Has The Global Run On Silver Begun? Shortages On The Horizon?

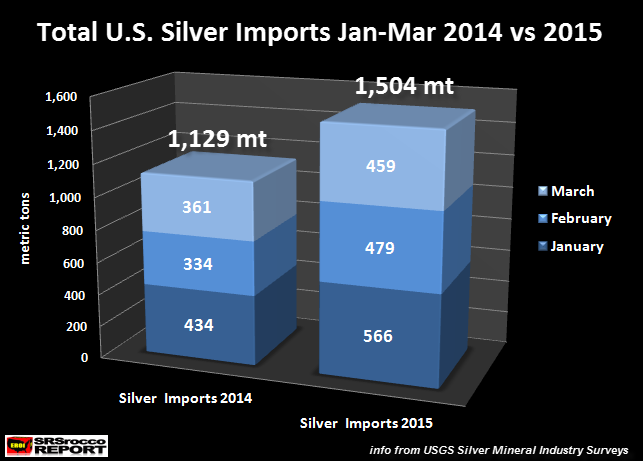

First, I recently wrote an article Why Is The U.S. Importing So Much Silver Bullion?, showing that U.S. silver imports picked up considerably in the first two months of the year. Well, this continued into March as total U.S. silver imports reached a hefty 1,504 metric tons (mt) compared to 1,129 mt during the same period last year:

U.S. silver imports are 33% higher than the first quarter of 2014. If we consider industrial silver demand, Silver Eagle sales and the Comex Silver Inventories, the U.S. Silver Market did not require an additional 375 mt of silver. Industrial silver demand was probably lower due to a falling U.S. Q1 GDP. Silver Eagle sales were actually less the first quarter of 2015 compared to 2014 and total Comex silver inventories didn’t change all that much.

So, what gives? If the U.S. Silver Market needs less silver than it did during the first quarter of 2014, someone must be stockpiling silver. There has been speculation that JP Morgan may be one of the big buyers. If they are, they are buying bullion bars and not Silver Eagles or Maples. Furthermore, I do believe there are hedge funds and individuals coming in and buying huge amounts of Silver Eagles. This is probably due to the increased financial turmoil stemming from the Greek situation.