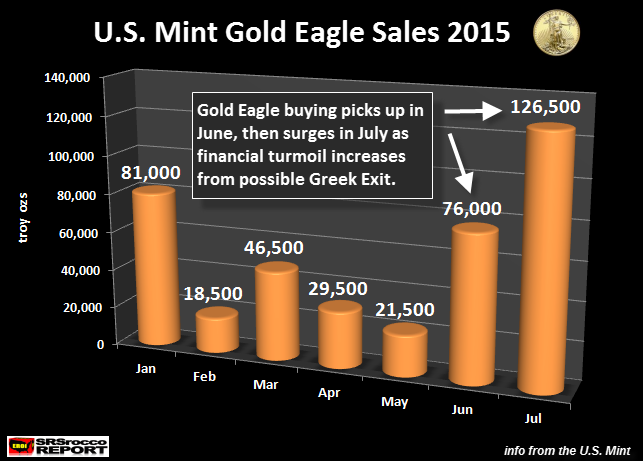

Financial Time Bombs Push Gold Eagles Sales To Record High

The reason for the big surge in the U.S. Mint’s Gold Eagle sales is due to the increasing number of financial time bombs that are now set to go off in the future. Financial contagion stemming from a Greek default and possible exit from the European Union triggered increased buying of Gold Eagles in June.

Sales of Gold Eagles were a measly 21,500 oz in May. However, this picked up significantly towards the latter part of June as the financial situation in Greece became more dire. Gold Eagle sales in June jumped more than three times the rate compared to the prior month reaching 76,000 oz. But, this was just a warm-up for the further spike in demand in July.

If we look at the chart below, we can see that Gold Eagle sales for the month of July are 126,500 oz. The U.S. Mint updated their figures yesterday adding another 8,000 oz sold in one day.

UPDATE: another 16,500 oz of Gold Eagles sold today for a total of 143,000 oz for July.

As I mentioned in a past interview and in my recently released THE SILVER CHART REPORT, investors tend to buy more silver as the price declines, while spikes in physical gold buying occurs during financial turmoil.