The Precious Metal Favored During A Financial Crisis Isn’t Gold

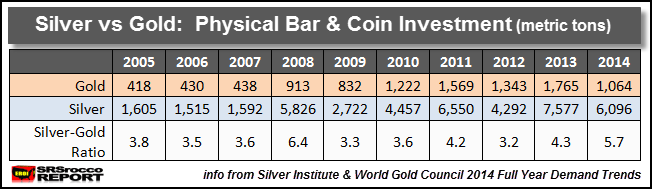

Before the failure of Bear Stearns, Lehman Brothers, Merrill Lynch and AIG (2008), physical gold and silver investment was minimal. For example, in 2007 total physical gold investment was 438 metric tons (mt) while investors purchased 1,605 mt of silver. This translates to 14 million oz (Moz) of physical gold investment versus 51 Moz of silver.

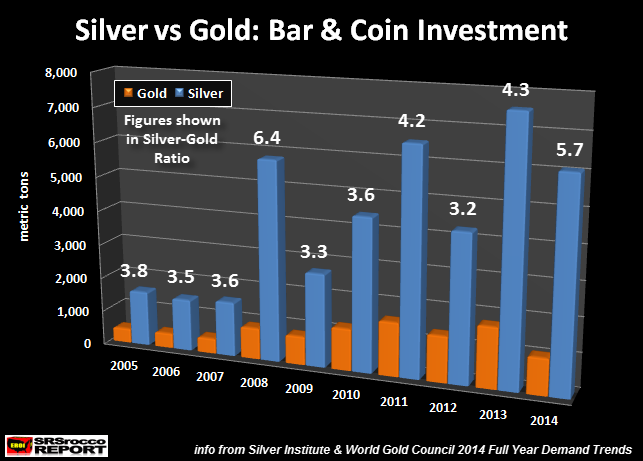

But, the very next year as the U.S. and world financial system experienced a heart attack, physical gold and silver investment surged. Even though physical gold investment more than doubled to 913 mt, silver investment demand skyrocketed to a stunning 5,826 mt. This can be clearly seen by the physical silver-gold investment ratio in the chart below:

Investors purchased 6.4 times more silver bar and coin than gold in 2008 compared to 3.6 times in 2007. Basically, gold bar and coin demand doubled in 2008 vs 2007, whereas physical silver investment nearly quadrupled. Then in 2009, overall physical precious metal investment demand (and the ratio) declined as the Fed and Central Banks used massive monetary injections to bring stability back into the global economic and financial system.