Silver Bullion S.T.A.R. Storage

We segregate metals into uniquely identified parcels which are audited, insured and guaranteed to be genuine customer owned private property, stored under exclusive Singapore jurisdiction in our fully owned vault The Safe House. Our aim to provide our customers with one of the safest storage options in the world.

Safely store wealth outside the banking system

Gold and silver bullion, stored outside the financial system in a safe jurisdiction, is a wealth insurance and a crisis hedge that will protect you in the worst of situations.

Although bullion does not generate fiat interest, preciousness lies in the fact that it is a scarce commodity that cannot be created out of thin air, thereby increasing in real value over time. As the major world currencies such as the US dollar, yen, euro and the Chinese yuan devalue their currencies through extremely low interest rates and massive currency creation, the real purchasing power of fiat currencies is eroded despite interest payments.

The US dollar, for example, has lost over 98% of its purchasing value since 1913, whereas gold has increased (in dollar terms) by a factor of 60 over the same time period. Throughout history, excessively debased currencies will eventually become worthless and unsustainable debts will eventually be defaulted upon; but physical gold and silver, despite short-term price fluctuations, will endure as a reliable store of value as they have for over the last 4,000 years.

As we are entering times of financial turbulence and as more people realize the extent of our global financial system's fragility, it is only prudent to protect some of your wealth through the physical storage of gold or silver outside the banking system. If no significant crisis occurs you will be hardly worse off, but if a currency or banking crisis does occur, your physical bullion will be a financial lifesaver.

Chat with a Specialist

Precious metals offered

Electric Vehicle (EV) metals offered

Our Storage Charges (Effective November 1st 2024)

Metal |

Standard |

Discounted 10,000 points |

Bulk 50,000 points |

Silver |

0.70% |

0.60% |

0.50% |

Gold |

0.35% |

0.30% |

0.25% |

Platinum |

0.45% |

0.40% |

0.35% |

Palladium |

0.45% |

0.40% |

0.35% |

Nickel |

1.50% |

1.30% |

1.10% |

Cobalt |

2.50% |

2.30% |

2.10% |

| Percentages represent annual storage charges, based on the locked-in spot metal price at the time of order submission. You can lock-in storage charges for up to 5 years. | |||

Storage Charge Example:

If gold is trading at 2,600 USD per troy ounce when a renewal is submitted and the annual storage fee percentage is 0.3%, then the annual storage fee is 7.80 USD per troy ounce. If you pre-pay for 3 years, then the 7.80 USD annual fee is fixed and will apply to all 3 years regardless of gold price changes during these 3 years.

This system allows clients to fix their storage rates for up to 5 years from the current date via prepayment. Should you sell the gold, any non-utilized storage fees will be refunded. Because you own individual bars/parcels, each is tracked individually.

Discounted Storage Rates Example:

Your account will be automatically upgraded to Discounted Storage rates when your holdings reach or exceed 10,000 points and will be upgraded to Bulk Storage rates when your total stored holdings reach or exceed 50,000 points.

A “point” represents ounces stored in your account whereby a silver ounce counts as one point and a gold, platinum, or palladium troy ounce count as ten (10) points. See point(s) details.

Storage Charges For Orders / Renewals Submitted on or before October 31st, 2024

These storage rates can be prepaid and locked in for up to 5 years from the date of purchase, if submitted prior to November 1st (Singapore time zone). Any unused storage fees are refunded in case of sellback.

|

Fixed Fee (ounce/year) * |

In % (of metal price) | |

Silver |

0.2293 USD (0.3025 SGD) |

0.70% (0.23 USD / 32.75 USD) |

Gold |

9.6182 USD (12.6922 SGD) |

0.35% (9.62 USD / 2,748.06 USD) |

Platinum |

9.6182 USD (5.9380 SGD) |

0.45% (4.50 USD / 999.97 USD) |

Palladium |

5.1582 USD (6.8068 SGD) |

0.45% (5.16 USD / 1,146.27 USD) |

Nickel |

236.1739 USD/ton (311.66 SGD) |

1.50% (236.17 USD / 15,745 USD) |

Securely lend or borrow funds using parcels as collateral

The Secured Peer-to-Peer Loans Platform enables customers to quickly, easily and reliably lend and borrow to each other using their parcels as collateral. Interest rates are set by customers themselves in a bid/ask system, and there are no restrictions on how borrowed funds are used. Loans can be readily rolled over into new ones upon expiration, as there is an abundance of lenders.

