Gold price surge: the fear trade is back

In late afternoon trade on the Comex division of the New York Mercantile Exchange gold for February delivery was changing hands for $1,218.40 an ounce, up $14.40 or 1.2% from Monday's close. Just before noon a series of huge trades saw the metal reach a day peak of $1,223.30, the highest since December 15.

Overall volumes traded also picked up with 176,000 lots or 17.6 million ounces traded, more than double the daily average over the holiday period.

The Dow Jones recovered towards the end of the day after another nearly 300 point drop for the blue-chip index, while the broader S&P500 slid beneath 2,000 points in lunchtime trade, down 4.5% from record highs reached at the end of last year. The Nasdaq's decline was the fifth straight day of losses.

After appearing to stabilize last week crude oil on Tuesday hit fresh lows with US benchmark West Texas Intermediate briefly dipping as low as $47.55 a barrel. Oil has lost 9.8% of its value since the start of the year after sliding 46% in 2014.

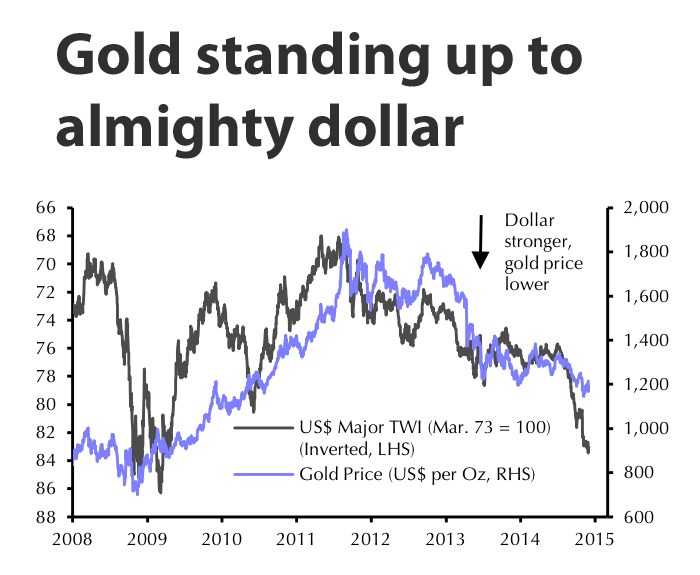

Gold was finding favour among investors seeking a safe haven as worries mount about the break-up of the Eurozone and default on debts by member Greece, the crude oil rout and its impact particularly on Russia, and the rampant dollar sparking an emerging market currency crisis.

Read More : www.mining.com/gold-price-the-fear-trade-is-back-76498/