Secured Peer-to-Peer Lending Platform

Silver Bullion acts as escrow, custodian and platform provider to securely enable lending and borrowing between clients at their chosen terms. Clients have made 750,511,682 SGD loans since 2015 with no defaults, thanks to high collaterals and our sweeper fund.

Borrowing (Ask)

Borrowing requires eligible physical assets (e.g., bullion, luxury watched) to be vaulted with us to guarantee loan repayment. Clients with physical assets can create borrowing requests to ask for funds at their chosen terms.

- Your assets remain your property

-

A lien is placed on the parcels you choose to use as loan collateral. These parcels will need to stay in our vault until the loan is returned.

- Fast, efficient, and inexpensive

-

Loans contracts are made in minutes, funds are released on the 1st, 8th, 15th and 22nd of each month and the only processing fee is a 0.5% p.a.* of loan amount, payable at loan end. *(1% for - 1 month loans).

- Deposit existing assets with us

-

Unlock liquidity from your existing eligible assets. After transfer-in and authentication, you can obtain funds without selling your eligible assets and avoid potential capital gains taxes.

Lending (Bid)

Lending requires USD / EUR / SGD to be held in our escrow account so it can be lent to borrowers. Lenders create lending offers to bid for loans at their chosen terms.

- Secured

-

Your loan is secured with 160% to 200% of borrower’s assets and should, during the loan term, the collateral fall to 110% we will liquidate the assets to cover the loan.

- Reliable

-

A separate “sweeper fund” absorbs eventual payment delays by your counterparty, ensuring reliability and enabling smooth roll-overs without idling funds.

- Authenticated and Insured collateral

-

The collateral is authenticated by us and further insured by Lloyd’s of London underwriters– covering theft, infidelity and mysterious disappearance.

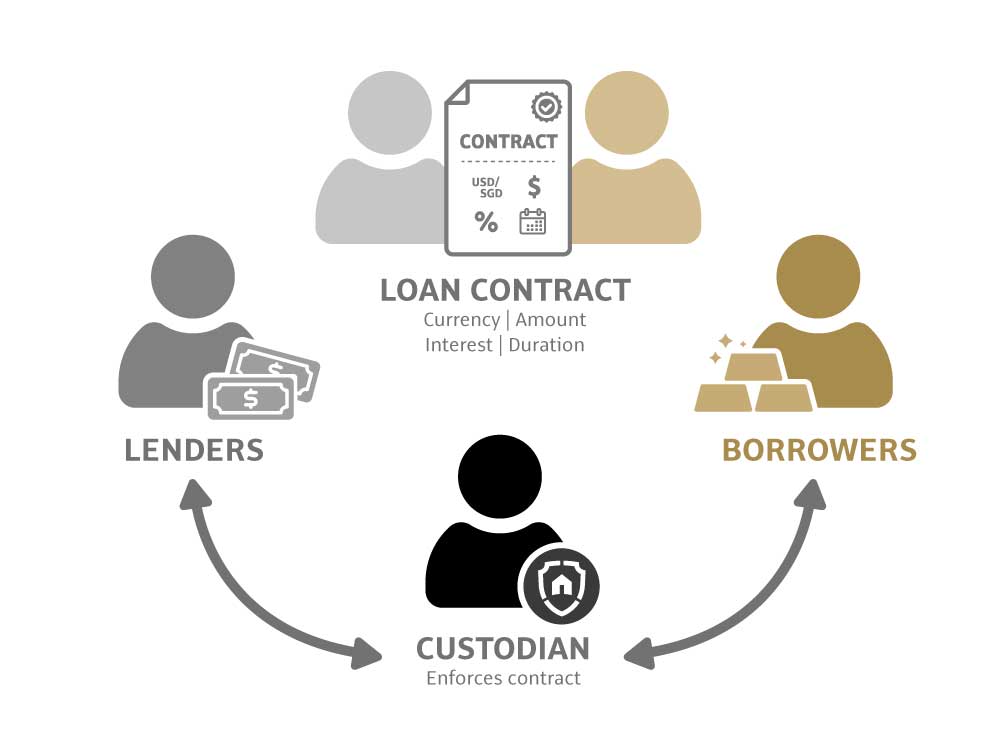

How Secured Lending Works

Over the last 8 years, we have processed 17,759 loans without any defaults to lenders. The steps involve:

- Bid/Ask Market

-

Available lending offers and borrowing request for the next loan start date are listed in the Bid/Ask Market. All loans start on the next loan starting date, being the 1st, 8th, 15th or 22nd of each month.