Current lending offers (USD):

-

1 month: 5.25% p.a.

-

6 months: 5.75% p.a.

-

12 months: 6.25% p.a.

-

24 months: 7.00% p.a.

Current borrowing requests (USD):

-

1 month: None

-

6 months: None

-

12 months: 5.00% p.a.

-

24 months: 5.75% p.a.

Key questions to ask your storage provider(s)

- 1. How do I know I am a legal title owner rather than an unsecured creditor? [read more...]

-

Prerequisites for Ownership Status

There is a near truism in the precious metals industry which states that, “If you can’t touch it, you don’t own it”.

This statement is true in most cases because storage solutions which rely on generic quantity or weight counts are, by definition, based on an IOU system, making the client, in a legal sense, an unsecured creditor rather than an owner.

Prerequisites for Ownership Status

In the precious metals industry, you will often find that bullion storage is categorized as “Unbacked”, “Unallocated”, “Allocated”, and in some cases “Reserved” as follows:

- Unbacked: Your position is simply a financial bet (long or short). You are not an owner as there is nothing to physically own. Legally, you are an unsecured creditor.

- Unallocated: There is a small amount of bullion to cover everybody’s claim. You are not an owner as the small amount of bullion is on the provider’s balance sheet. Legally, you are an unsecured creditor.

- “Fully” Allocated: The provider tries to buy or sell bullion to match, with a delay unless they distinguish between in-stock and pre-order bullion, the buying and selling of bullion by clients so that claims are matched with physical.

- Segregated/Fractional ownership: Only when physical bullion is present, uniquely identified, and uniquely tracked—not just listed by generic oz quantity. Further, the metals are transferred to your name via an invoice to attest the legal title transfer wherein you would become the actual owner under the jurisdiction in which the invoice was issued.

Keep in mind that these terms, other than "reserved" which requires documentary proof, are often used loosely because precious metals is mostly a self-regulating industry. So, full allocation often comes down to how transparent the storage system is.

S.T.A.R. Storage has been “Reserved” from the beginning and, although more expensive and restrictive, it is well worth the trouble as it is a prerequisite for clients to be legal title owners.

"Unsecured Creditor" vs. "Owner" Status

From a legal point of view, investors are normally unsecured creditors because their money is recorded as a liability with their immediate counterparty, who in turn typically becomes an unsecured creditor themselves, as they transfer funds to other counterparties along the counterparty chain.

As the name suggests, unsecured creditors are completely dependent on the solvency of their counterparties, leaving you vulnerable to systemic risks. The typical exceptions to this rule are real estate, where you receive legal title to your property, and self-custody of physical goods such as bullion, in which case legal ownership was transferred via an invoice.

If you purchase an asset for storage and, in the vast majority of cases, do not get an invoice, you can be relatively certain that you are an unsecured creditor—that you own a claim, not a physical asset.

On the other hand, if you receive a valid invoice, you would be an owner of the bullion as evidenced by the invoice. To issue an invoice for goods, the issuer must be in possession of the goods, and the goods must be uniquely identifiable if they remain under custody of the seller.

A storage invoice stating “monster box of 500 Maple Leaf coins” for example is essentially an IOU because it does not specify what specific box you own, nor does it guarantee that bullion exists at the time of the transaction. So, ultimately it is a promise.

On the other hand, a sealed parcel with ID SB20005XXX, owned by Silver Bullion Pte Ltd, and containing a monster box would be valid property because it is a specific, existing asset giving the client ownership of the parcel, and relegating Silver Bullion Pte Ltd to act as a storage agent for the client owner.

An advantage to being a legal title owner is that it makes it very difficult and illegal to encumber your bullion. See encumbered bullion. Another advantage is that your claim to the parcel survives the dissolution of your dealer. In other words, if your dealer goes bankrupt, you would still be the owner of the parcel, and a bankruptcy court would not be able to claim it from creditors. Whereas, as an unsecured creditor, you would probably have lost any claims you had. Furthermore, in Singapore, falsifying an invoice is a criminal rather than civil matter making the humble invoice a very powerful document indeed.

However, from a dealer perspective, issuing storage invoices for physical parcels does not allow for shortcuts and is much more complicated and expensive compared to issuing promises and virtual quantities because:

- An invoice dealer would need to own sizable bullion amounts as buffer, as only bullion owned by the dealer can be transferred to a customer and a distinction between bullion in-stock and pre-order would need to be made. In the case of virtual quantity dealers, there are no such restrictions allowing minimal capital to be invested in the dealership.

