Gold's up, gold's down, where is gold going now?

Gwen Preston - Resource Maven

Last week was a great one for gold. After an eight-week decline pulled the price back 11.5% to a closing low of $1,147.25 per oz. on Mar. 18th, gold jumped back to close above $1,200 on Mar. 26th. The question everyone is asking now: where will it go from here?

The long answer is the gold is looking good in the short term based on US dollar weakness, US economic softening in general, the phenomenon that a long list of government bonds are offering negative yields, and geopolitical events. The fact that commercial futures traders have winnowed their short positions to very low levels adds extra support to a bullish short-term outlook for the yellow metal. I’ll go through each of those factors in turn.

Greenbacks and Gold

The easiest way for gold to gain would be for the US dollar to stop rallying. That, in turn, depends on a raft of US economic factors as well as global geopolitical events.

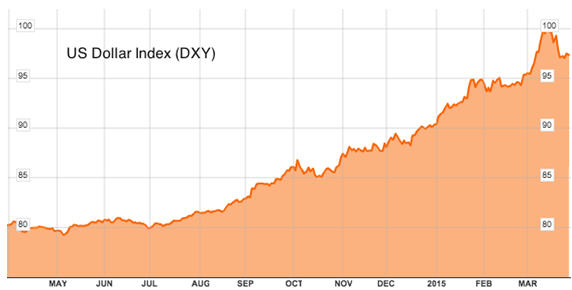

But there is good reason to believe the dollar’s ascent will take a real breather here, if for no other reason than its run to date:

As my friend Brien Lundin put it: No tree grows to the sky, no market makes this kind of rise without a correction. It looks like the correction has begun: the greenback slid more between Mar 15thand 25th than had for over a year. And there is real impetus driving the dollar down.

Read More: www.mining.com/web/golds-golds-gold-going-now/