China’s appetite for gold down, but not gone: World Council

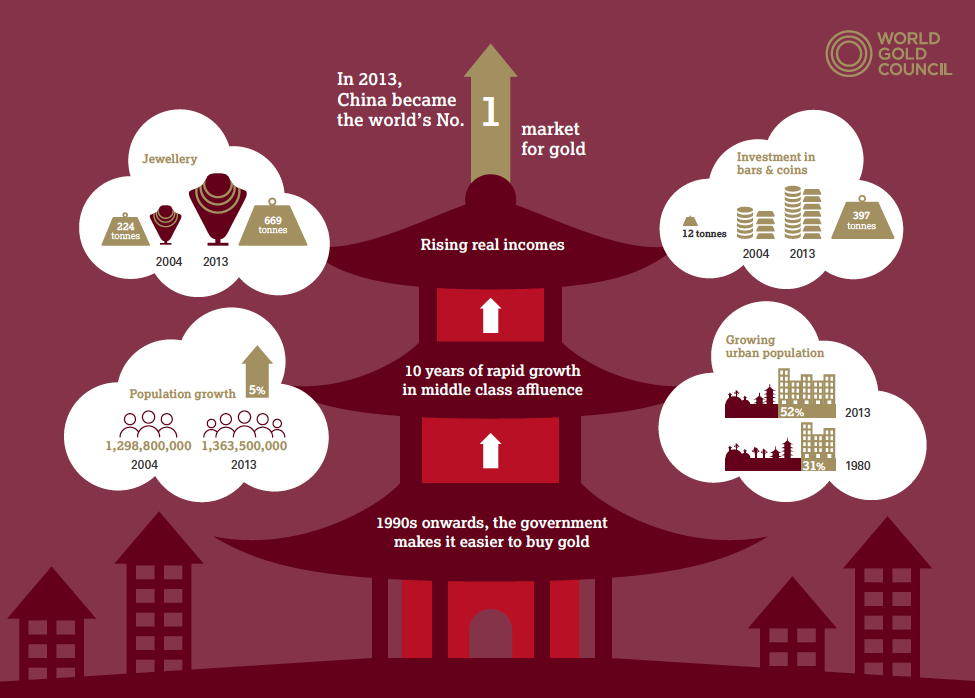

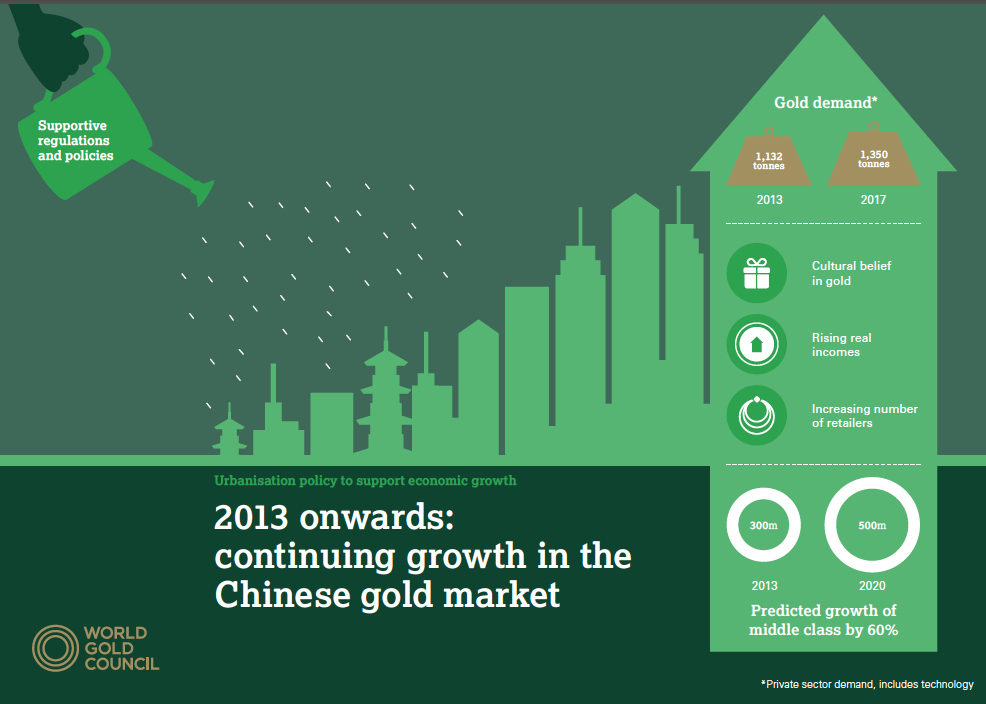

Gold demand in China has expanded every year since 2002, when it declined, according to the industry group, whose forecasts are closely watched in the gold market.

The nation’s appetite for the yellow metal has helped to underpin gold prices since 2001, when many price and trading restrictions were relaxed. Last year saw frenzied buying as Chinese investors and jewellery buyers sought to capitalize on low prices.

As a result, demand jumped 32% in 2013, and China overtook India as the world's largest gold-consuming nation. But it is unlikely that record pace can be maintained, even if prices turn lower, shows the WGC’s latest study.

A decreased interest for gold in China would threaten the recent price recovery, according to some investors. Gold futures are up 10% year to date, after dropping 28% last year, the largest annual fall since 1981. Unrest in Ukraine, a bumpy start to the year for stocks, and the US Federal Reserve's commitment to low interest rates in the long term have propelled gold higher. Investors typically seek the metal as a haven in times of turmoil and a store of value during periods of low rates.

Read More: www.mining.com/chinas-appetite-for-gold-down-but-not-gone-world-council-20697/