- Physical parcelization is a lot of work, physical risk to the dealer, and requires much more complex operations compared to a dealer that gives promises and can easily outsource operations.

- Storing bullion in parcels that are individually retrievable also requires at least three times more space and cost compared to simply stacking bullion up a wall on a first-in first-out basis.

- It does not allow for bullion leasing because the bullion is not on the dealer balance sheet.

Ownership

Ownership is a bedrock characteristic of our storage program and a key to our success as customers are becoming more sophisticated and understand the value of having legal title to one’s assets. That’s why we developed S.T.A.R.’s “Reserved” concept, supporting invoicing and customer ownership from the beginning.

For drums of EV metals such as nickel and cobalt, we identify each drum as a ‘parcel’, sans the plastic wrapping, as these drums weigh either 200 kg or 250 kg—or even in large two-ton bags—and each parcel has its own ID. We do not depend on warehouse receipts, as the invoice issued to customers is strong and sufficient evidence of ownership of the nickel or cobalt.

- 2. How do I know the metal I paid for, actually exists? [read more...]

-

It might seem illegal, but it is common for bullion companies to not store physical bullion while charging storage charges. Often, the provided rational is that the bullion will be hedged financially, and if the customer needs the bullion, then it will be bought in the market when requested. There have been several class action lawsuits against major banks about this in the past. Tellingly, the usual defense was "it is an industry practice".

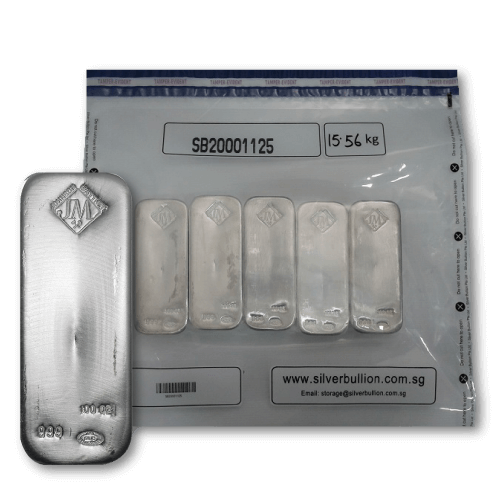

Bullion Presence

These is how we prove that the parcels indeed exist:a. Invoices and purchase orders: S.T.A.R. customers own their bullion in specific, sealed, and uniquely identified tamperproof bullion bags referred to as "parcels". In the case of EV metals, they are stored in drums, which are also uniquely identified by an ID. Parcel ownership is transferred and returned via invoices and purchase orders that list the specific parcel codes bought and sold. In Singapore, falsifying an invoice is a criminal offense rather than civil, so the humble invoice is a strong statement.

b. Photos of your parcels: You have access to the "Parcel Photo" report which contains a page describing each parcel you currently own and a clear photo that clearly shows the parcel's seal number, content, and weight.

c. Vault Inventory Report by parcel: We publish the vault operator(s) inventory check confirming the physical presence of each parcel by serial code by vault. This is updated at least twice a week.

d. Third Party Specialized Material Auditors: The Bureau Veritas (formerly Inspectorate), is a world-renowned inspection company and our financial auditor, on a quarterly basis. The latest Bureau Veritas report can be downloaded online by S.T.A.R. customers. In the case of EV metals, they are also verified to be present by the warehouse operator via an updated warehouse report.

Refer to the Terms of Service for more details.

- 3. How do I know my assets were not also sold to other customers (no concurrent nor multiple claims) [read more...]

-

It is only natural that a reserved system needs a way to ensure that a parcel is not sold to multiple customers concurrently, as it would essentially downgrade the storage product to an unallocated storage system.

Exclusivity

The Parcel Ownership List contains all S.T.A.R parcels and lists the respective owner of each parcel. Ownership is represented by your anonymous eight-digit S.T.A.R. Owner ID so that your privacy is protected.

The complete parcel list is made available for download to all S.T.A.R. Storage customers so that each owner can crosscheck their parcel holdings. This means that any double allocation would be obvious to all S.T.A.R. Storage customers. Besides our internal checks and customer review, this list is further checked by our accountants and annually by Singapore financial auditors.