- Lenders and Borrowers agree on terms

-

When a lending offer and borrowing request match, a contract is created. The bid / ask market enables lenders and borrowers to find a mutually agreeable amounts, interest rates (2% to 10% p.a.), currencies (SGD, USD or EUR) and durations (1, 6, 12 or 24 months).

- Transfer of Funds and Low Fees

-

Silver Bullion will send the funds to the respective parties, ensuring reliability. The only loan processing fee is a 0.5% p.a. of principal (1% for 1-month loans) charged at the end of the loan.

When a loan expires the borrower can:

- Return the funds by or before the due date to Silver Bullion.

- Roll-over the loan with another loan – to be set 1-week before expiry.

- A combination of the above.

When a loan expires the lender can:

- Return or utilize the funds.

- Roll-over the funds into another loan – to be set 1 week before expiry.

- A combination of the above.

Should a borrower not return funds on time:

Our “sweeper fund” will cover any payment shortfall ensuring that the lender will still obtain funds on time, a 1% late fee will be charged to the borrower for the shortfall.

Liquidation of Collateral Occurs When:

Should a borrower not return funds for a period of 1 month or should the value of the pledged collateral fall to 110% of collateral then the collateral will be liquidated to ensure the loan repayment.

IMPORTANT: We do not facilitate asset leasing as it can put your asset at risk, instead your property can only be used by you as collateral to obtain low interest loan from other clients.

Loan Duration and LTV Ratio

-

Loan Durations and Loan to Value Ratio Metal Loan Duration LTV Ratio Gold 1 mth 62.5% 6 mth 12 mth 24 mth Silver,

Platinum,

Palladium,

Nickel & Cobalt1 mth 62.5% 6 mth 50% 12 mth 24 mth

Latest Rates

For Loans Starting on 22 Apr 2024

| Accepted Contracts | ||||

|---|---|---|---|---|

| Terms |

Volume

/

Contracts

|

Last Rate | Change | Lowest Lending |

| 1 month EUR |

2,526,000

/

203

|

4.75% p.a. | 0.25% | 4.25% p.a. |

| 1 month SGD |

190,809,000

/

5,205

|

5.00% p.a. | 0.25% | 5.00% p.a. |

| 1 month USD |

165,542,260

/

4,250

|

6.00% p.a. | -1.00% | 5.00% p.a. |

| 6 months EUR |

1,866,500

/

101

|

7.25% p.a. | 2.00% | 7.00% p.a. |

| 6 months SGD |

40,717,000

/

1,752

|

4.50% p.a. | -0.75% | 5.00% p.a. |

| 6 months USD |

77,603,952

/

1,700

|

6.00% p.a. | 0.75% | 5.50% p.a. |

| 1 year EUR |

3,012,500

/

128

|

6.50% p.a. | 0.25% | 7.00% p.a. |

| 1 year SGD |

20,370,500

/

1,027

|

5.00% p.a. | - | 5.00% p.a. |

| 1 year USD |

65,541,150

/

1,662

|

5.50% p.a. | 0.50% | 5.50% p.a. |

| 2 years EUR |

4,034,000

/

113

|

6.50% p.a. | -0.50% | 7.50% p.a. |

| 2 years SGD |

7,857,000

/

357

|

5.50% p.a. | 0.25% | 6.75% p.a. |

| 2 years USD |

39,384,500

/

1,261

|

6.50% p.a. | - | 6.50% p.a. |

| Summary of Active and Completed Contracts | |||||

|---|---|---|---|---|---|

| Amount Lent | Contracts Matched |

Late Payments

Cases where a lender payment was delayed. Note: Should a borrower be late in repaying his/her debt, the Sweeper Fund will forward cash to ensure the lender is paid on time. The Sweeper Fund essentially acts as an additional buffer to help ensure timely payments. Find out more about the Sweeper Fund. |

Defaults

Cases where a lender did not receive payment back. Note: Should a borrower be late in repaying his/her debt, the Sweeper Fund will forward cash to ensure the lender is paid on time. Essentially the Sweeper Fund will take on the bad debt to prevent delays or defaults. This provides times for the borrower to remedy the missed payment and, if need be, for the borrower collateral to be liquidated. Find out more about the Sweeper Fund. |

