Silver Eagle Sales Steal The Show While Top Silver Miners Lose Money.

In February, 2013, investors purchased 3,368,500 Silver Eagles and 80,500 oz of Gold Eagles. Thus, we had a Silver/Gold Eagle ratio of 42 to 1. This year, investors purchased 3,750,000 Silver Eagles compared to 31,000 oz of Gold Eagles. This is a staggering 121 to 1 ratio, shown in the chart.

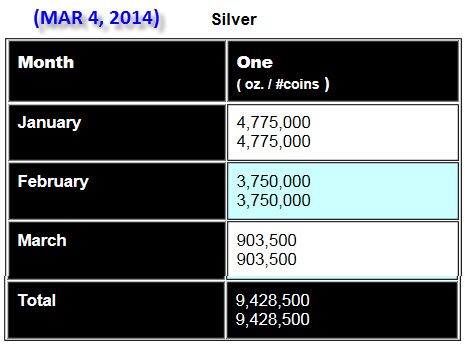

The chart shows that Silver/Gold Eagle ratio for the past four years including the 70 to 1 ratio for the beginning of 2014, calculated a few weeks ago. If we update the total sales for 2014 presently, we have the following:

2014 Silver Eagles = 9,428,500

2014 Gold Eagles = 123,000 oz

Silver/Gold Eagle Ratio = 77/1

As I mentioned in my last Silver Eagle article, Public Affairs person, Michael White stated in an email that the total allocation for the last week of February was 1,250,000. Last Friday, the U.S. Mint updated their figures showing at total of 3,750,000 for February and another complete sell-out of their weekly allocated amount.

Furthermore, the U.S. Mint sold 903,500 Silver Eagles as of Tuesday, March 4th. The total allocated Silver Eagle amount for this week is 1,100,000. Which means 82% of the total Silver Eagles allocated to the authorized dealers have already been purchased in the first two days of this week.

I would imagine the total allotment of 1.1 million Silver Eagles will be sold by the end of the week.

Top Primary Silver Miners Continue To Lose Money

The fourth quarter results are out from most of the primary silver miners and again… we see continued losses. Pan American Silver, Coeur and Hecla all lost fiat currency in Q4 2013.