- 4. How do I know the metal is genuine and not plated or made of other materials? [read more...]

-

Dealers will normally reply that the metal comes from trusted sources. For the most part, this answer has merit, but often a dealer will also buy back bullion from sources other than mints or foundries. Having the ability to conclusively determine bullion genuinity is a must for us. Trusting is good. Being able to test is better.

DUX Testing

Silver Bullion Pte Ltd developed a comprehensive metals testing program back in November 2012 called DUX. DUX is an acronym that stands for Density Ultrasound and X-ray fluorescence testing. Each test measures and compares a different physical characteristic (mass and volume, ultrasound celerity, and surface metal composition) in such a way that counterfeit metal might pass an individual test, but not the DUX trio of tests.

In addition, we also employ electrical conductivity measurement testing, or ECM, with devices which measure electrical resistivity. Each metal has its own unique quantifiable properties. Introducing this fourth means of testing further solidifies our testing methodologies.

For testing of EV metals, we will employ sample testing. This is because each drum or bag is sealed intact. Unlike storing precious metals such as silver—which is largely inert, antiseptic, and antimicrobial, or gold bullion which is truly inert)—nickel is classified as suspect carcinogen and must be handled with care when being vaulted.

All Transfer-in bullion and buybacks, not coming directly from mints, foundries, primary distributors or metal exchanges are tested in this manner and DUX test reports are associated with the transferred bullion on a parcel by parcel basis.

- 5. How do I know the metal is not encumbered nor leased out [read more...]

-

There is a common practice in the precious metals industry to lease out stored bullion to generate additional income.

The basic premise is:

1. Entity A has a large amount of bullion that was acquired using client funds and now holds it on the company balance sheet, as clients are unsecured creditors.

2. Entity A then takes a large chunk of the bullion and leases it to Entity B for a fee.

3. Entity B leases the bullion, pays the fee to A, and promises to return the bullion at a certain date.

4. Entity B then proceeds to sell the bullion to other entities and assumes that they can return the bullion at some point in the future.

In such a scenario the bullion is, unbeknown to the customer, leased out and then sold to another party. Often, the bullion does not even need to be physically moved as the lease normally involves only claims to the bullion and it can generate a nice side income for entity A.

In such a scenario, the bullion against which the client has a claim has been “encumbered’. Entity A can even claim that the bullion is still allocated, as the bullion often is physically still in the vault. This practice allows Entity A to charge less, or even give free storage to clients by using the leasing income as a source of revenue.

Although it sounds illegal, this practice is widespread and is legal in large part because the clients do not really own the bullion, as they merely have a claim for bullion against Entity A which in turn sees the client claims as mere liabilities on their balance sheet. See Unsecured Creditor vs. Owner for details.

As an interesting side note, you might have heard that Germany was quoted a seven-year delivery timeline to get back 300 tons of gold which was stored for free for the Germans, courtesy of the New York Federal Reserve. Although there is no firm evidence, this looks like a typical case of bullion leasing with the lease being over in seven years. Refer to an article on the subject that we published in February 2013.

Encumbrance

We do not lease bullion (or EV metals) or out of principle. Furthermore, our “Reserved” storage characteristic and the legal ownership status of our customers make bullion leasing by design very difficult or literally impossible, as the bullion—due to ownership transfer—is not on our balance sheet.

- 6. What intermediaries in the counterparty chain stands between me and my bullion? [read more...]

-

Storing bullion and base metals is based on a chain of trust and a set of legal contracts that extend from the customer, through intermediaries, and all the way to the vault or warehouse where the metals are stored.

Each link implies additional legal, jurisdictional and financial exposure, so the fewer the number of links, the better. Because it is an industry practice by dealers not to fully disclose to customers where or with whom bullion is stored or which repatriation and Force Majeure clauses are in effect, the customer would know only about the first link of his storage counterparty chain and have little real understanding how vulnerable their bullion is in a systemic crisis.

Counterparty chains matter because your metal is only as safe as the weakest link in your chain. Should an intermediary in a systemic crisis scenario go bankrupt, you might find out too late that your bullion claim only goes as far as the bankrupt intermediary. This could be a company you never heard about.

Further, as an unsecured creditor, your claim to recover assets of the bankrupt intermediary is very low in the order of repayment (seniority) and secondary to secured creditors of the bankrupt intermediary, e.g. banks, which always secure themselves via fixed and floating charges.

