ETF and central bank buyers storm gold market

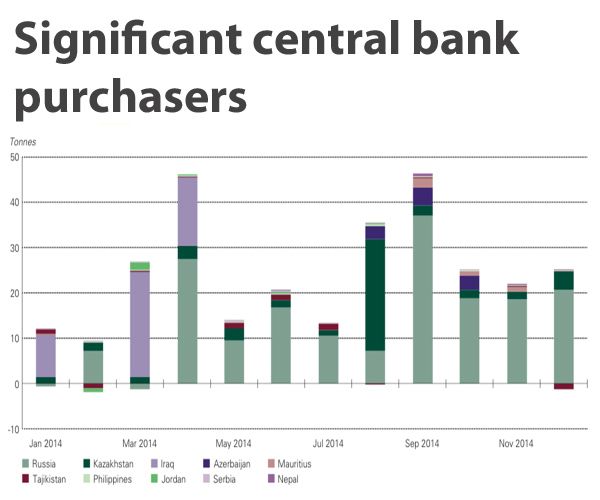

Technology demand continued its long-term decline, dropping to an 11-year low in 2014. On the flip side central bank purchases jumped close to a 50-year high of 477 tonnes while net investment demand managed to eke out gains of 2% for a total of 904.6 tonnes during the year.

Juan Carlos Artigas, Director of Investment Research at the WGC, cautions however that the positive year-on-year comparison was not necessarily driven by an improvement in investor sentiment, but rather by a slowdown in outflows.

The report shows annual outflows from gold-backed ETFs turned into a 159t trickle from the 880t torrent in 2013 in no small part due to the strength of the US dollar, continued improvement in the world's largest economy and the relatively stable gold price environment.

Read More: www.mining.com/gold-investment-demand-29712/