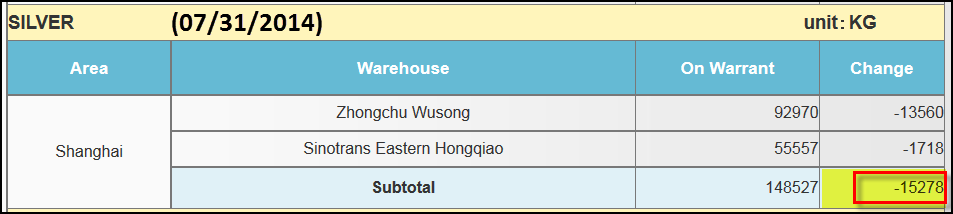

Chinese Silver Inventories Nearly 90% Depleted At Shanghai Futures Exchange

It’s important to understand that the Shanghai Futures Exchange as well as the Shanghai Gold Exchange behave more as a physical delivery market than the COMEX. I was speaking with Chris Marchese, analyst at Silver-Investor.com on this very subject.

I don’t spend a lot of time researching or analyzing the trading behavior in the silver or gold futures market. Chris went onto say the most of the silver and gold contracts at the COMEX are settled in cash, whereas the vast majority of contracts on the Shanghai Exchanges are settled in physical metal.

Which is probably the reason we are seeing a huge draw-down of silver stocks at the Shanghai Futures Exchange.