Simplicity

As The Safe House is a subsidiary of Silver Bullion, by storing through S.T.A.R. Storage, you effectively reduce your counterparty chain to a single link. The absence of intermediaries means that you have legal, financial and jurisdictional certainties. To modify the saying, “the buck starts and stops with us”.

- 7. How sound are the companies along the counterparty chain, and who are they? [read more...]

-

Silver Bullion maintains a positive balance sheet, verifiable on the company BizFile report.

Compared to our operating expenses, we maintain high financial reserves, allowing us to operate for years without revenue if needed, much higher than typical businesses. When storage revenue is taken into consideration, we can operate indefinitely, even without new sales.

The Safe House, which required extensive initial capital investments, was financed 90% from internal funds by Silver Bullion while 10% came directly from Gregor Gregersen, Silver Bullion’s founder.

Neither Silver Bullion nor The Safe House have any debt, and Silver Bullion now owns a substantial amount of physical gold, silver and platinum outright, allowing for substantial in-stock inventory and thereby enabling customer ownership more efficiently.

Obtaining Company Financials

You can easily find unbiased and detailed information about a Singaporean company, such as registered company debtors, whether it is audited, in tax compliance, ownership details and official capitalization by downloading a BizFile report from the Accounting and Corporate Regulatory Authority (ACRA) of Singapore. Each report costs about SGD 5 and takes about five minutes to obtain via e-mail.

It is worthwhile reviewing such a file as it essentially lifts a curtain off the company, revealing hard facts and allowing you to independently verify claims that companies might make. If you are going to become a client of a storage program in Singapore it is worth spending five minutes and five dollars to review this report and counterparties on the counterparty chain.

To obtain company reports go to ACRA BizFile.

- 8. What is covered by your bullion's insurance coverage? [read more...]

-

Insurance comes in many guises. For a vault operator insurance is a major cost, thus lowering insurance through exclusions can make a big difference to the bottom line. Depending on the type of coverage and an insurance company’s inspection assessment some type of coverage might simply not be granted, such as infidelity, which could be deemed too risky for the insurer.

Insurance

As Silver Bullion Pte Ltd has moved into the vaulting business through The Safe House, we have acquired our own insurance policy instead of relying on direct insurance from an outsourced vault provider.

Obtaining an extremely strong all-risk vault insurance at good rate was probably the most important milestone for Silver Bullion and The Safe House as our insurance essentially removes all physical storage risk and has a better coverage than most established vaults.

Such strong insurance, issued by Marsh, was made possible because the underwriters' technicians who inspected the storage facility, processes, and people behind it, approved The Safe House unconditionally. The current amount insured is SGD 1 billion.

The insurance protects your bullion not only from theft and fire but also includes:

- Full infidelity coverage. In essence, the insurance will fully cover the possibility of inside jobs (TSH staff stealing bullion) for the entire policy amount per any one loss.

- Full mysterious disappearance coverage. We always felt uneasy storing bullion at a vault which would not be liable for mysterious disappearance of bullion. Therefore, it was an insurance priority for TSH to ensure this is included. Mysterious disappearance essentially covers the possibility of operational errors by TSH for the entire policy amount for any one loss.

S.T.A.R. Storage customers can download the signed Insurance Certificate and policy number when logged in as a Storage customer.

- 9. What jurisdictions the companies in the counterparty chain are exposed to? [read more...]

-

A Force Majeure clause relieves a party from an obligation under the contract if a certain event occurs so if you are seeking to protect yourself from systemic risks then you would want to make sure this clause does not undermine the very reason to store bullion in a separate jurisdiction.

A major reason The Safe House was created was that there is little bullion storage capacity in Singapore that is not run by a subsidiary of an overseas company, thereby implying direct or indirect exposure to European or US governmental regulations which will likely be bearing the brunt of upcoming systemic crisis. Such exposure creates legal ambiguity as to what would happen if a Western nationalization were to re-occur and is made evident in the Force Majeure clause of storage contracts, which typically indemnify the storage provider from “any governmental action, by any government”.

We believe that if you go through the trouble of storing bullion in Singapore then you should not have to sign such an “any by any” clause as it negates the very reason to store bullion in Singapore in the first place. Furthermore, unless you are dealing with a storage provider directly, you would not know what Force Majeure clauses your dealers accepted in their respective contracts with the next middlemen or storage facility. Such storage counterparty chains cause further legal vagueness and uncertainty.

