Why Bullion Secured Peer to Peer Lending is Safer than Bank Credit

|

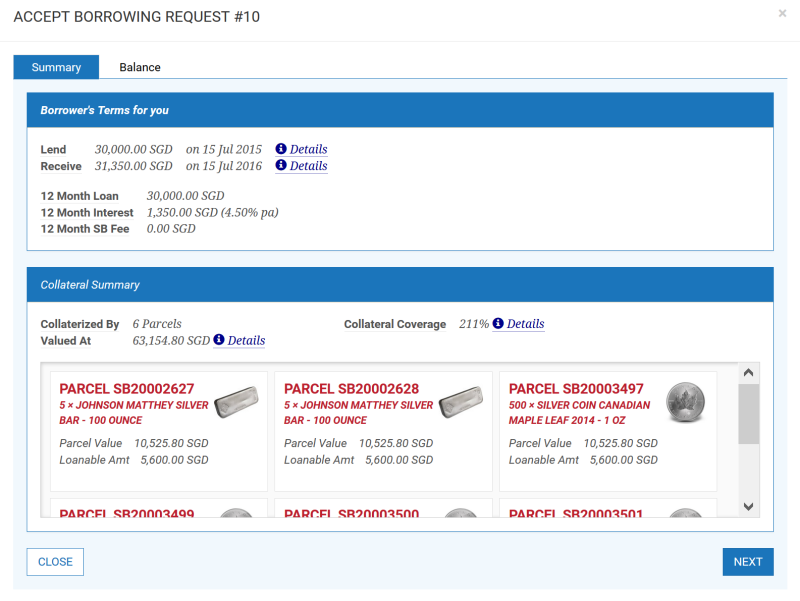

My parents spent most of their lives building holiday homes in the Tuscan countryside in Italy. After 25 years, we owned three picturesque villas and 42 apartments surrounded by 2,000 olive trees. It was 2006 and they were ready to retire. By 2007, a year before the US subprime bubble burst we had sold the villas. The following six years Italian home prices kept falling, forcing many property owners to forfeit their properties back to the banks, which typically had financed about 80% of the purchase price. One of these villas is now in its third fire sale auction at just 21% of our original 2007 selling price. Similar stories of real estate prices crashing are rife all over Italy. This is terrible for Italian banks, who now own forfeited property that is worth just a fraction of what they originally lent and they are unable to sell them. When I visited Italy last December, four local banks had just gone bankrupt, affecting about 100,000 families. Public radio broadcasts messages were full of anger and desperation from those affected, many of whom did not qualify for depositor insurance and lost everything, “I thought a bank is safe!” was the typical comment. What is often misunderstood is that you lose ownership of your cash the moment funds are deposited into a bank and that instead of an owner you have just become a bank creditor. Banks essentially operate an unallocated shared cash pool which is extensively leveraged and invested by the bank as they see fit. So when banks struggle and face performance issues, liquidity issues or capitalisation issues for instance as a consequence of loading up with excessive non-performing loans in an overleveraged financial system, it is only prudent for you to diversify some of your holdings out of this credit based system. Since banks pay very little interest on bank deposits there is little foregone interest loss anyway. Well insured physical gold and silver, owned – not owed - outside the financial system in a safe jurisdiction is a great wealth insurance. It may make you even very wealthy in case of a systemic crisis. A neat alternative for your cash is to lend directly to bullion owners who need liquidity and who are willing to pledge their bullion as collateral. Thereby you obtain a secured return that is higher and your loan is safer than a typical bank deposit. This secured P2P system might sound too good to be true at first, but its advantages are simple to explain. Specific bullion parcels of the lender, revalued every 5 minutes based international spot prices, serve as collateral to secure loans

By eliminating banking middlemen, both lenders and borrowers can set their own lending rates directly and thereby reduce the spread which banks would charge to depositors and borrowers and eliminate the tenor mismatch. So lenders can obtain a higher secured return and borrowers pay a lower interest rate. It is the lending equivalent of Uber (P2P for transport) or AirBnB (P2P for short term accommodation). By requiring borrowers to provide 200% collateral of physical investment grade gold or silver and us as a custodian fully insuring the collateral, the lenders are very well protected. Borrowers on the other hand get access to liquidity at low interest rates (presently at around 4% p.a.) quickly and easily without needing to sell their bullion. Collateral is legally owned as property by the potential borrowers, physically held in escrow at The Safe House Vault, fully insured through a Lloyd’s insurance underwriter and regularly inspected by either PricewaterhouseCoopers or Bureau Veritas. A word about the people who designed this P2P system might be in order. Gregor Gregersen was a senior data architect for Commerzbank (the second largest German bank), Otbert de Jong headed the global risk advisory department at ABN AMRO Bank and was a partner in PricewaterhouseCoopers and Simon Black is the founder of Sovereign Man, which is one of the best resources on internationalisation and spreading your risk. The widespread belief that just being a bank creditor is safe enough is a dangerous misconception and, while some banks are safer than others, you may want to consider to take steps to protect yourself by diversifying some of your assets out of intertwined credit based financial institutions. By Gregor Gregersen |