Gold & Silver Eagle Sales Spike In June As The Market Senses Financial Turmoil

For example, Goldcore published the article “Hold “Physical Cash,” “Including Gold and Silver” To Protect Against “Systemic Risk” – Fidelity”, stating:

A fund manager for one of the largest mutual fund and investment groups in the world, Fidelity, has warned investors and savers to have an allocation to “physical cash,” “including precious metals” to protect against “systemic risk”.

Then we had this from Zerohedge the very same day, “$140 Billion Bond Fund Goes To Cash As It “Braces For Bond-Market Collapse”:

Recently, it’s become readily apparent that some of the world’s top money managers are getting concerned about what might happen when a mass exodus from bond funds collides head on with a completely illiquid secondary market for corporate credit.

Furthermore, we have the continued threat of a Greek exit of the European Union. With the tremendous amount of volatility in the movement of bond yields over the past month, the Mother of all Black Swans may finally take place in the latter part of the year.

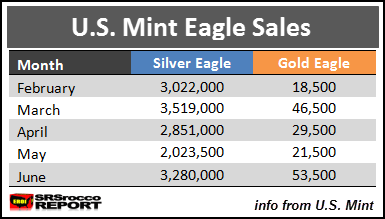

It seems as if precious metals investors can sense this as sales of Gold and Silver Eagles spiked in June. Gold and Silver Eagle sales jumped considerably higher from May:

Silver Eagle sales up until June 23rd are already 3.28 million oz (Moz), surpassing the total 2 Moz sold for May. Gold Eagle monthly sales are the second highest this year at 53,500, compared to 21,500 sold last month. The trend change looks even more clear when we look at sales of Gold and Silver Eagles since February.