannot be reused across multiple loans.

- Once additional collateral is pledged to a loan, it cannot be removed until the loan is fully repaid and closed, at which point all collateral for that loan will be released.

- Only precious metals (gold, silver, or platinum S.T.A.R. parcels or grams) may be used as additional collateral.

If you do not currently have sufficient unencumbered precious metals and wish to add collateral, you may consider the following options:

- Purchase additional precious metals and pledge them as collateral. In volatile markets, gold may be preferred due to its lower price volatility, and S.T.A.R. Gold Grams also offers greater flexibility when managing multiple loans.

- Make an early loan repayment to close a loan. Once closed, the collateral from that loan will be released and may be pledged to other loans if required.

Please note that it is the Borrower’s responsibility to initiate loan collateral additions to mitigate the risk of liquidation in the event that collateral coverage declines to 110% of the loan principal.

You can view the latest collateral ratios for all your loans on your Holdings page and add collateral via the same interface. For inquiries or additional assistance, please email us at [email protected].

|