Force Majeure

Through The Safe House, being a subsidiary of Silver Bullion, we have full contractual transparency along the entire storage chain with no material Western regulatory exposure for stored bullion. Although a Western nationalization event or shipping restrictions would affect our ability to obtain new bullion and might stop us from accepting US dollars as payment, your existing bullion would not be affected by a Western nationalization occurrence.

- 10. Is your chosen jurisdiction is indeed a safe choice? [read more...]

-

Why do you claim that Singapore a such a good choice for bullion storage?

Although Singapore has no natural resources, it managed, over the last 50 years, to become one of the richest countries in the world through an excellent educational system, very efficient governance, hard work and pragmatism, extremely low corruption and simple but clear laws that foster competition and guarantee private property. Even with no capital gains taxes and low-income taxes, the country has consistently run a current account surplus since the mid-80s, even through the 1997 Asian Financial Crisis, the 2008 Financial Crisis, and the recent Covid-19 Crisis. English is the primary language along with Mandarin (Chinese), Malay and Tamil (Indian) dialect and the country boasts extremely low crime rates. In other words, Singapore is rich, safe and stable which we deem to be the criteria for choosing the best jurisdiction for bullion storage.

Besides being a leading financial center, Singapore has one of the busiest airports in the world, the busiest cargo port in the world and huge refineries on an offshore island called Jurong Island. Although Singapore is covered by malls and entertainment options, plenty of scarce land is reserved for nature parks and trees. Real estate prices are sky high as Singapore has become a favorite destination for able workers and entrepreneurs. A host of other, constantly evolving, industries and businesses call Singapore home and it is a top location for global companies to set up its Asian headquarters.

The Singapore Government is, in many respects, run like a business as governmental ministries, for example, have their budget reduced every year, rather than increased, and have to bid for additional funds which keep pressures on governmental officials to raise efficiency and services. Politicians are very well paid to attract smart individuals and minimize the temptation of favoritism or flat-out corruption. Most policies, a legacy of Lee Kuan Yew, are truly designed for the long-term benefit of the country rather than political maneuvering to win votes during election. Singaporeans are afraid to be outcompeted and will try just a bit harder which explains why the country has done so well.

Much of this success has come about because Singapore is one of the most trusted jurisdictions in the world and is well known as a country where laws are upheld in spite of external pressures. Lee Kuan Yew, the very long serving prime minister who is rightly seen as the architect of modern Singapore summarized Singapore’s success down to a single word: confidence.

This situation is excellent for bullion storage because, if Singapore (for example) were to nationalize gold due to US pressure (for example) the consequences would be an immense loss of confidence and would have a devastating effect on the Singapore economy. Although nothing is ever absolutely certain, Singapore has no incentive (as they are very wealthy already) and it has a lot to lose by supporting a hypothetical US gold nationalization.

An interesting case illustrating Singapore’s willingness to stand up to foreign pressure was the Michael Fay graffiti case, where then President Bill Clinton and a group of US senators tried in vain to prevent Michael Fay from being caned. Read about it here.

These factors make Singapore a great jurisdiction for Gold and Silver storage. To better understand how and why Singapore works we highly recommend reading “From Third World to First” written by Lee Kuan Yew himself.

Singapore is so small, can it not be invaded overnight?

Singapore has been very careful to neither ally nor distance itself with any major power as they try to avoid policies that could cause conflict down the line. In line with this policy, Singapore has managed to build a number of mutual defense treaties with surrounding countries designed to reinforce stability in the region.

Surprisingly, Singapore also carries an enormous stick give its small size. Regionally this city nation is a military heavyweight, given the two year compulsory military service for Singaporeans that allow the armed forces, police and the civil defence force to deploy over a million personnel with a large portion deployable at short notice given the yearly week-long readiness drills. Singapore's defense budget is similar to a medium-sized defense spender internationally and it has the highest military expenditure in the entire ASEAN region.

Singapore even has a defense industry which locally manufactures and exports the SAR 21 rifles and various artillery pieces which are used by other militaries and Special Forces. Among others Singapore has both training and military bases in Taiwan, Thailand, Australia, India and the United States (Idaho). In other words, Singapore is very well defended regionally.

You can read more about it here. Additionally, we prepared this feature about Singapore which you can read here.

Additional services

Safe Deposit Boxes, a TSH Service

Resources

Download the Safe Deposit Box Brochure (Updated October 2022)