How UN, CIA, IMF. and World Bank statistics have misrepresented Singapore debt

Look up global statistics on country debt and you might be led to the United Nations’ latest report titled: “A World of Debt”. In it, Singapore is listed as the 7th most indebted country worldwide. The International Monetary Fund (IMF) also has Singapore as the 5th most indebted country worldwide, just below Eritrea. And the CIA has Singapore ranked as the country with the fourth highest public debt in the world (as of 2020).

The World Bank lists Singapore as having a debt to GDP ratio of 153%, and The World Debt Clock is counting up Singapore debt to GDP at over 170%. These authoritative sources present Singapore as a very indebted country; one of the most indebted in the world.

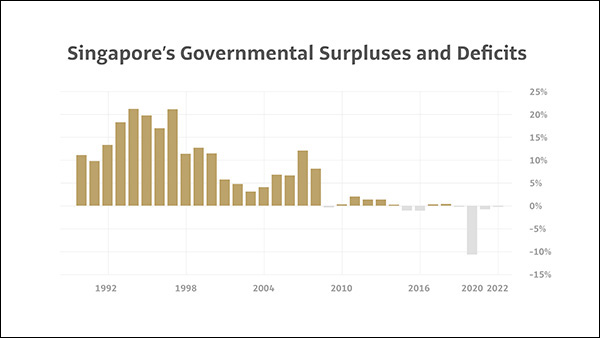

Such large debts are nearly always accumulated over decades through large and persistent governmental budget deficits year after year. Yet, as presented in the chart below, the Singapore Government has had substantially more surpluses than deficits over the last 30 years.

Data sources: TRADINGECONOMICS.COM,

The Singapore Government is even required under its constitution to operate on a balanced budget over each 5 year term, unless a special draw on governmental reserves is approved, as happened in 2020. This requirement means that every government coming in must ensure that all of its expenses are fully covered before the end of their term, with no debt or liabilities carried over.

*Note: The CIA actually makes a special note to account for this, hidden away on the individual country page for Singapore, under the section “Public debt”.

So how can Singapore be so heavily indebted?

The reality is that Singapore has no net debt.

To make sense of these contrasts two major factors need to be understood:

1.Different Debt Definitions – Most countries list their enormous unfunded pension and medical liabilities separately from their official debts, greatly under-reporting their real debts. Singapore does not.

2.Gross Debt vs. Net Debts - Most countries borrow to fund government expenses and have no future return on the expense. Singapore only borrows, primarily from its own pension system (CPF) to fund investments managed by the countries sovereign wealth funds, generating income.

Different Debt Definitions

Many countries have large amounts of unfunded liabilities. These are things like pension systems and other pay-as-you-go systems like Medicare and MedicAid, where the money is pooled and there’s no specific amount allocated to the individual.

Usually, such systems are unfunded. Those currently working will be contributing to the system while those retiring will be taking out from it. But because it’s one common pool of money, the people paying in tend to be left with no savings for themselves; that money has already been shared across the board. That’s especially true when considering the shrinking population worldwide.

Further, if there are surpluses from unfunded liabilities for the year, these tend to be spent by the government. So, subsequent generations are inheriting bigger and bigger burdens.

Taking the United States as an example, estimates for these liabilities are immense, between USD$100 trillion to USD$150 trillion, which means even on a conservative basis (like the Wall Street Journal’s estimate of USD$ 100 trillion), that’s at least 400% of GDP. Add that to the 115% debt captured by the IMF, and that’s at least 515% worth of GDP.

Looking back at Singapore, we have the Central Provident Fund (CPF). This is more like a 401K system, where every citizen pays 20% of their income into the fund on a monthly basis. Under law, this 20% contribution is matched by another 16%* from the employer, so 36% of the gross wage goes into the scheme.

(* For employees 55 and below. Contributions for both parties decrease as age approaches 70)

Every citizen has an own account only he can access. When the money goes in, the Singapore government issues the equivalent in Special Singapore Government Securities(SSGS), so the proceeds can then be invested through one of its sovereign wealth funds.

Adding Gross Debt vs. Net Debts

So, CPF money from Singapore’s citizens is placed in SSGS, which then funds the investments made by Singapore’s sovereign wealth funds. What the U.N., the CIA, IMF and World Bank, are capturing as debt, is really a wealth transfer from Singapore’s “retirement fund” to its sovereign wealth funds.

Singapore’s reserves amounts are only partially made public, but according to Wikipedia estimate, Singapore’s three sovereign wealth funds have an estimated value of US$1.6 trillion, being around 387% of GDP.

|

Debt as % of GDP for 2021 |

||||

|

Jurisdiction |

Nominal Debt |

Unfunded Liabilities2 |

Sovereign Wealth Funds 3 |

Net Debt/Surplus |

|

United States of America |

115% |

400% |

N/A |

515% Debt to GDP |

|

Singapore |

164% |

N/A |

387% surplus |

223% Surplus to GDP |

- IMF Central Government Debts: https://www.imf.org/external/datamapper/CG_DEBT_GDP@GDD/CHN/FRA/DEU/ITA/JPN/GBR/USA/SGP)

- American Enterprise Institute - https://www.aei.org/articles/federal-unfunded-liabilities-are-growing-more-rapidly-than-public-debt/

(Supporting sources Wall street Journal https://www.wsj.com/articles/how-much-washington-really-owes-100-trillion-debt-social-insurance-expenditure-medicare-medicaid-treasury-11671571955) - Wikipedia Singapore Reserve Estimate https://en.wikipedia.org/wiki/Reserves_of_the_Government_of_Singapore

- https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=SG

Looking at the numbers again, we see that it should really be 515% debt to GDP for the United States compared to 223% surplus to GDP for Singapore, after accounting for unfunded liabilities and sovereign wealth funds respectively.

While we do not know the full size of Singapore’s reserves, about 50% of the investment returns from its sovereign wealth funds are made available for spending on the Government Budget. This is known as Net Investment Returns Contribution (NIRC). It’s been the single largest contributor to government coffers, bringing in S$18.1 billion for the financial year 2020.

This means that, unlike most countries that are caught in increasing debt spirals, Singapore has a large yearly investment return and no net debts. The fact that there is no net Government debt, is confirmed by Singapore’s Ministry of Finance, addressing the same CIA Public Debt Factbook statistics described earlier (refer to question 39 ).

The Singapore Government has further been awarded the strongest credit rating from Standard & Poor’s, Fitch, R&I and Moody’s.

In Conclusion: Singapore has no net debt

Over the years, the gross debt reports by the IMF, the United Nations, the CIA and the World Bank, have created a highly distorted picture of Singapore’s debts. Book authors, bloggers, mainstream and social media sources who quote these sources then created a narrative that Singapore is dangerously indebted when the opposite is true.

Not all debt is equal, and not all countries operate on the same terms.

Singapore is unique, with good social and economic stability. Just two of the reasons why Silver Bullion has chosen Singapore as its base of operations.