||

| 750,511,682 SGD | 17,759 | 0 | 0 | ||

Latest 10 Contracts

| Created On | Payout On | For Amount | Duration | At Rate |

|---|---|---|---|---|

| 19 Apr 2024 | 22 Apr 2024 | 76,500 SGD | 1 Month | 5.00% p.a. |

| 19 Apr 2024 | 22 Apr 2024 | 21,000 SGD | 6 Months | 4.50% p.a. |

| 18 Apr 2024 | 22 Apr 2024 | 13,000 SGD | 1 Month | 4.75% p.a. |

| 18 Apr 2024 | 22 Apr 2024 | 3,000 SGD | 1 Month | 4.00% p.a. |

| 17 Apr 2024 | 22 Apr 2024 | 51,000 SGD | 12 Months | 5.00% p.a. |

| 17 Apr 2024 | 22 Apr 2024 | 77,500 SGD | 24 Months | 5.50% p.a. |

| 17 Apr 2024 | 22 Apr 2024 | 42,000 SGD | 6 Months | 5.25% p.a. |

| 16 Apr 2024 | 22 Apr 2024 | 26,000 SGD | 6 Months | 4.50% p.a. |

| 16 Apr 2024 | 22 Apr 2024 | 6,500 SGD | 6 Months | 4.50% p.a. |

| 16 Apr 2024 | 22 Apr 2024 | 11,000 SGD | 1 Month | 4.50% p.a. |

| View all past contracts in PDF or Excel format. | ||||

| Created On | Payout On | For Amount | Duration | At Rate |

|---|---|---|---|---|

| 19 Apr 2024 | 22 Apr 2024 | 32,000 USD | 1 Month | 6.00% p.a. |

| 19 Apr 2024 | 22 Apr 2024 | 13,000 USD | 1 Month | 7.00% p.a. |

| 19 Apr 2024 | 22 Apr 2024 | 8,500 USD | 1 Month | 7.00% p.a. |

| 19 Apr 2024 | 22 Apr 2024 | 35,000 USD | 1 Month | 6.25% p.a. |

| 18 Apr 2024 | 22 Apr 2024 | 77,500 USD | 24 Months | 6.50% p.a. |

| 18 Apr 2024 | 22 Apr 2024 | 21,000 USD | 24 Months | 6.50% p.a. |

| 18 Apr 2024 | 22 Apr 2024 | 21,000 USD | 12 Months | 5.50% p.a. |

| 18 Apr 2024 | 22 Apr 2024 | 4,500 USD | 12 Months | 5.00% p.a. |

| 18 Apr 2024 | 22 Apr 2024 | 6,000 USD | 24 Months | 5.50% p.a. |

| 17 Apr 2024 | 22 Apr 2024 | 26,000 USD | 1 Month | 6.25% p.a. |

| View all past contracts in PDF or Excel format. | ||||

| Created On | Payout On | For Amount | Duration | At Rate |

|---|---|---|---|---|

| 16 Apr 2024 | 22 Apr 2024 | 11,500 EUR | 12 Months | 6.50% p.a. |

| 13 Apr 2024 | 15 Apr 2024 | 50,000 EUR | 6 Months | 7.25% p.a. |

| 8 Apr 2024 | 15 Apr 2024 | 38,500 EUR | 6 Months | 5.25% p.a. |

| 7 Apr 2024 | 8 Apr 2024 | 4,000 EUR | 12 Months | 6.25% p.a. |

| 7 Apr 2024 | 8 Apr 2024 | 8,500 EUR | 12 Months | 6.00% p.a. |

| 7 Apr 2024 | 8 Apr 2024 | 10,500 EUR | 6 Months | 6.00% p.a. |

| 5 Apr 2024 | 8 Apr 2024 | 65,000 EUR | 24 Months | 6.50% p.a. |

| 5 Apr 2024 | 8 Apr 2024 | 51,000 EUR | 1 Month | 4.75% p.a. |

| 4 Apr 2024 | 8 Apr 2024 | 112,000 EUR | 24 Months | 7.00% p.a. |

| 4 Apr 2024 | 8 Apr 2024 | 8,000 EUR | 1 Month | 4.50% p.a. |

| View all past contracts in PDF or Excel format. | ||||

How Do I Get Started

-

Open a S.T.A.R. Storage account (open account). The account is free to open and does not require the purchase of bullion. Once approved you will have the ability lend or borrow.

-

Log into your account and view the current lending offers and borrowing requests from where:

To borrow either submit your own borrowing request or accept a lender's existing offer. You must have either purchased bullion through us or transferred your bullion to our vault to borrow.

To lend either submit your own lending offer or accept a borrower's existing request. You must have SGD, USD or EUR funds in your P2P Loan Account (see wire instructions) to be a lender.

-

When lenders and borrowers match, a loan contract is created whose payout will occur on the earliest 1st, 8th, 15th and 22nd of the month. The next payout / loan start is 22 Apr 2024. Contracts can be in SGD, USD or EUR and have durations of 1, 6, 12 or 24 months.

-

On the loan start date, the custodian (Silver Bullion) forwards lender’s funds to the borrower and holds collateral. On loan maturity, funds are returned to custodian who then releases borrower collateral and returns funds to lender.

Find out more:

More details on Secured Peer-to-Peer Loans